Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- DOT was strongly bullish on the every day value charts on the time of writing.

- DOT’s Funding Charge was constructive, and sentiment improved.

Polkadot [DOT] bulls have been upbeat in regards to the $8 worth after overcoming a sizzling promote stress zone. Thus far, DOT has rallied by 70%, constructing on the spectacular upswing in January. However most significantly, current Bitcoin’s [BTC] retest of $25K boosted DOT bulls to beat a vital promote stress zone.

Learn Polkadot’s [DOT] Worth Prediction 2023-24

Will the brand new assist zone maintain?

Supply: DOT/USDT on TradingView

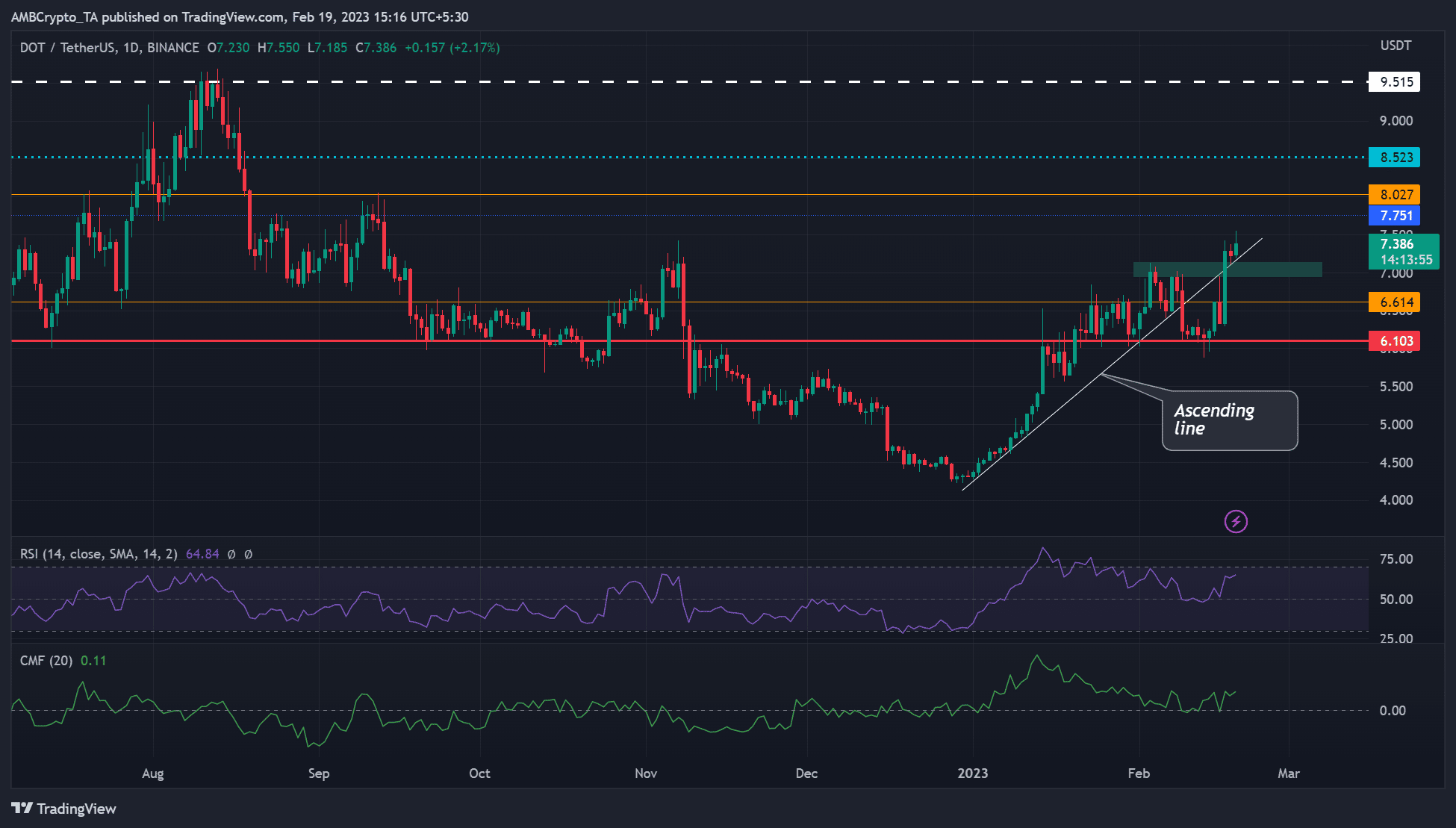

DOT confronted vital challenges regardless of the rally witnessed previously a number of weeks. On the finish of January, it went into an prolonged consolidation section and oscillated between $6.103 and $6.614. It broke above the vary on February 3 however hit the availability zone at $7.000, prompting it to interrupt under the ascending line.

