Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- The each day market construction, at press time, was about to flip bullish

- Two ranges for decrease timeframe merchants to be careful for as a retest can present buying and selling alternatives

The discharge of the CPI information was simply across the nook, on the time of writing. Ease in inflation is predicted, however is that this expectation already priced in? Does that specify the latest Bitcoin pump proper right into a zone of resistance at this vital second? And, what can that imply for Polkadot merchants?

Learn Polkadot’s [DOT] Worth Prediction 2023-24

Merchants can put together themselves for the bullish and the bearish eventualities. Since DOT can be at a vital inflection level, its subsequent leg will not be but sure. Proof for the subsequent transfer could be awaited earlier than assuming positions out there.

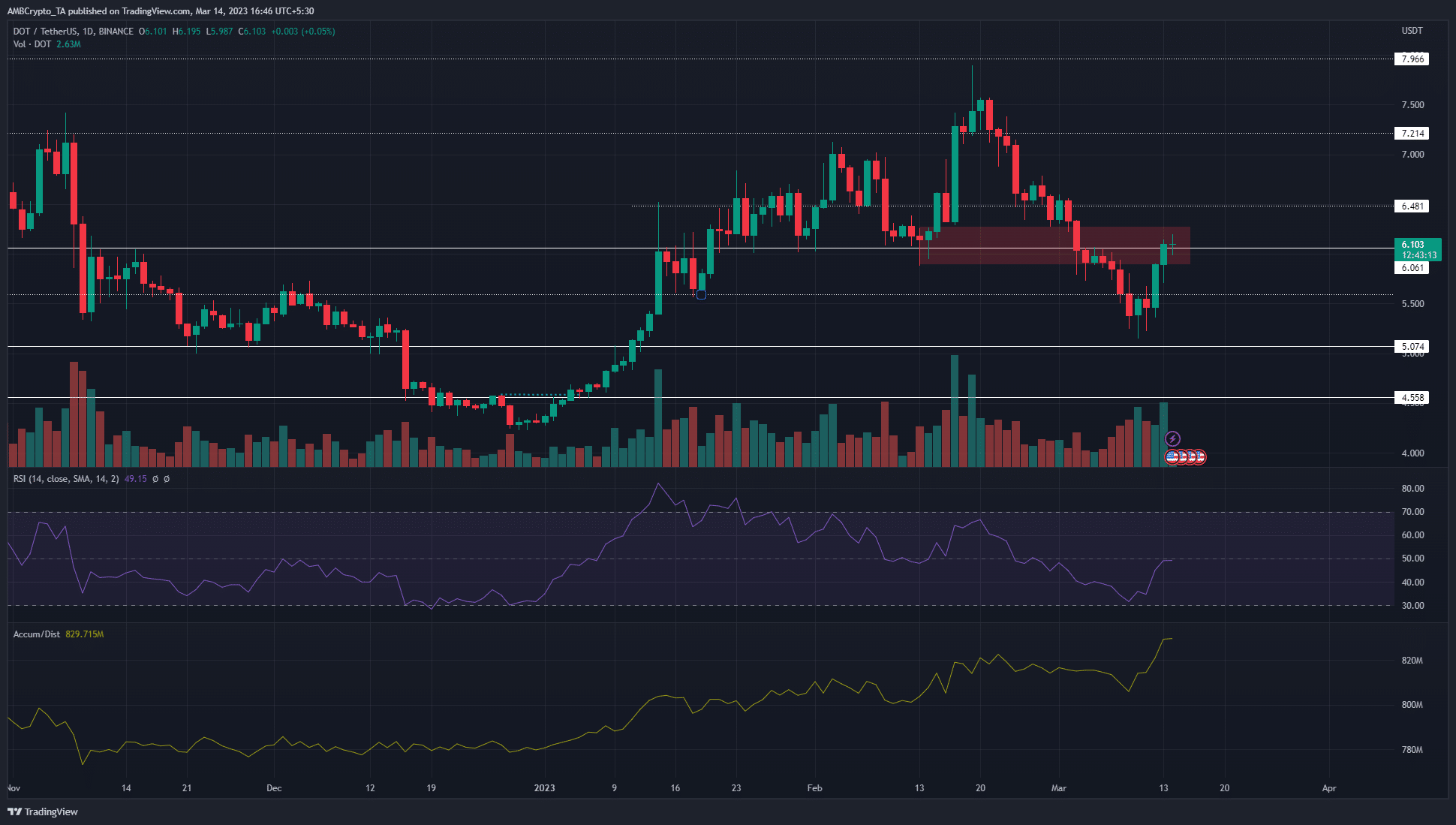

The each day bearish breaker is more likely to oppose DOT bulls

Supply: DOT/USDT on TradingView

A former bullish order block, which was flipped to a bearish breaker in early March, was highlighted by the purple field. On the time of writing, the worth was inside this zone, testing it as a zone of provide. Furthermore, this space had confluence with the $6.1-level of resistance. Bitcoin was buying and selling just under the $25.2k resistance, which marked the highs of August 2022 and February.

