- Ripple’s authorized counsel alerted the crypto group a couple of potential market crash resulting from impending SEC actions

- XRP’s worth motion confirmed that the token might edge in direction of the bullish momentum within the brief time period

Because the crypto market briefly recovered over the weekend, Ripple’s [XRP] lawyer, John E Deaton, tweeted that the group wanted to be watchful. In keeping with the authorized practitioner, the US SEC, led by Gary Gensler, was not finished with crypto companies.

Deaton additionally famous that the SEC’s doubling of its workforce was geared toward bringing down the crypto sector.

A few of us have been saying @GaryGensler and the @SECGov was coming after Crypto for two years. He actually doubled the scale of the SEC workers devoted to crypto and pushed regulation by enforcement in non-fraud circumstances like @Ripple @LBRYcom @dragonchain and @BlockFi, to call just a few. https://t.co/4v1ijY4Cl4

— John E Deaton (@JohnEDeaton1) December 4, 2022

Learn Ripple’s [XRP] Value Prediction 2023-2024

Responding to a tweet by Bitboy Crypto who talked about the bromance SEC with embattled FTX founder, Deaton stated that the regulatory authority was solely involved about enforcement as a substitute of their main responsibility.

Beware! One other collapse may very well be imminent

Deaton expanded on the SEC’s motion plan by noting that the SEC is likely to be one other notable alternate, which might have an effect on the market negatively. He stated,

“I imagine it much more in the present day as a result of it might trigger one other 50% crash. Then incumbents take a bigger share.”

6 months in the past on @FoxBusiness w/@cvpayne @LizClaman @CGasparino @EleanorTerrett I stated that Gensler would sue a significant alternate or two for promoting unregistered securities. I imagine it much more in the present day as a result of it might trigger one other 50% crash. Then incumbents take a bigger share.

— John E Deaton (@JohnEDeaton1) December 4, 2022

In mild of the event, XRP strayed away from the record of high cryptocurrencies with wonderful performances. In keeping with CoinMarketCap, XRP exchanged fingers at $0.391 at press time.

The token struggled to place up an attention-grabbing efficiency within the long-term as nicely. It misplaced 20.88% within the final 30 days, and the final seven days produced a slight 2.70% improve.

