- DOT was behind Ethereum when it comes to weekly improvement exercise contributors.

- Progress within the NFT house was witnessed however the different metrics have been bearish.

Polkadot’s [DOT] Moonbeam community not too long ago introduced just a few notable integrations that seemed promising for the Polkadot ecosystem. As an example, Bifrost partnered with Moonbeam to leverage its underlying infrastructure to realize fast market entry. The partnership will permit Bifrost to make use of acquainted Ethereum instruments, permitting them to enter the market easily.

1/3

An thrilling integration within the Dotsama ecosystem! 🎉@bifrost_finance offers one thing distinctive for @MoonbeamNetwork and @MoonriverNW parachains! 🚀The Liquid Staking for $GLMR and $MOVR Tokens. 🪙

Watch the video to study extra: ⬇️https://t.co/PNDCVBWJ1f pic.twitter.com/Hr3Zk6tyX1— Polkadot Ecosystem PromoTeam (@PromoTeamPD) November 22, 2022

Learn Polkadot’s [DOT] Worth Prediction 2023-24

Polkadot has been within the information for a number of weeks now relating to its improvement exercise. Even not too long ago, DOT was on the checklist of well-liked chains based mostly on weekly improvement exercise contributors, solely behind Ethereum.

POPULAR CHAINS RANKED BY WEEKLY DEV ACTIVITY CONTRIBUTORS

🥇 Ethereum: 165

🥈 @polkadot: 139 🔥🔥

🥉 Cardano: 126

4. Close to Protocol: 60

5. Solana: 58

6. Bitcoin: 41

7. Avalanche: 37

8. Algorand: 30

9. Tron: 20

10. Fantom: 10#Polkadot $DOT #Blockchain #Relaychain #Layer0 #BTC pic.twitter.com/MeTbSKkmK3— Polkadot Insider (@PolkadotInsider) November 23, 2022

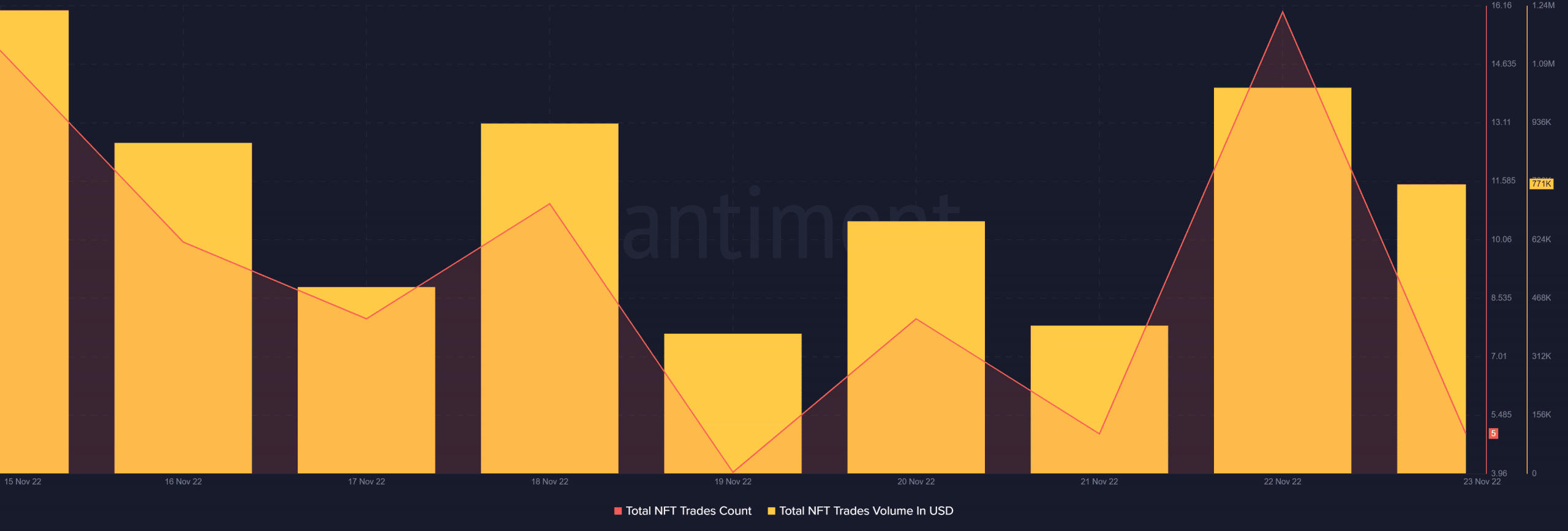

Curiously, Santiment’s chart revealed that Polkadot additionally witnessed development in its NFT ecosystem. Polkadot’s whole NFT commerce rely and NFRT commerce quantity in USD each spiked final week.

