Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- QNT hiked 7% up to now 24 hours.

- QNT confirmed worth/open curiosity (OI) divergence.

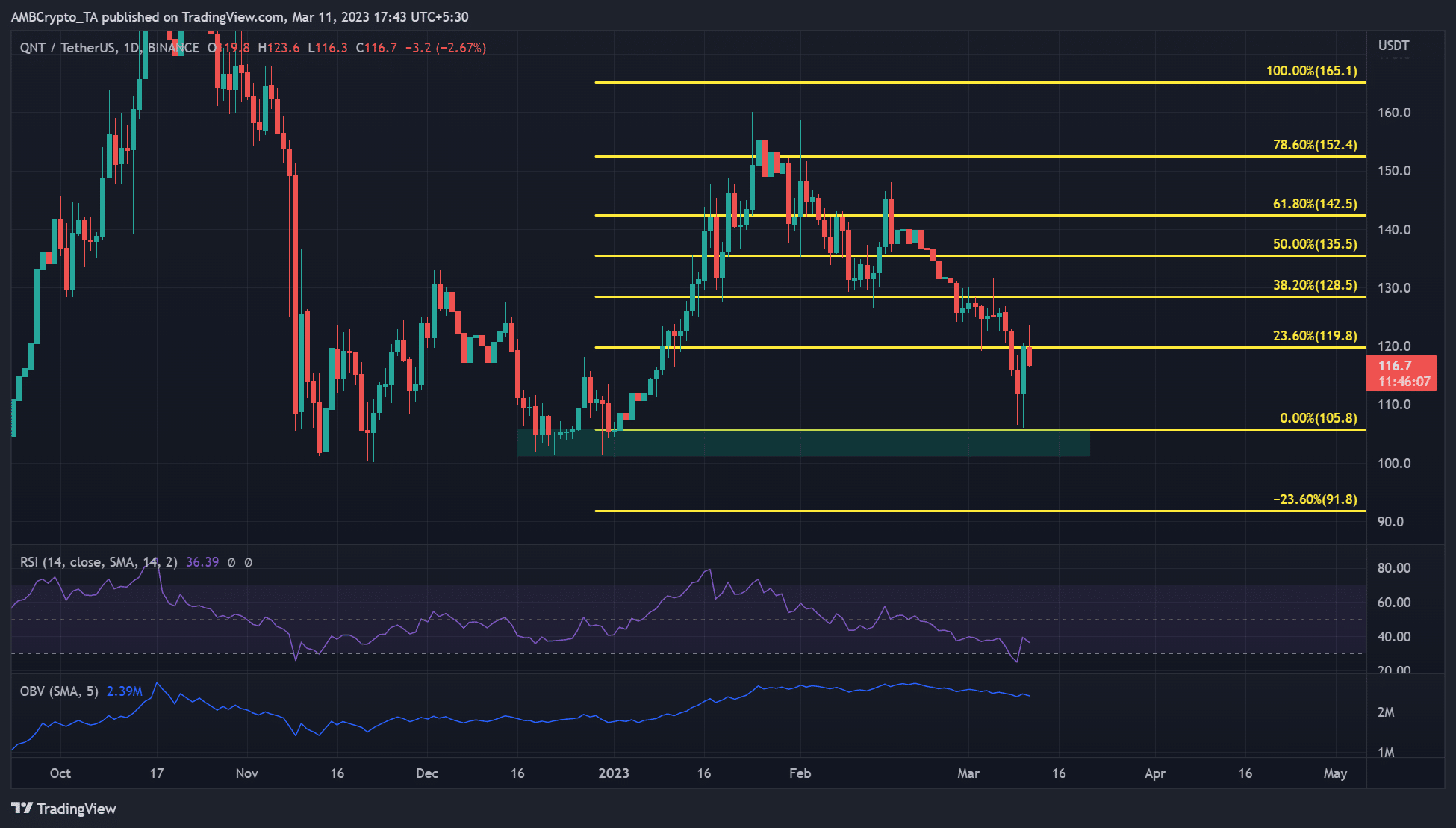

Quant [QNT] cleared all of the good points made in early 2023 after retesting January lows. It was caught between the $128.5 – $119.8 vary within the first week of March.

Nonetheless, it dropped under $120 and hit January’s lows of $105.8 earlier than inflicting a rebound. Previously 24 hours, QNT rallied 7%, hitting the 23.6% Fib stage ($119.8).

On the time of writing, QNT confronted short-term stress as Bitcoin [BTC] confronted elevated market uncertainty. A pullback retest on this assist might supply new shopping for alternatives.