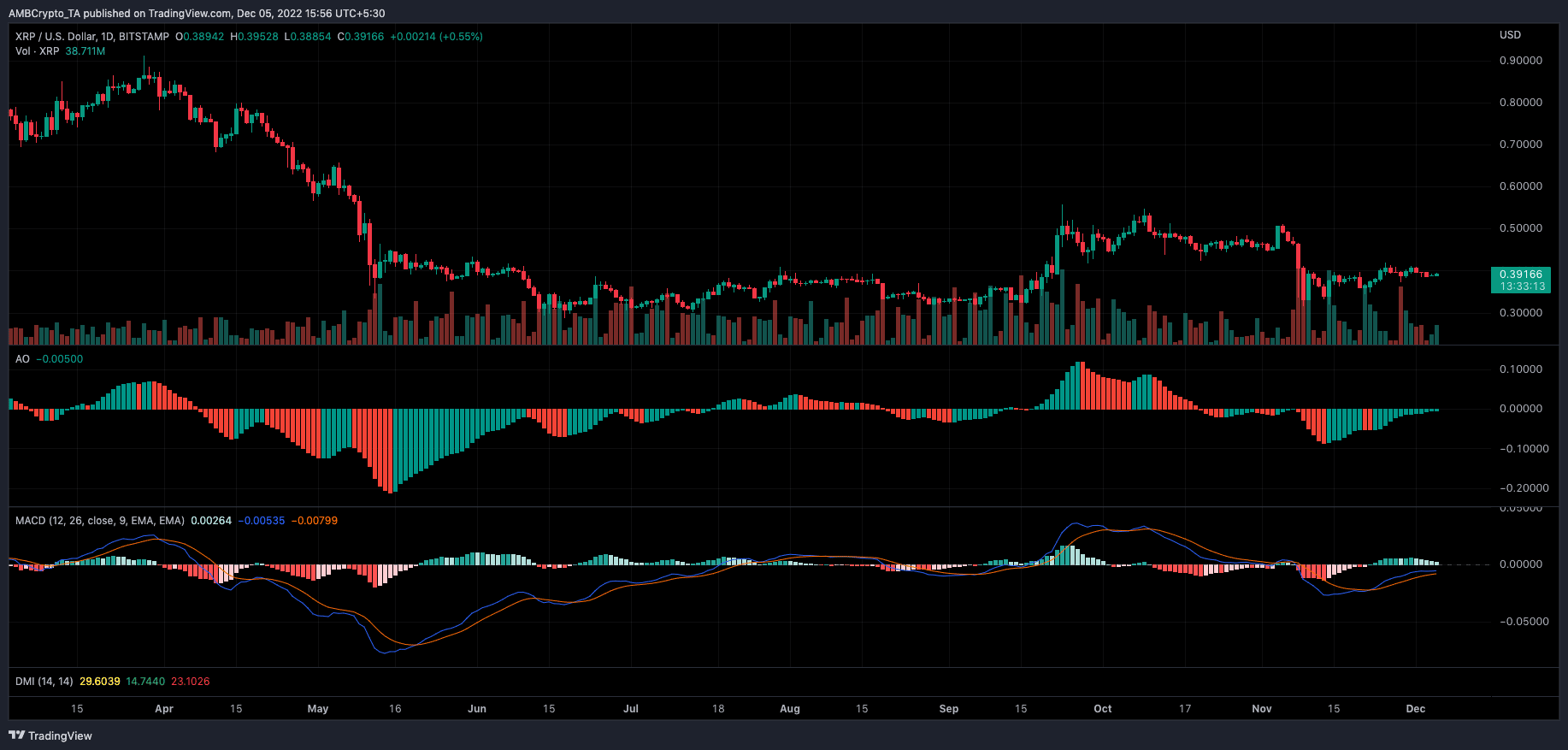

Nevertheless, XRP’s momentum signified that the battle won’t final an prolonged interval. This was as a result of the Superior Oscillator (AO) was above the equilibrium degree. This meant that the XRP momentum was bullish. Moreover, since there have been no twin peaks shut by, it indicated {that a} fall was not imminent.

Supply: TradingView

The Transferring Common Convergence Divergence (MACD) stood beneath at 0.00264. Though this worth was constructive, each promoting (orange) and shopping for (blue) energy was beneath the zero-point histogram. Nevertheless, for the reason that consumers confirmed extra management, it implied that XRP was eyeing a concrete bullish edge.

Which approach ahead?

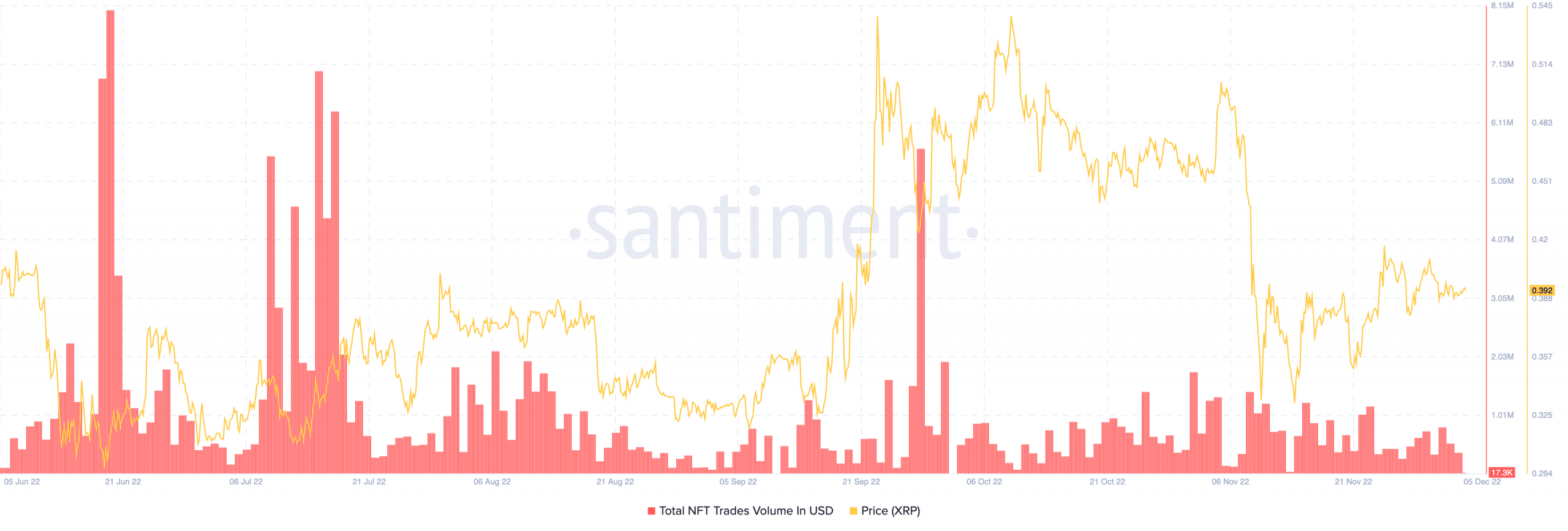

Regardless of the bull potential, Ripple didn’t replicate such with its NFTs. Santiment revealed that the NFT commerce quantity was at its lowest level since 13 November. At press time, the NFT quantity was merely $17,300. Such a low worth meant that the collectibles beneath the Ripple chain didn’t look engaging sufficient for buyers to activate their purchase triggers.

Supply: Santiment

As for its tussle with the regulators, the recent filing confirmed that the top was nearly right here. There was, nevertheless, no certainty about who would merge guests, despite the fact that Ripple opposed the SEC movement on the abstract judgment.