The NFT house isn’t what it was. This has grow to be painfully apparent to these inside Web3 over the previous few months. From controversial memecoin escapades to overwhelming regulatory initiatives, the magic of the metaverse has been palpably waning all through 2023.

Because it stands, the present state of the non-fungible ecosystem is a far cry from the market highs that helped kick off the 12 months. But, this spherical of “NFTs are crashing” feels totally different than instances previous. With this bout, the causation behind NFTs slowing down feels extra nuanced. Moderately than worry, uncertainty, and doubt (FUD) main the market down, there might be one thing extra at play.

NFTs by the numbers

Though group sentiment is troublesome to measure quantitatively, market well being can normally be gauged by the charts. These seemed good originally of the 12 months, with NFT gross sales up 43 %. This was a welcome change from the bear market that enveloped nearly all of 2022.

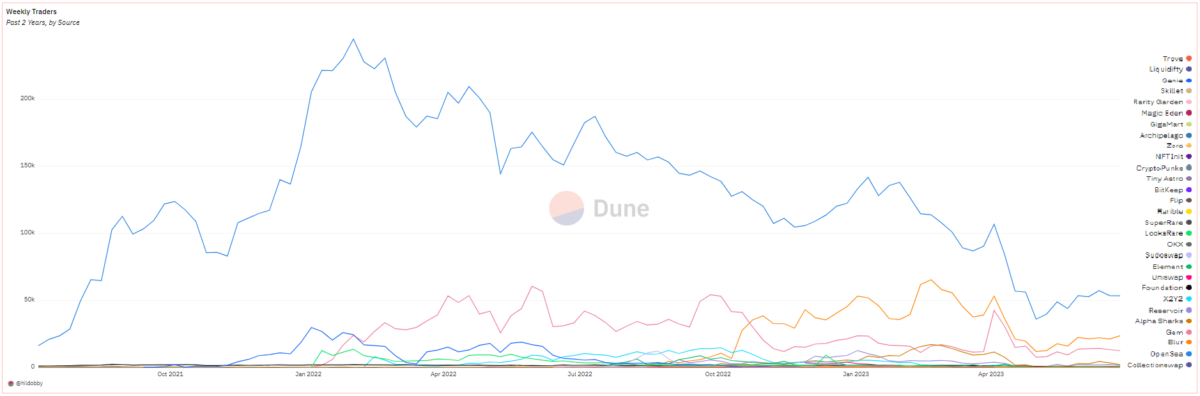

But, in current months it’s grow to be clear that the success we witnessed in Q1 has not continued. To date in 2023, nearly all of NFT sales volume has been generated on Blur (extra on that later). And whereas quantity was up in an enormous manner through the winter, after peaking in February, each quantity and trades dropped and dwindled all through the spring.

It initially didn’t appear all unhealthy, although, as a result of, firstly of the sunny season (June), the NFT market witnessed a slight uptick in exercise. However upon additional inspection, it grew to become clear that this uptick won’t essentially be indicative of a constructive development however fairly quite a lot of points at the moment unfolding throughout a variety of distinguished blue-check initiatives.

Bored Apes and Azuki

Most notably, the Bored Ape Yacht Membership and Azuki — which have every respectively grow to be the focus sooner or later in 2023 — have been feeling the warmth. Though, over the previous few months, the majority of NFT sales volume has come from these two initiatives, this newest spherical of buying and selling appears oddly decoupled from the remainder of the NFT ecosystem.

That’s as a result of as a substitute of demand fueling buying and selling and leading to ground costs rising, as we’ve seen time and time once more with the launch of secondary collections, present buying and selling appears to be the results of ground costs dropping and merchants subsequently seeking to money in on a superb deal.

Whereas this isn’t unusual in Web3, particularly as Blur continues to dominate the market, it’s odd for such an occasion to occur to BAYC. As a silo throughout the NFT house, BAYC (and CryptoPunks, for that matter) has anecdotally existed in a world of its personal, unwavering within the face of hypothesis and regulation. However just lately, this has modified.

