Solidus Labs’ 2022 Rug Pull report revealed that 8% of all Ethereum (ETH) tokens and 12% of all BNB Chain tokens are rug pull scams.

The report considers knowledge from Jan. 1 to Dec. 1, 2022, and in addition detected over $11 billion value of ETH transactions have been both immediately linked to rip-off tokens or have been included within the cash laundering strategy of rug pulls.

This knowledge results in the estimation that 8% of all Ethereum tokens are programmed to execute rug pulls.

Evaluating the publicity to those rip-off tokens, the report additionally revealed that the BNB Chain hosts the very best variety of rip-off tokens, with 12% of all BNB Chain tokens being scams.

117,629 rip-off tokens in 2022

The report acknowledges that the trade analysis recognized 24 rug pulls in 2021 and 262 in 2022. Nonetheless, Solidus Labs’ sensible contract scanning device Menace Intelligence recognized over 200,000 rip-off tokens deployed between Sept. 2020 and Dec. 2022.

Menace intelligence detected 83,268 rip-off tokens between Jan. 2021 and Dec. 2021. This quantity recorded a 41% spike within the first 11 months of 2022 and elevated to 117,629.

Bigger affect than FTX

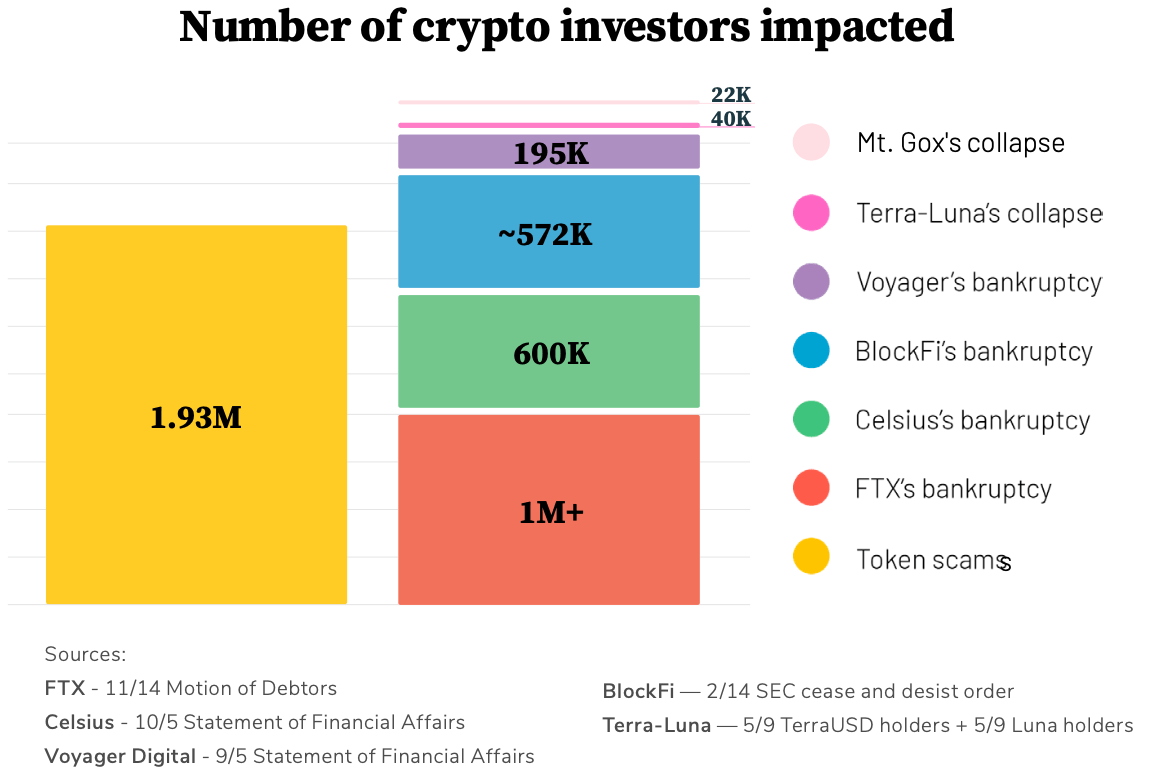

Solidus Labs additionally in contrast the affect of those rip-off tokens with the key occasions of 2022, together with the Terra (LUNA) collapse that began the bear market and the FTX fallout.

The outcomes confirmed that 1.93 million buyers had misplaced funds to rip-off tokens, greater than the variety of buyers affected by the Terra and FTX collapses mixed.