If BTC can escape previous this resistance, it will sign bullish sentiment throughout the market. This might prime DOT to climb previous the $6.1-level as properly. Nevertheless, a each day session shut above the breaker can be required earlier than consumers can search for alternatives to enter lengthy positions. The market construction was on the verge of flipping bullish as properly, because the latest decrease excessive at $6.06 from 5 March may very well be overwhelmed.

However, if the worth sees rejection and falls beneath the $5.75-level, it will be an indication that bears had taken management. Quick sellers can thereafter look to quick the asset, with a stop-loss above the $6.1-mark. To the south, targets can be the $5.6-level and the March low at $5.15.

How a lot are 1, 10, or 100 DOT price in the present day?

The RSI was at impartial 50 at press time, whereas the A/D line had climbed over the previous few weeks to indicate sturdy shopping for strain. This was one other indication that DOT was in a major space, but it surely appeared the consumers had an edge.

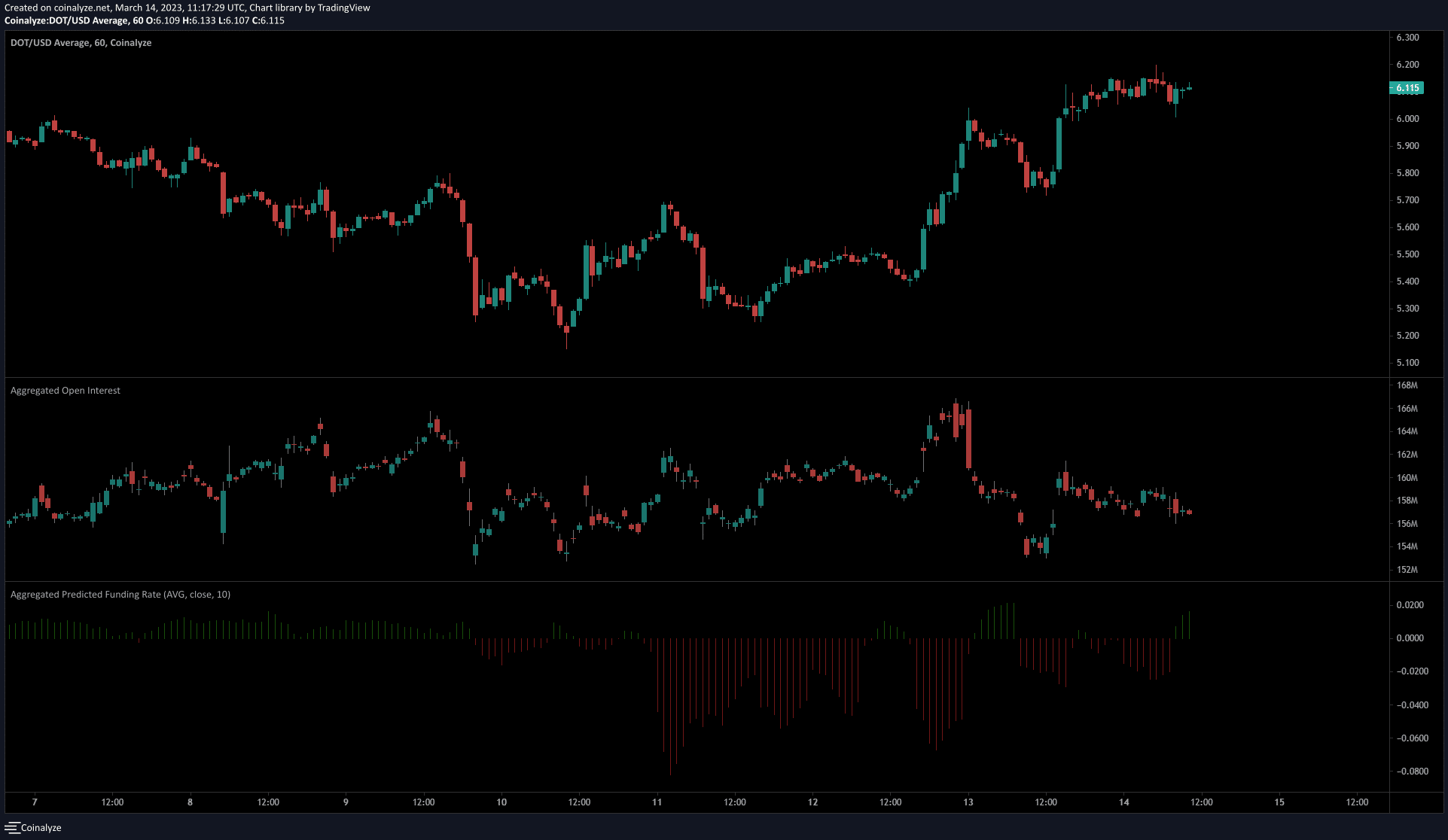

OI indicated individuals may very well be attempting to fade the rally

The Funding Charge jumped into optimistic territory to sign that the sentiment was bullish. Nevertheless, the 1-hour chart confirmed a drop in Open Curiosity over the past 12 hours previous the time of writing. On this interval, the worth continued to climb greater.

This advised that lengthy positions have been discouraged and bearish sentiment started to take maintain. And but, it may very well be too early to quick Polkadot. The response of Bitcoin over the subsequent couple of days would present the path of the market over the approaching weeks.