Quantitative analyst Plan B says that Bitcoin (BTC) is flashing alerts that strongly recommend that the main digital asset by market cap is bottoming out and beginning a brand new market cycle.

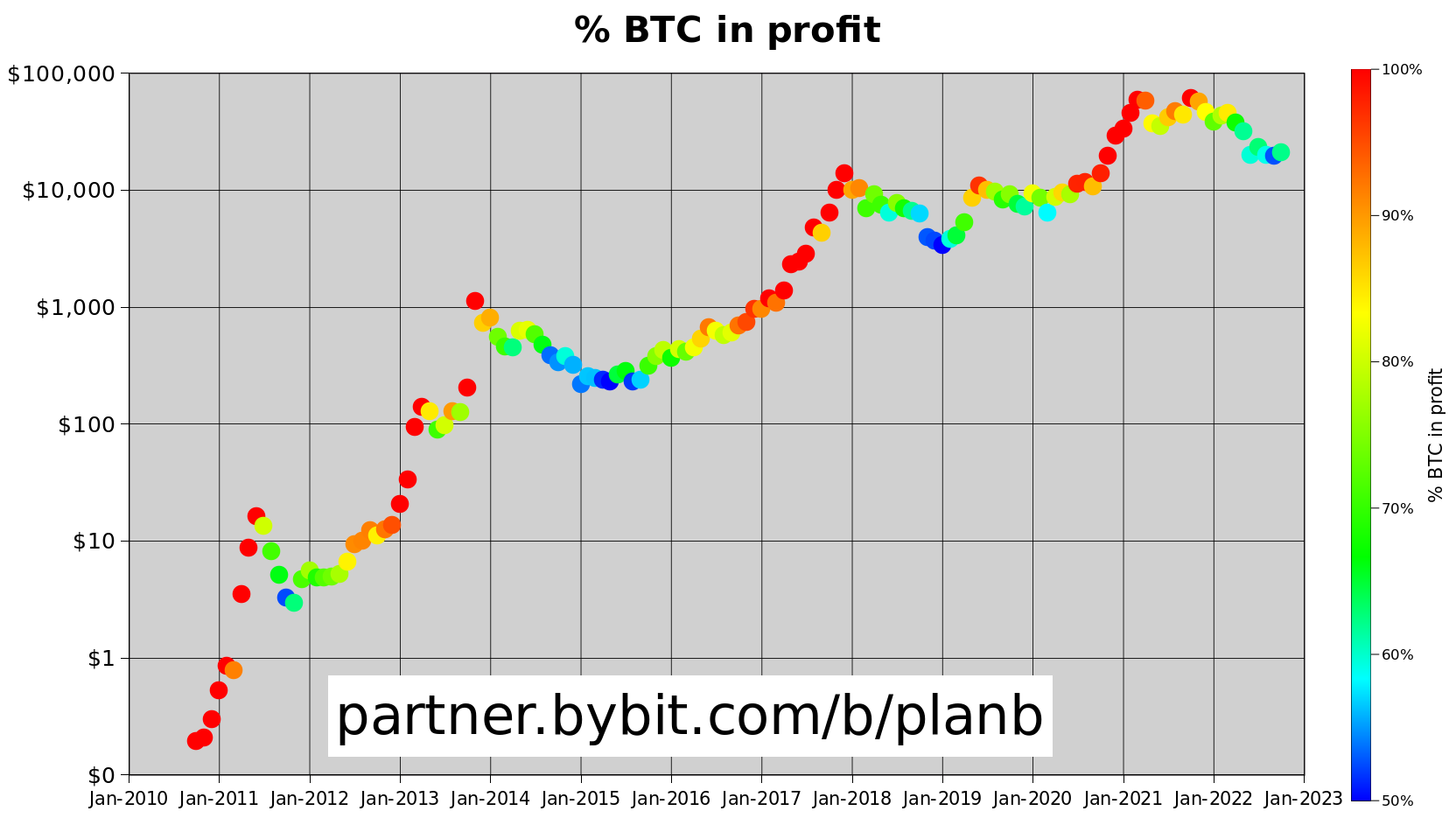

The pseudonymous analyst tells his 1.8 million Twitter followers that on-chain knowledge is indicating that greater than half of BTC in circulation is now in a state of revenue.

Plan B’s chart exhibits a cycle of BTC going from majority in revenue, depicted by purple dots, to roughly half in revenue, depicted by darkish blue dots.

In accordance with the analyst, cash in revenue going from 50% to over 60% is a robust bottoming sign.