Within the case of BAYC, ground costs have been steadily dropping. On the time of writing, the gathering ground sat around 30 ETH (about $57,000). Notably, that is the bottom we’ve seen Apes fall since 2021. An analogous narrative is taking part in out with Azuki, with the model’s core collection having hit a ground of just below 7 ETH ($13,000).

Though there are a variety of causes this value motion could also be occurring, many holders and lovers have pointed to dilutions and fragmentation as the basis trigger. Extra particularly, BAYC holders have felt disenfranchised by Otherside and HV-MTL, successfully splitting the Yuga NFT ecosystem. Equally, Azuki lovers have been thrown right into a tizzy in gentle of the model’s current controversial enlargement, Azuki Elementals.

After all, there are nonetheless issues to be made relating to the impact that BAYC and Azuki are having in the marketplace. For one, holders from blue chip collections similar to these have truly remained fairly steadfast. But, whereas HODLers be HODLing, value is (and traditionally has been) decided by incremental patrons and sellers. Lengthy story quick, if there aren’t any new patrons, there’s typically a sluggish bleed downwards.

Moreover, whereas Bored Apes and Azuki NFTs waning undoubtedly impacts the NFT ecosystem at massive, they aren’t the only real catalysts for NFTs happening. Azuki Elementals did serve to take away someplace round $38 million from the ecosystem, which implies even whales are possible being conservative with their purchases at the moment.

The Blur impact

One other possible candidate partially accountable for this newest crash isn’t collectors however fairly the platforms and marketplaces they function inside. When as soon as OpenSea was the dominant pressure within the higher NFT market, Blur has unequivocally taken over as the key breadwinner of the non-fungible ecosystem. After all, the trail to Blur’s prominence wasn’t devoid of controversy, and even now, the higher NFT group speculates about how the platform’s infrastructure would possibly push NFT assortment costs down.

Probably the most main level of rivalry regarding Blur comes from its native token, $BLUR. By a number of airdrops, the token sought to reward platform loyalty and consumer engagement — a system we’ve seen used many instances over with governance and group tokens ($RARI, $LOOKS).

Nevertheless, the $BLUR token rewards (paired with a royalty-free market) is a significant draw for high-profile collectors. Whereas Blur’s aforementioned monopoly on NFT gross sales quantity is undoubtedly spectacular, it’s just lately come to gentle {that a} handful of prominent traders is perhaps utilizing the platform’s incentivization system to wield an affect over NFT costs.

Now, Web3 observers are questioning if {the marketplace}’s successes didn’t come with no probably bigger value to the broader NFT ecosystem. In response, some have even taken the stance that Blur’s recognition as a possibility for token farming may need the facility to tank the NFT market altogether.

A holistic view of the blockchain

Particular instances like BAYC, Azuki, and Blur apart, although, there’s extra to be stated in regards to the NFT macroclimate as a contributing issue to the present downward development we’re seeing throughout the NFT market itself. And absolutely high of thoughts for many throughout the blockchain business is that ETH is pumping, and the federal government is watching.

At this present stage of maturation in Web3, the unpredictable value motion of crypto paired with mounting regulation of the crypto and NFT house have added a palpable layer of uncertainty to the way forward for the blockchain business. These components, above many others, are absolutely influencing purchaser habits and contributing to market fluctuations.

Particularly, within the case of ETH, important value motion typically poses a menace to the worth of NFTs. As ETH rises, many merchants decide to take income or, on the very least, reconfigure their portfolios to make use of ETH as a secure haven for market volatility. In different instances, collectors would possibly try to dump some NFTs at ground costs or hunt down main sale alternatives (like a sub-30 ETH Ape), additional influencing the market.

If we have been to take a look at an much more macro view of Web3, although, it appears possible that advents like Soulbound Tokens, NFT Ticketing, and “phygital” items struggling to actually cross over to the mainstream may also be having an impact. Total, there’s been a lower in main manufacturers getting into the NFT house, and the acronym itself has gone down in utilization in popular culture in comparison with the place it was on the top of the preliminary increase.

After all, it really is anybody’s guess the place the NFT house shall be even a 12 months from now. However with market components in thoughts, creators, collectors, and builders alike would do nicely to be aware of the altering NFT panorama and bear in mind why the creators of tradition started flocking to the blockchain within the first place.