Excluding the affect of the rip-off tokens, the FTX collapse had the biggest affect on the trade by affecting simply above 1 million buyers. Celsius’ and BlockFi bankruptcies adopted as second and third by affecting 600,000 and 572,000 buyers, respectively.

Contemplating the importance of those numbers, Terra’s collapse nearly seems as a minor disaster because it impacted almost 40,000 buyers.

CeFi publicity

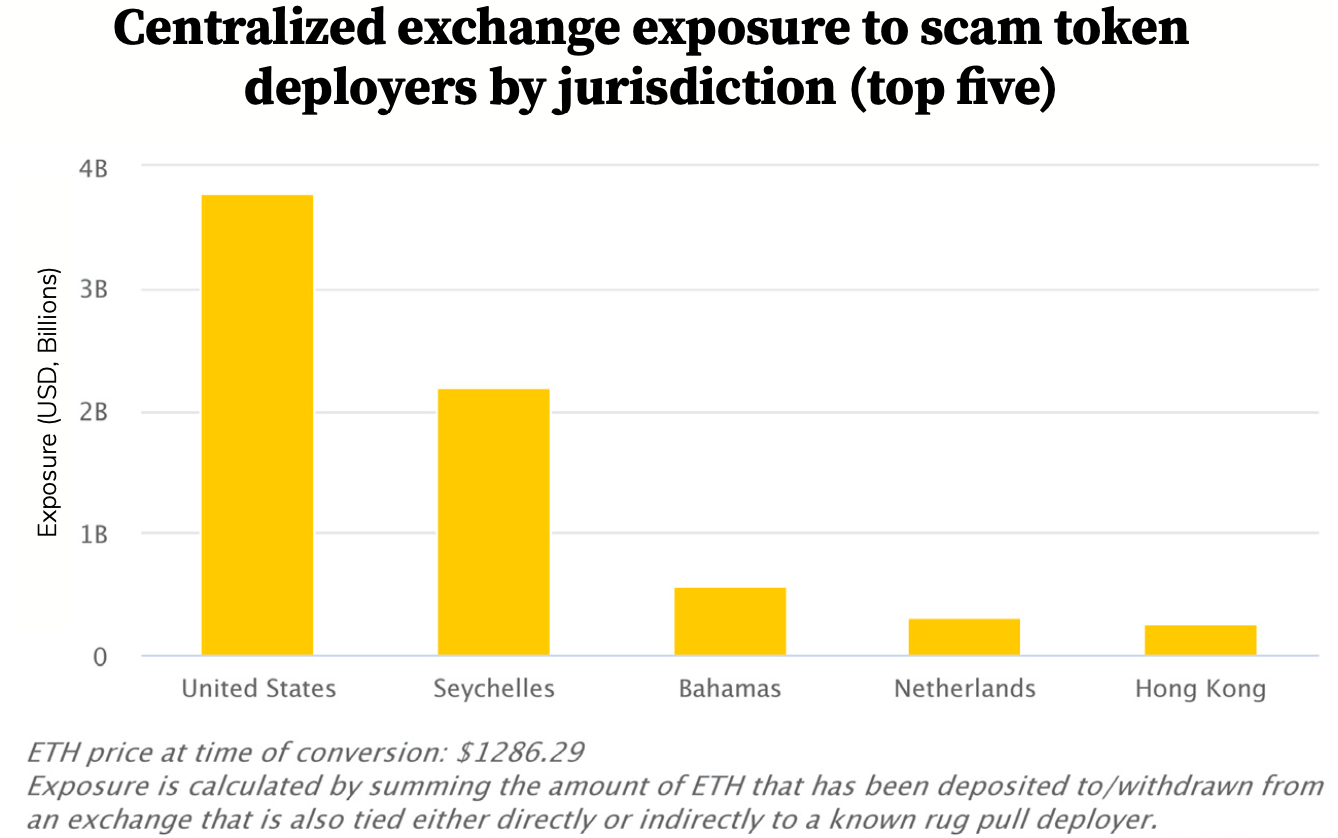

In accordance with the report, 99% of those rip-off tokens weren’t detected by conventional approaches. These scams most well-liked to deploy in centralized exchanges (CeFi) and managed to deposit and withdraw funds from 153 totally different CeFi platforms.

The report additionally supplies a breakdown of the exchanges in query. In accordance with knowledge, CeFi exchanges based mostly within the U.S. have the very best publicity to rip-off tokens, with round $3,75 billion.

East African nation Seychelles follows because the second with simply above $2 billion, whereas the Bahamas comes third with $500 million.