“Extra backside alerts: >60% of all Bitcoin is in revenue”

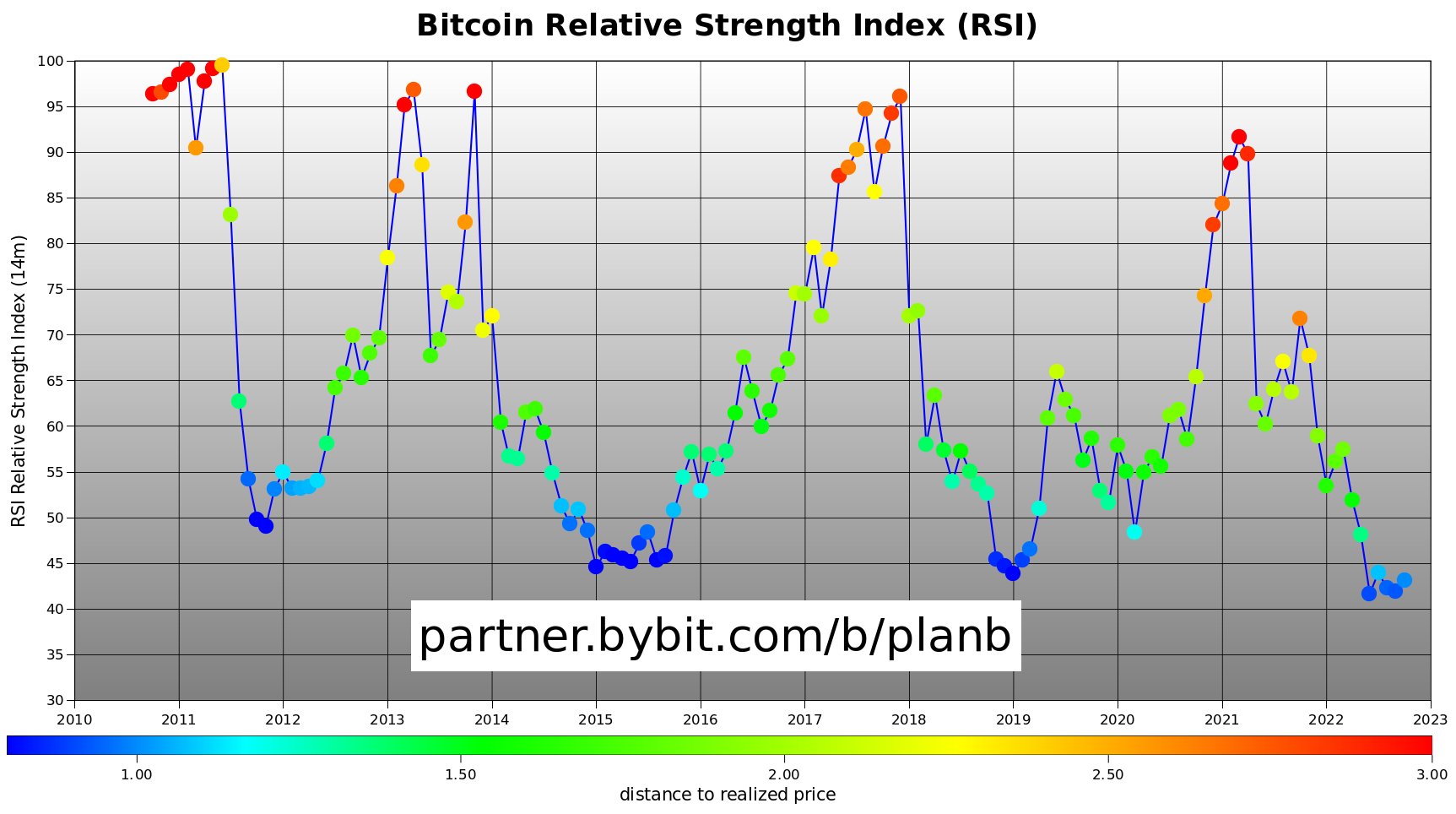

Plan B additionally has his eye on Bitcoin’s long-term relative energy index, one of the vital broadly used momentum indicators that goals to find out whether or not an asset is oversold or overbought. Utilizing the indicator on a 14-month scale, Plan B factors out that BTC’s RSI is at historic lows, suggesting that Bitcoin is deeply undervalued.

“Bitcoin RSI won’t keep low eternally!”

