Well-liked on-chain analyst Willy Woo says Bitcoin (BTC) might be due for a brief squeeze within the close to future.

Woo tells his 1 million Twitter followers that BTC’s fundamentals are choosing up.

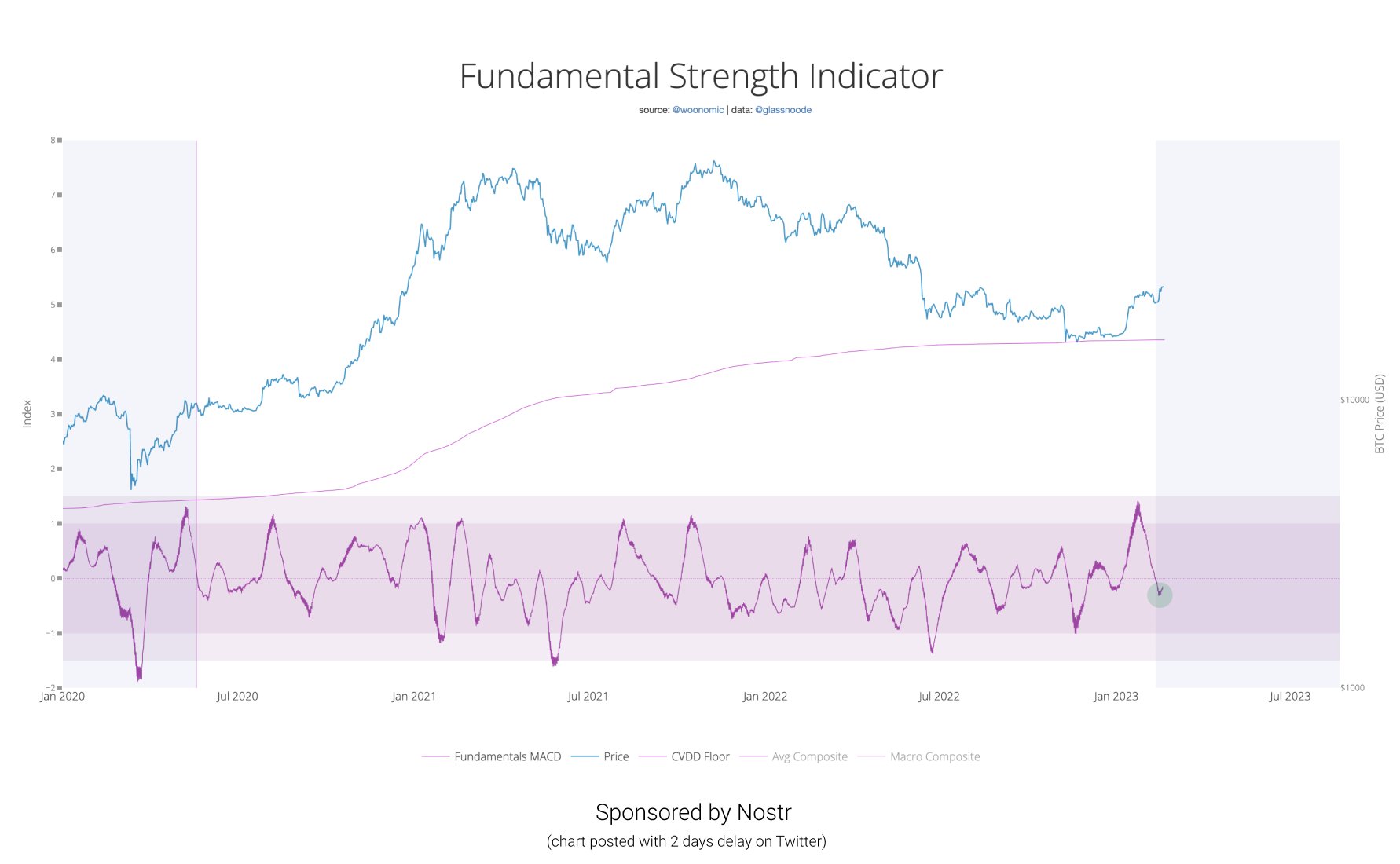

“Elementary Power Indicator is not overheated and beginning to rise (FSI tracks the power of 17 elementary and technical indicators)

If value will get a lot above $25,000, we might be in for a brief squeeze.”

A brief squeeze occurs when giant numbers of merchants who shorted an asset determine to chop their losses in response to an surprising value bump. The squeeze then triggers extra rallies.

