We beforehand examined the state of Bitcoin mining, nonetheless, it’s additionally crucial to take take a look at the brand new information that’s now accessible.

That is courtesy of the general public Bitcoin miners who lately printed their productiveness information for January 2023.

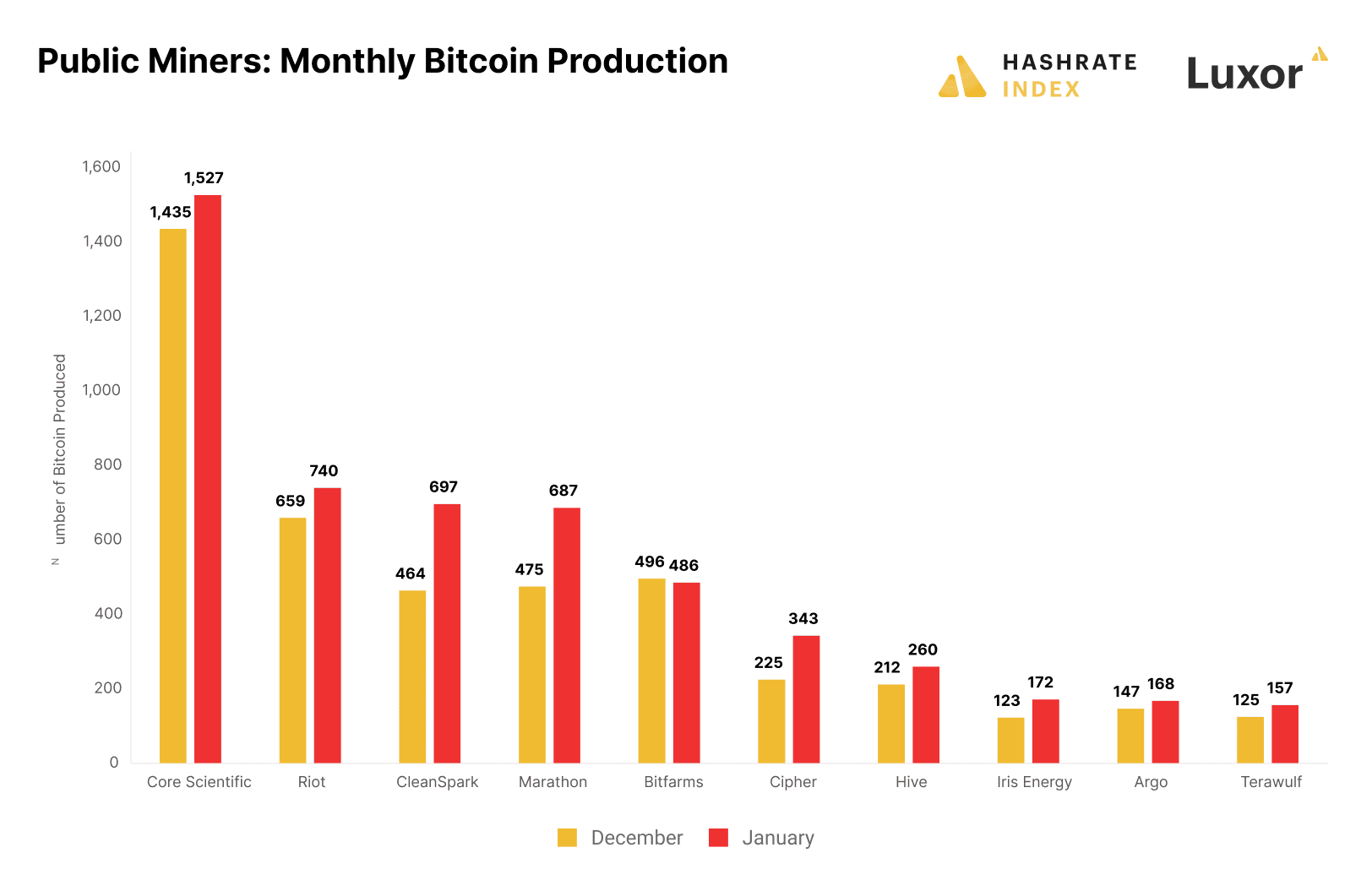

Whereas we beforehand seemed into Bitcoin mining from the angle of reserves, the newly printed information concentrate on manufacturing and hash charge.

These segments achieved noteworthy development and growth in January 2023, in comparison with December final yr.

In line with the report, 10 of the key public miners averaged larger Bitcoin manufacturing in January 2023, than in December 2022.