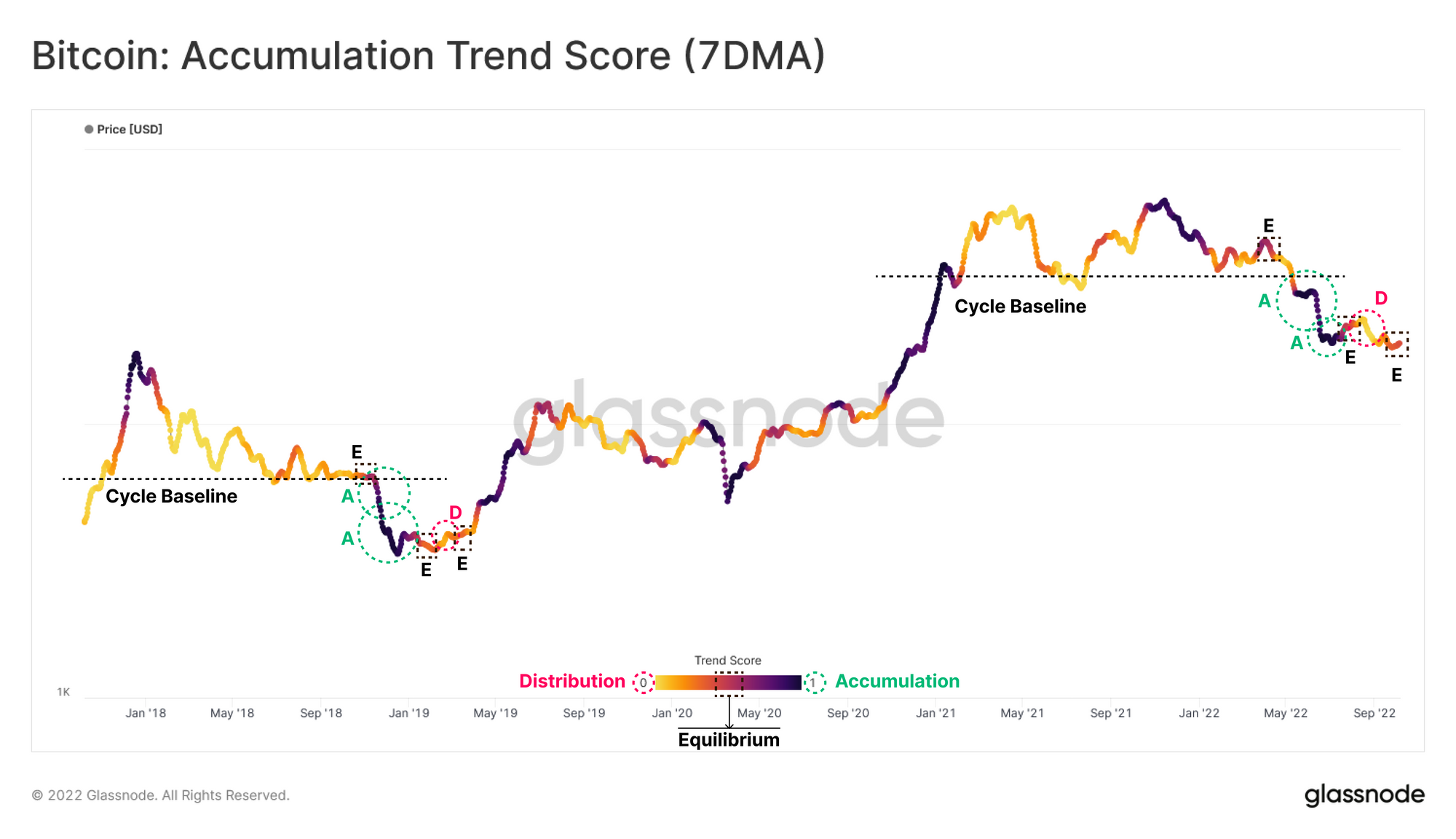

Main crypto analytics agency Glassnode has additionally reported that on-chain metrics recommend that Bitcoin is forming a bear market flooring. In a current report, the agency stated BTC’s accumulation development rating, which exhibits the aggregated steadiness change depth of energetic buyers up to now month, is mirroring the 2018/2019 bottoming course of.

Says the analytics agency,

“All through the capitulation in early 2022, the buildup development rating signifies important accumulation by giant entities has taken place, in addition to the seizure of the current bear market rally to $24,500 for exit liquidity. At current, this metric suggests an equilibrium (impartial) construction out there, which stays just like early 2019.”

At time of writing, Bitcoin (BTC) is buying and selling at $20,767, flat on the day.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Melkor3D