NFT

NFT market Blur has rapidly grow to be a major buying and selling venue since its October launch.

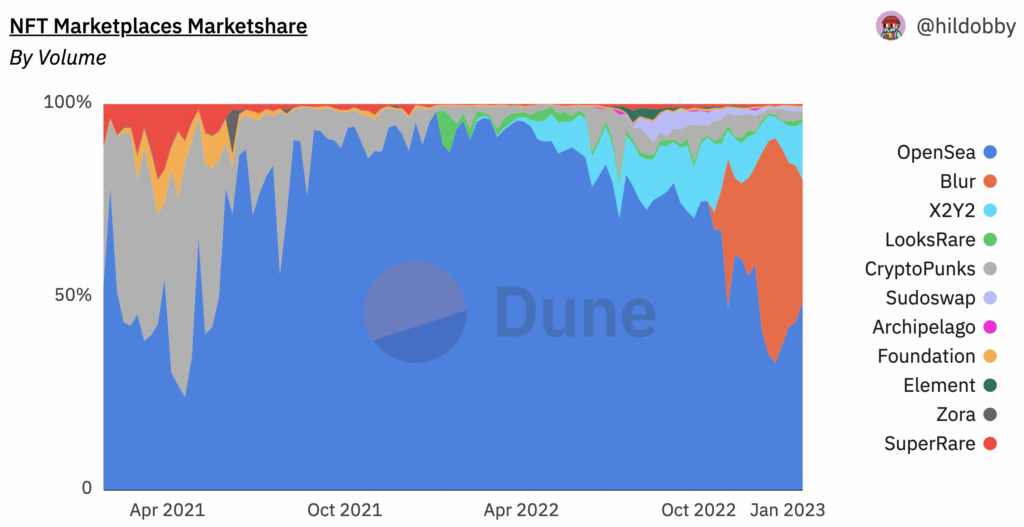

Rivaling OpenSea — the most important NFT market by buying and selling quantity and each day energetic customers — Blur at the moment instructions round 32% market share, with OpenSea at practically 49%.

Whereas OpenSea is a singular venue, Blur additionally serves as an NFT market aggregator. It’s now the most important by far with greater than 70% of the market, per a Dune Analytics dashboard (aggregators permit NFT shopping throughout a number of platforms concurrently).

Sara Gherghelas, a researcher at blockchain analytics unit DappRadar, advised Blockworks that the current enhance in buying and selling quantity on Blur is probably going correlated to the upcoming launch of the BLUR token on Feb. 14 and its third and ultimate airdrop.

Incentivizing NFT buying and selling

Blur has deliberate for a complete of three airdrops since its launch, just lately inspiring common weekly buying and selling volumes round $98 million.

Its preliminary airdrop rewarded so-called “care packages” to customers who actively traded NFTs throughout the bear market — to assert, merchants merely needed to record an NFT on its platform. Care packages are supposed to be ultimately exchanged for BLUR.

An analogous strategy was applied for the second airdrop — the place customers have been rewarded for itemizing NFT gross sales on its Blur.

Its ultimate airdrop, which is deliberate to happen alongside its token launch, will distribute greater than twice the variety of care packages. Customers are additionally capable of tally reward factors based mostly on their bidding actions.

“It’s price noting that bids don’t have to be accepted to earn factors in the direction of Airdrop 3, which helps forestall wash buying and selling and inflation of factors,” Gherghelas mentioned.

Blur needs to be a platform for professional NFT merchants

Airdrops are usually not the one cause for increased buying and selling volumes on the Blur platform.

