- BTC receives the highlight after the reveal of the Ordinal NFTs.

- The derivatives market sends combined indicators as volatility slows.

We not too long ago checked out how a JPEG NFT constituted the biggest block on the Bitcoin blockchain community. Now it has emerged that roughly 13,000 Ordinal NFTs have been launched on the Bitcoin community.

Learn Bitcoin’s value prediction 2023-2024

The Ordinal NFTs have acquired combined reactions within the crypto group. Some really feel that this exploration of the Bitcoin community is a step in the appropriate path that will provide extra alternatives sooner or later.

Others declare that the transfer goes past what Bitcoin stands for. However, the ground value for these NFTs has been rising.

Ordinal Punks are popping off on Bitcoin. 📈

The ground value has risen to 2.2 BTC ($50K) with a brand new ATH sale of 9.5 BTC ($215K) as we speak. pic.twitter.com/mHZ1MUqGnz

— nft now (@nftnow) February 9, 2023

The potential influence of getting NFTs on the community is maybe the most important concern. Will it decelerate the community or make it extra congested? The Ethereum community has skilled such challenges up to now which have impacted the value of ETH.

Normally, community congestion is translated as excessive demand and this will likely ship a constructive suggestions search for the native cryptocurrency. Is such a state of affairs believable for Bitcoin? Let’s take a look at what we all know thus far. Bitcoin’s imply transaction dimension is at present at a 4-year excessive.

📈 #Bitcoin $BTC Imply Transaction Dimension (7d MA) simply reached a 4-year excessive of 894.524

Earlier 4-year excessive of 892.529 was noticed on 04 June 2021

View metric:https://t.co/PJ0bkLTuVs pic.twitter.com/rqgW5TOuZe

— glassnode alerts (@glassnodealerts) February 9, 2023

The state of the Bitcoin derivatives market

Bitcoin’s derivatives market has been a wholesome indicator of the state of the market up to now. It would provide insights into BTC’s present place.

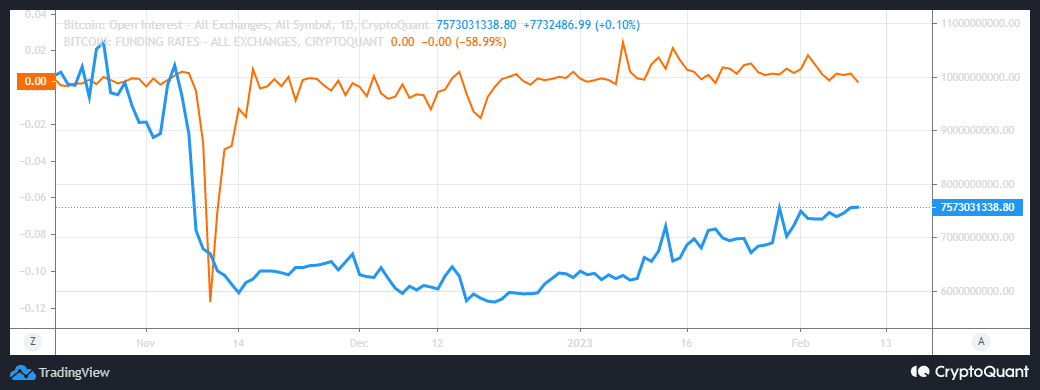

BTC’s open curiosity managed to take care of an upward trajectory, confirming that there’s nonetheless some stage of demand for BTC within the derivatives market.

Supply: CryptoQuant

Bitcoin’s funding charges have dropped regardless of the upper open curiosity. This can be a reflection of the market’s indecisiveness, particularly with the declining volatility.

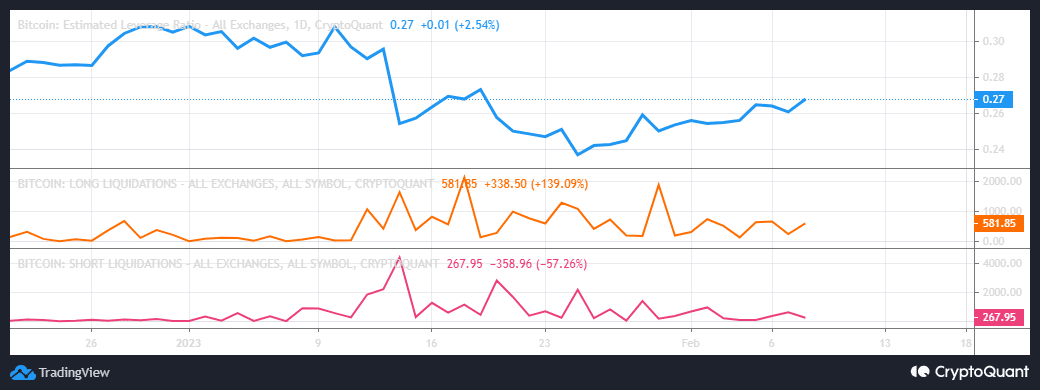

In the meantime, market indicators reveal that the extent of demand for leverage is step by step rising. That is doubtless as a result of decrease volatility has compelled buyers to search for different technique of boosting their potential features.

Supply: CryptoQuant

Liquidations had been nonetheless comparatively low at press time, however there was a notable improve in lengthy liquidations within the final 24 hours. Quick liquidations decreased throughout the identical time because the bears gained extra dominance.

What number of are 1,10,100 BTCs value as we speak?

The cryptocurrency has been caught inside a slender vary ($22,400 and $22,200). The market has skilled some draw back in the previous couple of days regardless of bullish indicators reminiscent of a golden cross and decrease relative energy.

Supply: TradingView

The present projection is that a further bearish consequence might ship BTC as little as $22,500 which is inside the closest help vary. Alternatively, one other rally might yield a retest of the $24,000 resistance vary.