NFT

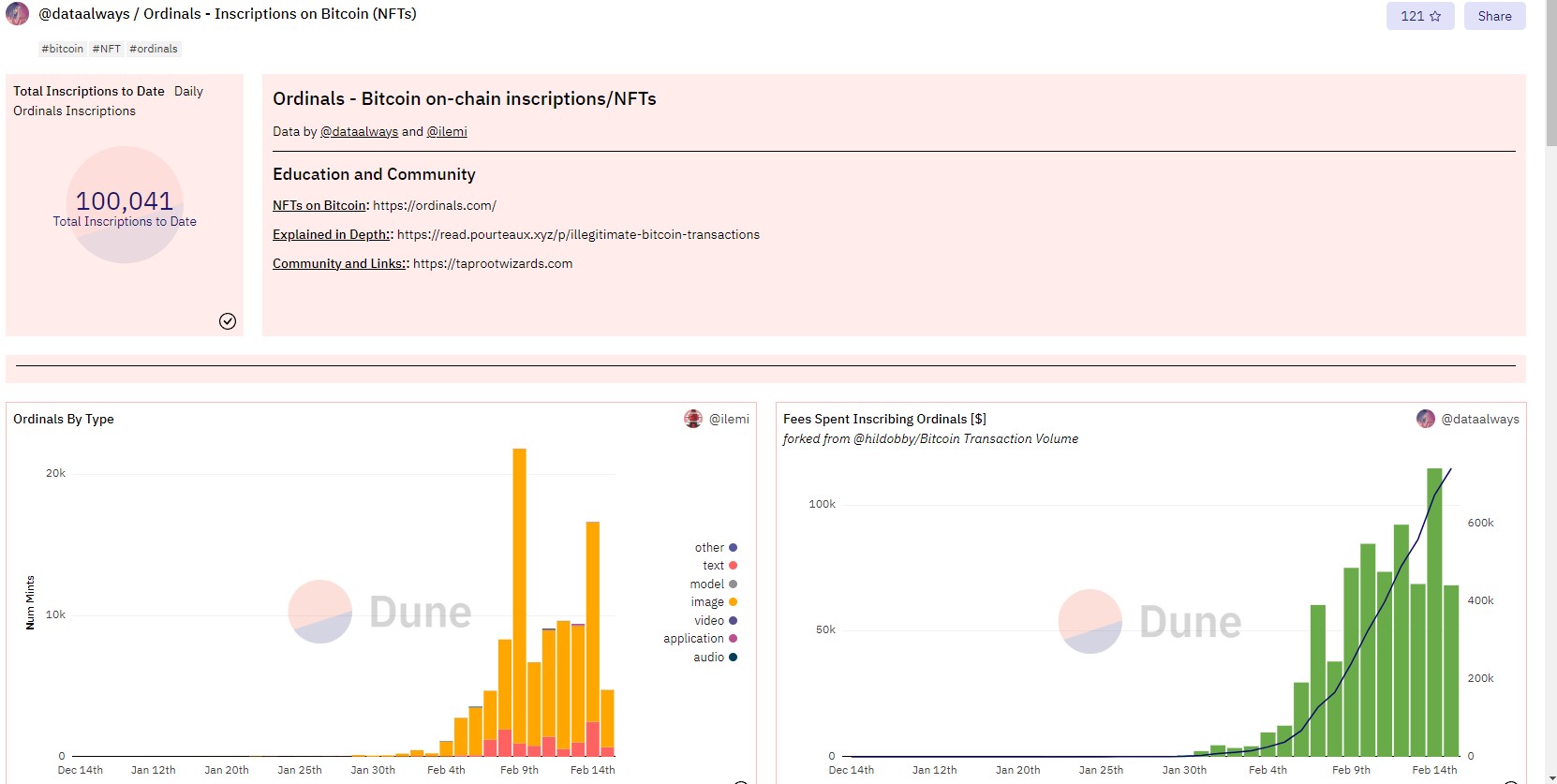

The variety of Ordinal inscriptions handed 100,000 late Tuesday, proving that the venture to deliver digital property natively to the Bitcoin blockchain continues to intrigue the crypto house since its launch final month.

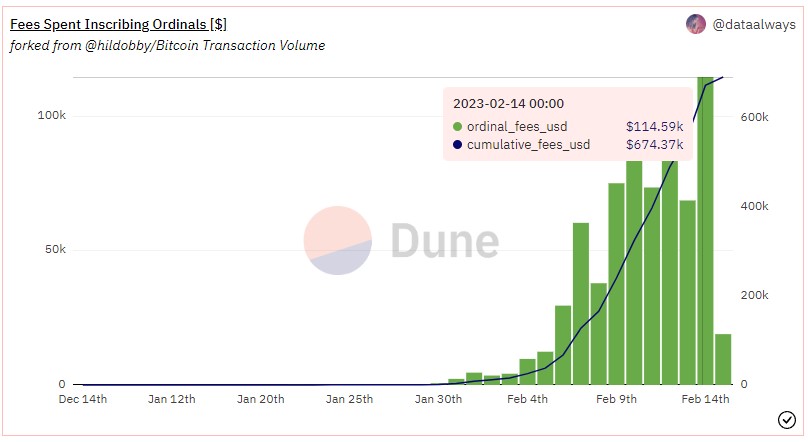

The 100K milestone was carefully watched, and comes lower than a day after Ordinals crossed the 75,000 inscription mark, in accordance with a Dune report, with transaction charges for the digital collectibles topping $114,590 earlier at this time.

