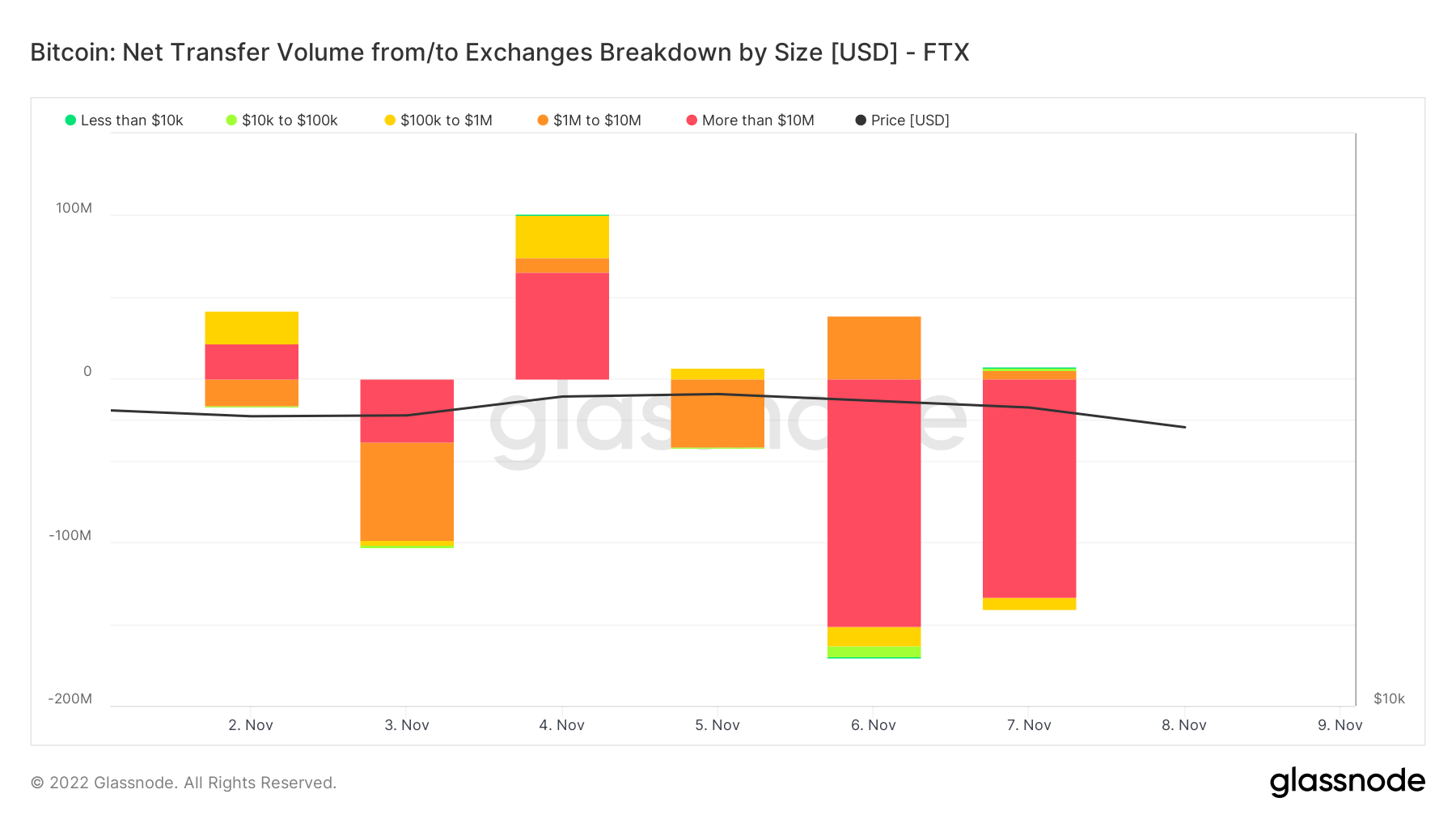

FTX recorded a withdrawal of over $360 million price of Bitcoin(BTC) in two days, with the vast majority of promote strain coming from whales.

That is reportedly the tenth-biggest BTC withdrawal this yr. As well as, Nansen knowledge reveals that FTX stablecoin outflows have been the very best amongst exchanges over the previous seven days, as reported by Knowledge Nerd. The stablecoin withdrawals recorded $451 million in weekly outflows.

The large sell-off has occurred following Binance’s CEO’s announcement that Binance can be liquidating its FTX’s native change token FTT.

Within the meantime, FTX CEO Sam Bankman-Fried tried to calm fears of a potential collapse by reassuring that FTX and its property have been positive and that the agency possessed sufficient to cowl all of its purchasers’ positions.

Even so, the CEO’s submission was largely ignored, as FTX continued to see withdrawals, with monitoring sources indicating unfavourable BTC balances. As of Nov. 7, FTX’s BTC stability was -19,956 BTC, in accordance with the on-chain analytics platform CryptoQuant.