Supply: Santiment

All these constructive developments really mirrored on DOT’s worth chart, as its worth elevated by greater than 7% within the final 24 hours. As per CoinMarketCap, at press time, DOT was trading at $5.41 with a market capitalization of over $6.1 billion.

Nevertheless, can DOT maintain this uptrend, or was this simply an aftereffect of the present bullish pattern, which a lot of the cryptos have been displaying?

Hassle across the nook?

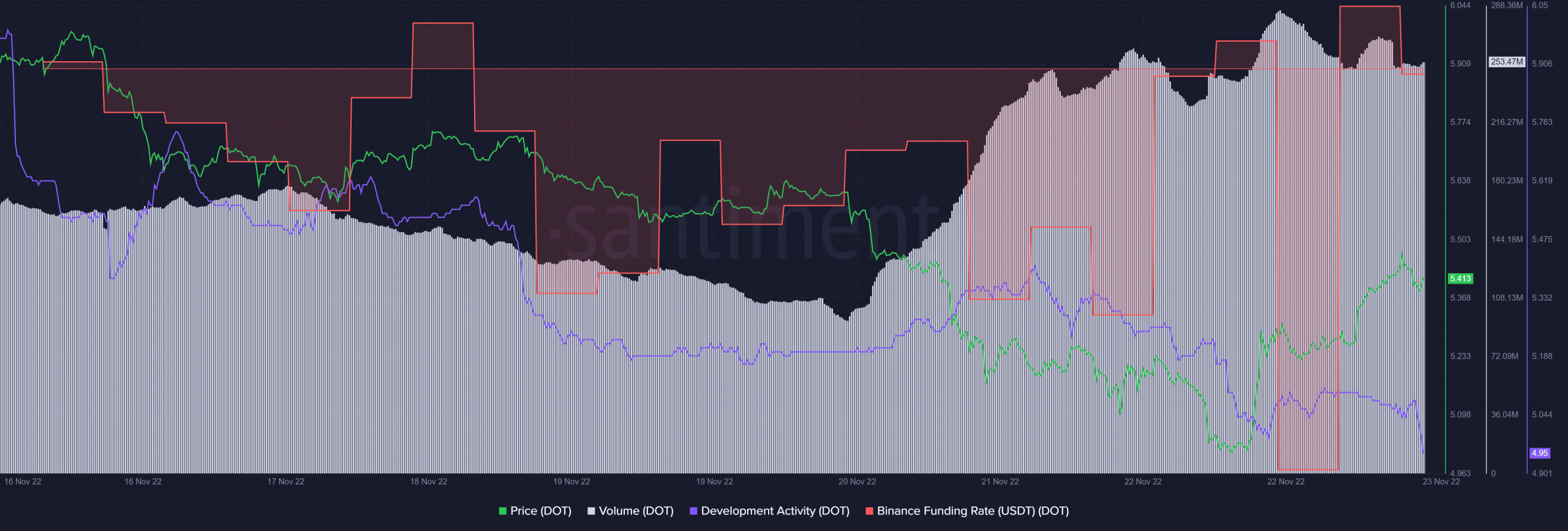

A take a look at DOT’s on-chain metrics offered some readability relating to what to anticipate from the token within the days to return. Regardless of being solely behind Ethereum when it comes to improvement exercise contributors, DOT’s improvement exercise decreased significantly over the previous week. That is, by and enormous, a unfavourable sign for the community.

DOT’s Binance funding charge additionally marked a pointy decline, reflecting much less curiosity from the derivatives market. Nonetheless, on the time of writing, DOT’s Binance funding charge did present indicators of restoration by registering an uptick. Actually, DOT’s quantity additionally elevated considerably, which reduces the probabilities of an unprecedented worth fall within the coming days.

Supply: Santiment

The indications seemed higher

Although a lot of the metrics weren’t supporting DOT, just a few of the market indicators have been in favor of the patrons as they instructed a worth hike. DOT’s Relative Power Index (RSI) registered an uptick and was heading towards the impartial mark, which may be bullish.

DOT’s On-Stability-Quantity (OBV) additionally adopted the same route and went barely up. In keeping with the MACD’s discovering, the bears nonetheless had a bonus out there, however issues might take a U-turn as there was a chance of a bullish crossover quickly.

Supply: TradingView