Supply: Hashrate index

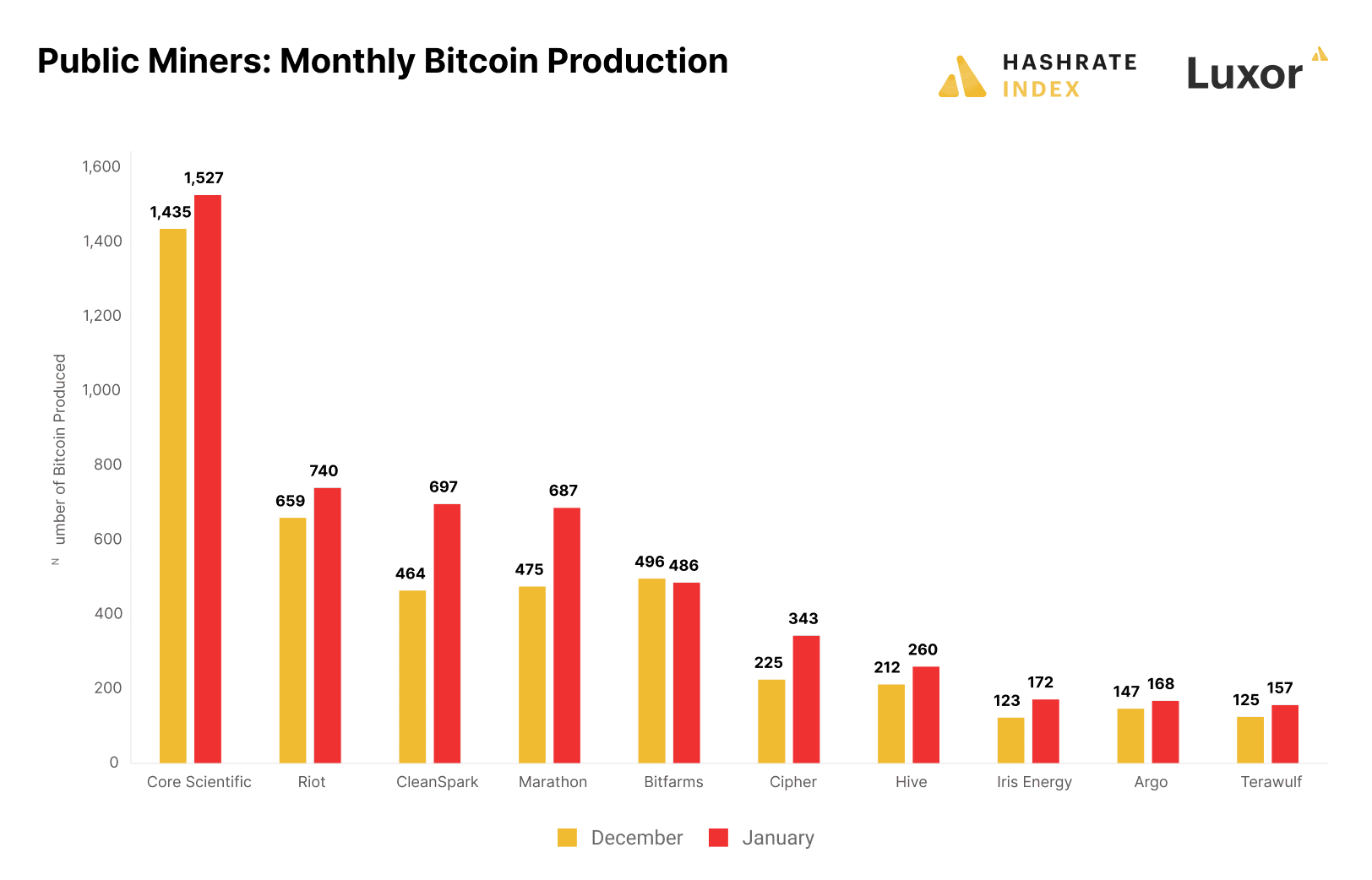

The hash charge findings additionally reveal an nearly related final result. Not less than seven of the ten public miners within the record had the next self-mining hash charge in January in comparison with December.

Supply: Hashrate index

There are a number of prospects for the outcomes highlighted above. The principle one is that Bitcoin bulls have been dominant in January, opposite to the state of affairs in December.

This implies there was extra market exercise, therefore extra transactions. Miners could have adjusted or elevated the variety of mining rigs to attempt to meet the upper demand for Bitcoin available in the market.

As for the hash charge, the report revealed that a number of the mining firm’s operations have been affected by components akin to climate.

What in regards to the general Bitcoin hash charge efficiency?

A take a look at Bitcoin’s hash charge within the final 12 months reveals an upward trajectory. It went from as little as 164.47 TH/S in March 2022 to 310.87 TH/S in January 2023.