Learn Quant [QNT] Value Prediction 2023-24

Can the bulls defend the January lows?

Supply: QNT/USDT on TradingView

QNT depreciated 38.5% after dropping from $165.1 to $105.8. However inflicted a restoration earlier than going through a hurdle at 23.6% Fib stage ($119.8). The pullback might retest the $105.8 assist stage if the worth motion fails to shut above the 23.6% Fib stage.

Such a transfer might supply long-term bulls new shopping for alternatives with an entry at $105.8. The first and secondary targets can be the Fib ranges at 23.6% ($119.8) and 38.2% ($128.5).

The 2 attainable trades might supply a risk-to-reward (RR) ratio of 1:3 and 1:4.72, respectively, if the cease loss is under $105.8. The opposite vital resistance lies at 50%, 61.8%, and 78.6% Fib ranges.

Alternatively, a breach of January lows might appeal to aggressive promoting for QNT. The promoting stress might sink QNT under $100, however the $91.8 can verify the drop.

The RSI (Relative Energy Index) recovered from the oversold territory, displaying elevated shopping for stress. Nonetheless, it had a downtick at press time, which point out the short-term promote stress was witnessed on the time of writing.

Alternatively, the OBV (On Stability Quantity) has dipped since February 20 and restricted a robust restoration.

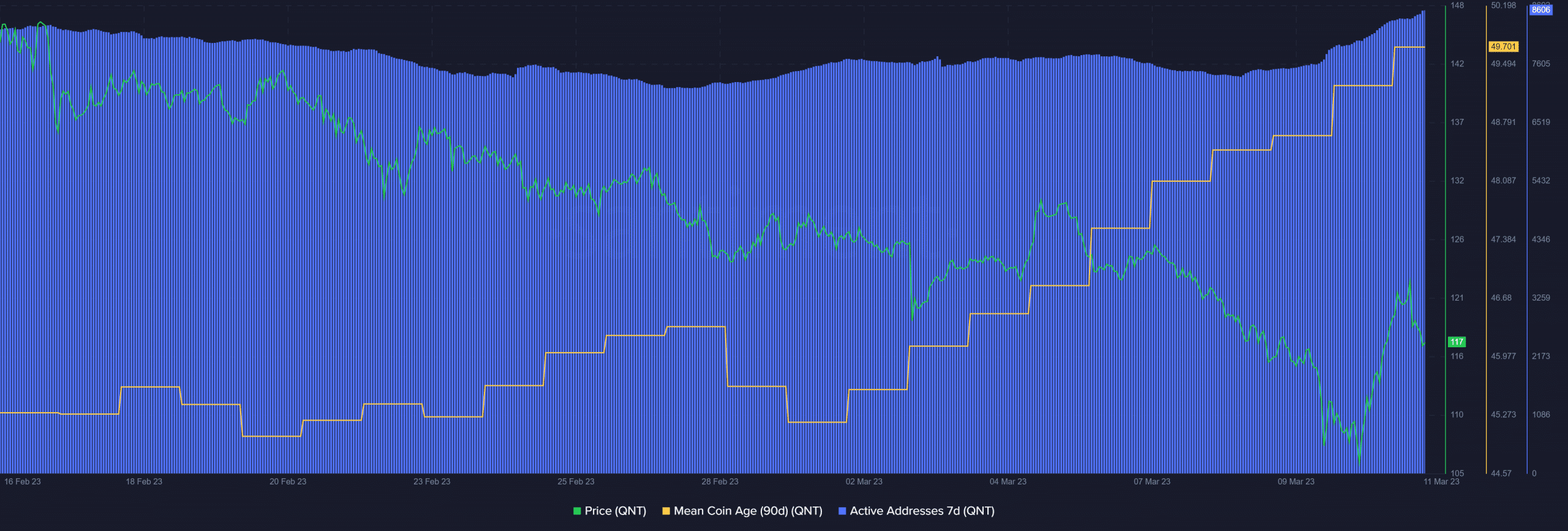

Lively addresses and Imply Coin Age surged

Supply: Santiment

As per Santiment, the 90-day Imply Coin Age rose to point a wide-network accumulation – proof of a attainable rally. As well as, energetic addresses spiked, displaying improved buying and selling volumes which might enhance additional restoration.

Is your portfolio inexperienced? Try QNT Revenue Calculator

Furthermore, there was a worth/open curiosity (OI) divergence as worth motion dropped whereas the OI elevated. It exhibits the demand for QNT remained sturdy regardless of the slight correction on the time of press time – a bullish sentiment that might assist the restoration.