The worth rejection at $7.000 set DOT right into a correction and misplaced about 14% of its worth. However the plunge was checked by the earlier $6.103 assist stage. After that, the restoration inflicted by bulls cleared the impediment at $7.000 and flipped the resistance into assist.

On the time of writing, the assist was confirmed, clearing bulls to focus on larger resistance ranges. Lengthy-term bulls might goal $8 in the event that they cleared one other hurdle at $7.751.

A break under the $7.000 resistance-turned-support will invalidate the bullish thesis. Such a downswing will tip bears to search for shorting alternatives at $6.614 or $6.103. An especially bearish situation might see DOT hit the $5.000 stage.

How a lot are 1,10,100 DOTs price at this time?

DOT noticed a constructive Funding Charge and improved buyers’ outlook

Supply: Santiment

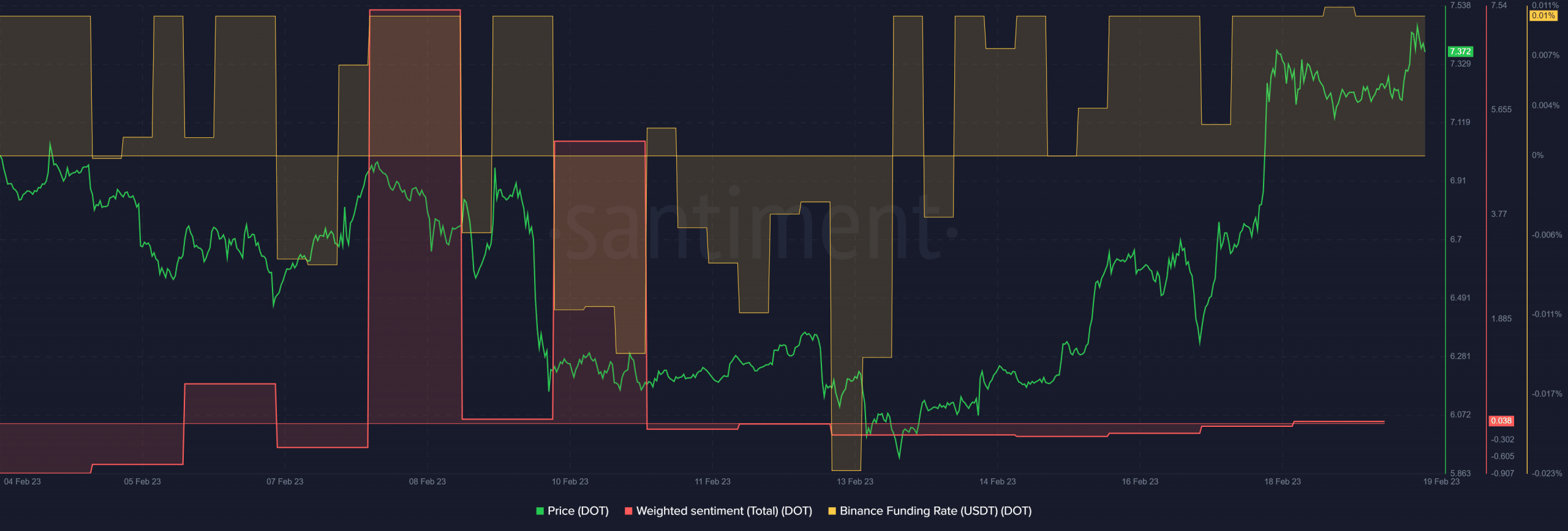

DOT noticed an improved buyers’ outlook, as proven by retreating weighted sentiment.

The sentiment moved from the detrimental territory and was barely above the impartial stage.

As well as, DOT’s demand within the derivatives market was spectacular, as highlighted by the constructive Funding Charge. Collectively, these constructive metrics counsel a bullish sentiment that would tip bulls to focus on $8.

In addition to, about $450M price of short-positions was liquidated previously 24 hours, according to Coinalyze. It additional reinforces the opportunity of bulls transferring towards September’s resistance stage of $8.027.

![Polkdot [DOT]: Bulls focused on $8 – Is it even attainable?](https://ambcrypto.com/wp-content/uploads/2023/02/zdenek-machacek-imXaftIwlc-unsplash-1000x600.jpg)