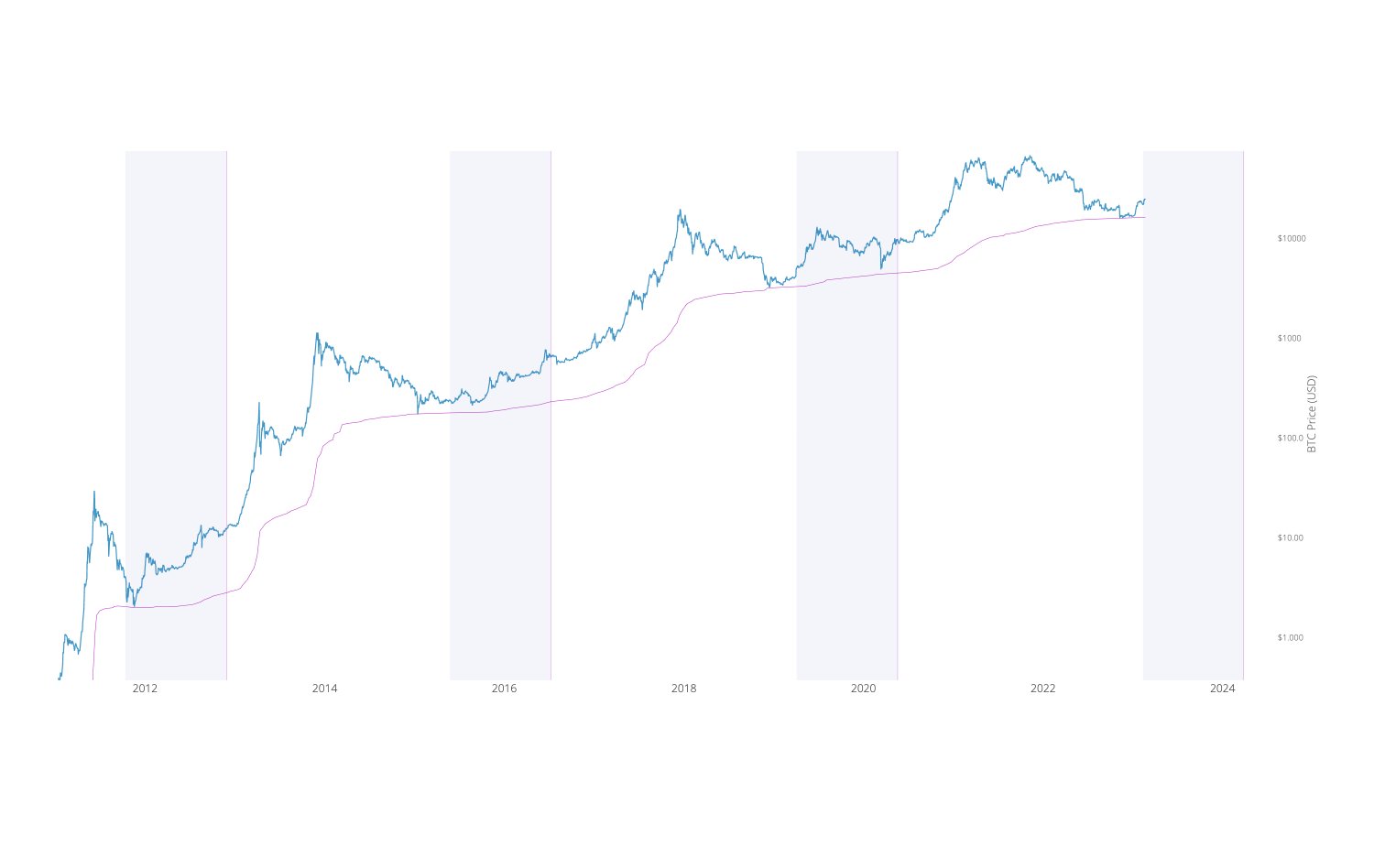

Woo notes Bitcoin might be “getting into the re-accumulation section of the cycle,” primarily based on his evaluation of the timing of previous cycles.

Says the analyst about the specter of a recession,

“Not an professional on trad macro, however appears like macro liquidity is on the uptick. BTC remains to be linked to this. Proper now anticipating a climb and a lifeless cat if the recession kicks in. Additionally, assume a de-coupling might occur in future cycles.”

BTC is price $24,204 at time of writing. The highest-ranked crypto asset by market cap is down 0.27% prior to now 24 hours and almost 1.7% prior to now week.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney

Featured Picture: Shutterstock/Konstantin Faraktinov