Moreover, CryptoQuant data reveals that Ethereum withdrawals on FTX have reached a brand new file. The present FTX reserve hits 108,246.43 ETH, the bottom since November 2020.

Worsening Withdrawal State of affairs?

Etherscan data signifies that FTX has stopped processing Ethereum (ETH), Solana (SOL), and TRON (TRX) withdrawals.

Lately, many customers have reported comparatively sluggish Bitcoin withdrawal speeds. Afterward, Reddit customers expressed concern over the developments and in contrast the scenario to Celsius halting withdrawals and deceptive customers earlier than it crashed.

In response to the considerations, the FTX stated yesterday that its node has “throughput limitations,” however the withdrawal can be accelerated quickly.

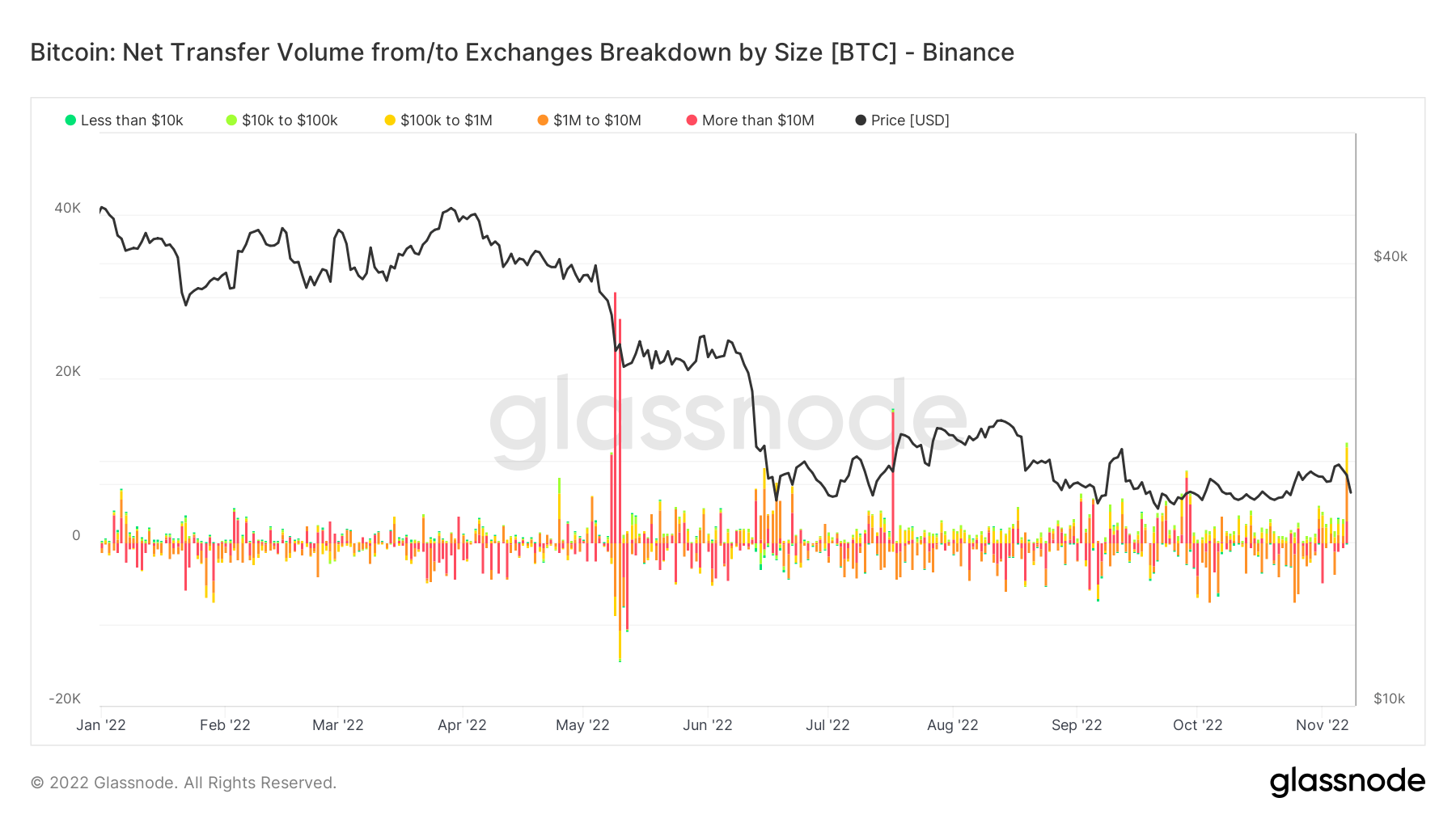

Amidst FTX’s lack of quantity, Binance’s Treasury is rising. After the occasion, Binance noticed the most important influx of BTC this yr.

Inside 48 hours, over 20K Bitcoins moved from FTX to Binance. Consequently, FTX’s Bitcoin holdings fell to six,000 in November from 80,000 in January, whereas Binance now holds over 640,000 bitcoins.

Amid the present occasions, BTC has fallen to a two-week low beneath the $20,000 mark however presently buying and selling at $20,206.97.