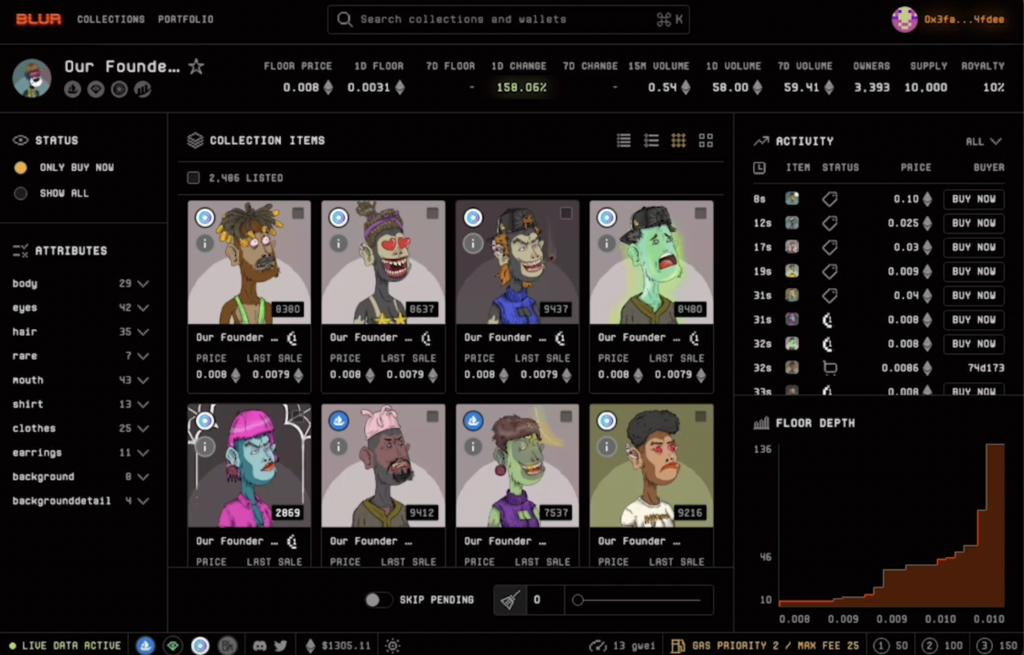

Blur is an area designed for seasoned merchants. These of us already boast increased buying and selling volumes than a typical retail dealer, Oskari Tempakka of Token Terminal advised Blockworks.

“In the event you take a look at the information accessible on Token Terminal, OpenSea has extra each day energetic customers than Blur, however Blur’s quantity is increased as a result of it’s primarily utilized by extra superior merchants,” Tempakka mentioned.

The person expertise of Blur can also be extraordinarily interesting to customers and sure drawing consideration from different NFT marketplaces with much less complicated options, Tempakka mentioned.

This sentiment is shared by an NFT dealer who goes by the pseudonym drew.

“You’re incentivized — 3 times, you have got a quick person interface and 0% market charges or royalty charges — so the extra you employ it, the larger your airdrop shall be — that’s why I feel folks gravitated in the direction of Blur,” drew mentioned.

An unknown future

A query stays: whether or not buying and selling volumes will persist after the ultimate airdrop in February, after which merchants have obtained all their gifted BLUR.

“If the airdrop is profitable and folks get some huge cash, it often causes a mini bull market or no less than a spike in quantity and shopping for — however after that, if there aren’t any incentives to bid at excessive costs — there’s a likelihood it might all come crashing down,” drew mentioned.

Tempakka, alternatively, stays cautiously optimistic concerning the NFT platform. He advised Blockworks that Blur’s founder beforehand estimated that greater than 90% of the platform’s buying and selling quantity was natural.

LooksRare, the NFT market’s earlier darling platform, additionally pushed to encourage merchants with profitable rewards paid out through a local token. Reviews rapidly surfaced attributing upwards of 95% of its quantity with wash merchants keen to maximise these payouts.

But when Blur maintains comparable buying and selling volumes following its ultimate airdrop, Tempakka expects extra NFT platforms to comply with its airdrop-heavy strategy to incentivize utilization.

“Time will inform how this performs out publish airdrop, however I’m excited to see how issues develop,” Tempakka mentioned.