I TOLD YOU 100K TODAY🔥🔥🔥

— trevor.btc (@TO) February 15, 2023

Closing in on 100k inscriptions

Near a 1 12 months excessive in transaction charge charges

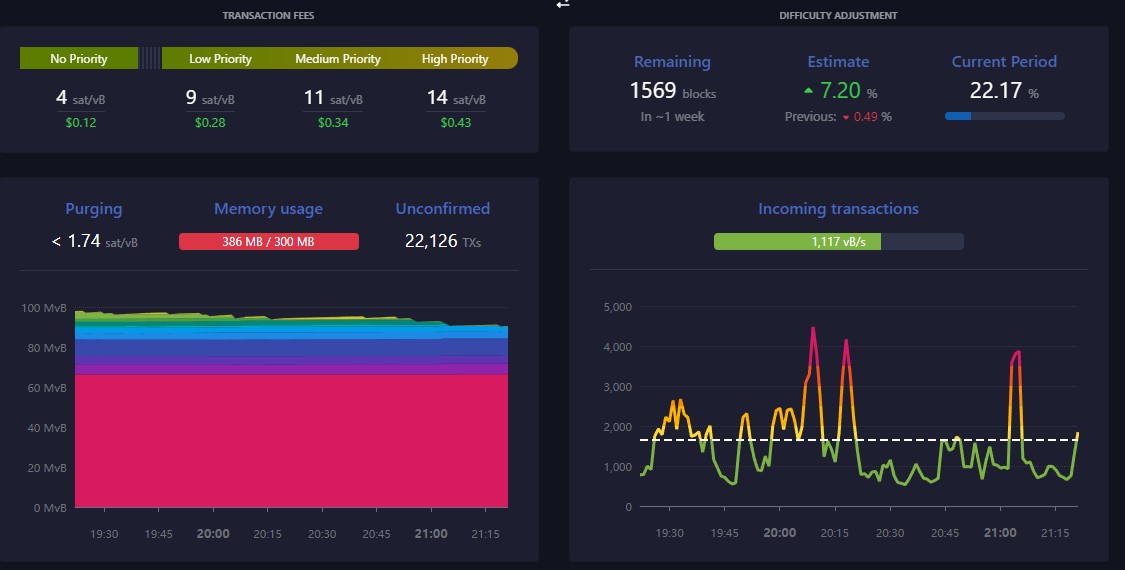

Mempool is over 100 blocks full and is purging something < 2 sat / vByte

Blockspace is at a multi-year premium

That is what adoption seems like

— NickH ◉ ⛏️ (@hash_bender) February 15, 2023

As Ordinals surged towards the six-figure mark, the reminiscence utilization per block exceeded the usual 300 MB capability by 86 MB, inflicting the community to purge any transaction lower than 1.74 sats/vB, or Satoshi per byte, in accordance with information from Bitcoin explorer, Mempool.

Even because the Bitcoin community needed to adapt to the large improve in site visitors, many Bitcoin trustworthy continued to see the Ordinal venture pretty much as good for the primary blockchain by market capitalization in accordance with CoinGecko.

“What the crew got here up with Ordinals is genius,” Alex Miller, CEO of Hiro, a developer for layer-2 good contract platform Stacks, informed Decrypt in an interview. “It’s tremendous core to the Bitcoin core ethos in that they principally took a number of various things and pieced them collectively in a approach the unique creators didn’t foresee or count on.”

In contrast to Ethereum or Solana NFTs that use good contracts, Ordinals are inscribed immediately onto particular person Satoshis, the bottom denomination of a Bitcoin, named after the pseudonymous creator of Bitcoin, Satoshi Nakamoto. As a result of Ordinals lack good contract assist and programmability, many within the Stacks group see its rise as an general profit to Bitcoin sidechain builders.

“There’s a variety of restrict to how a lot information you possibly can put in an Ordinal retailer, and that is actually the place we see Stacks goes to return in and actually broaden,” Miller stated. including that Ordinals has confirmed that there is huge demand to have the ability to use NFTs on Bitcoin.

Ordinals can also be nonetheless in its early phases, and lacks a number of key options for long-term development. These embody a seamless method to inscribe Ordinals with out the necessity to sync the whole Bitcoin blockchain, marketplaces to purchase and promote digital artifacts, and wallets that permit collectors to see their Ordinals—one thing Hiro and different builders are working furiously to launch.

We’ve begun rolling out assist to Hiro Pockets for Bitcoin, NFTs and Ordinals for a very cross-protocol Bitcoin Web3 expertise. https://t.co/OAVriTraFq

🧵 A thread with particulars… #bitcoin #web3 #stx #nfts #ordinals pic.twitter.com/SiWrIluFhk

— Mark Hendrickson | mark.btc | Hiro Pockets (@markymark) February 14, 2023

“The Stacks group have been saying for therefore lengthy that issues must be getting constructed on Bitcoin,” Miller continued. “As a result of it’s the most trusted factor that’s been across the longest, it’s not going wherever.”

Regardless of the thrill round Ordinals, Miller did acknowledge that the Bitcoin blockchain was not meant for use this fashion, noting the shortage of programmability of the blockchain, versus Ethereum, which has programmability in-built.

Ethereum NFTs are nonetheless early of their lifecycle as properly, Miller notes, and says he doesn’t see Ordinals as a problem to Ethereum’s dominance within the NFT house. Nonetheless, he does say that the on-chain information storage will make the Bitcoin blockchain a preferred place to inscribe vital data like deeds, actual property transactions, or authorities paperwork.

“I don’t suppose that [Ordinals] are going to be a one-for-one alternative for Ethereum NFTs,” Miller stated. “However I additionally don’t suppose the truth that they’re completely different goes to be an imposition for it—I feel it’s going to be an asset.”