This additionally implies that the Bitcoin community achieved larger ranges of decentralization and effectivity final month.

Supply: Coinwarz

What number of are 1,10,100 BTCs value at this time?

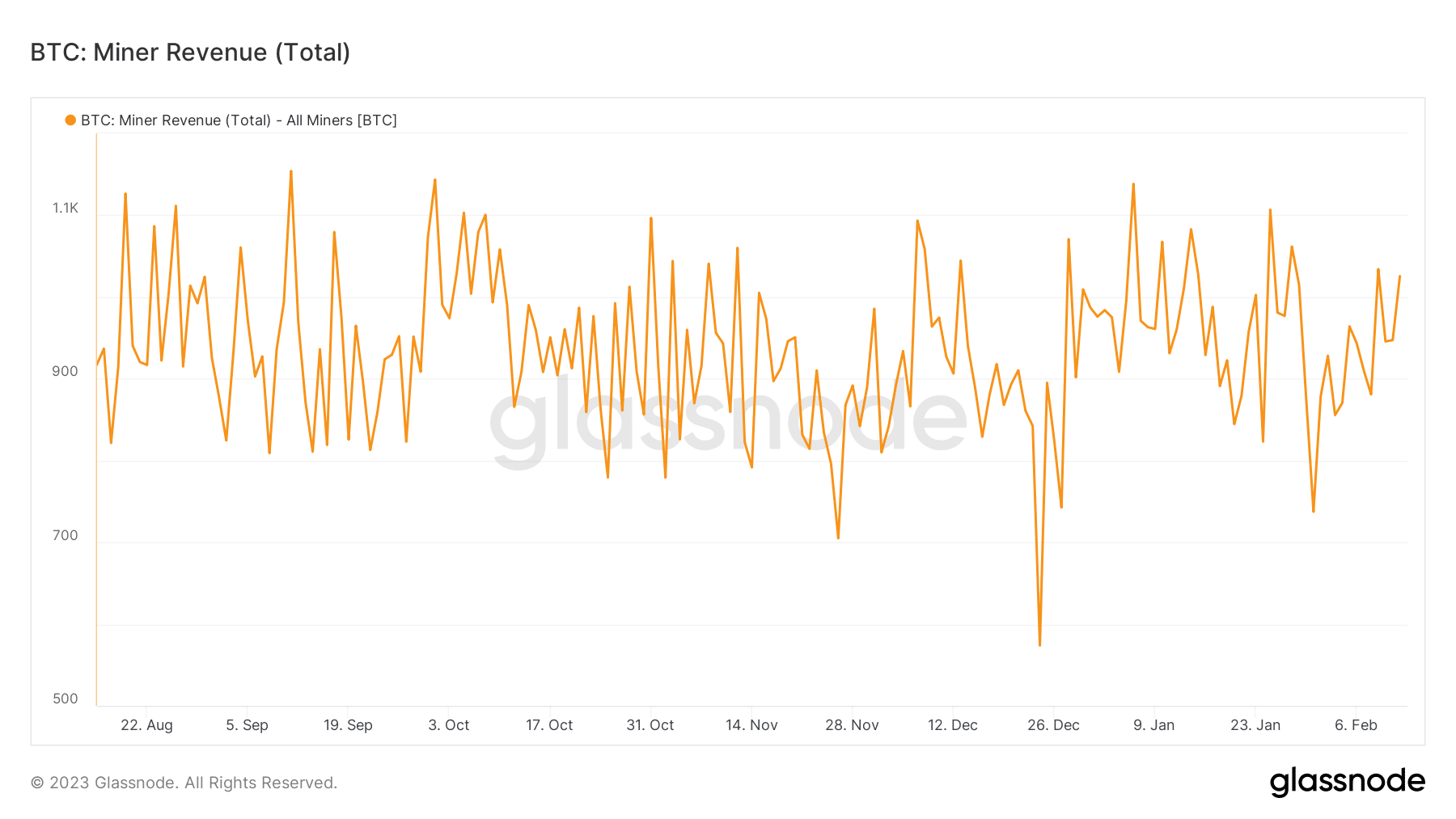

Miner income demonstrates a wholly completely different image. The bottom miner income was recorded on 24 December final yr.

That is across the vacation interval throughout which the value hovered close to its 2022 lowest ranges. Miner income efficiency in January was additionally peculiar on condition that it dropped sharply through the month.

Supply: Glassnode

The decline in miner income in January could have rather a lot to do with the hash charge.

The latter elevated through the month, as extra miners went dwell to capitalize on the bulls. Charges are sure to be decrease with extra competitors as extra Bitcoin miners come on board.