- The Securities and Alternate Fee added Valkyrie’s spot Bitcoin ETF software to its official docket, signaling an official evaluate of the submitting.

- Different establishments and the general public have 21 days to submit their feedback on the doable impacts of Valkyrie’s submitting, per the fee’s deadline.

- Valkyrie refiled its Bitcoin exchange-traded fund software after wall avenue titan BlackRock submits its personal software on June 15.

- The asset supervisor named Coinbase as its surveillance companion in a July 5 submitting after the SEC deemed earlier submissions insufficient.

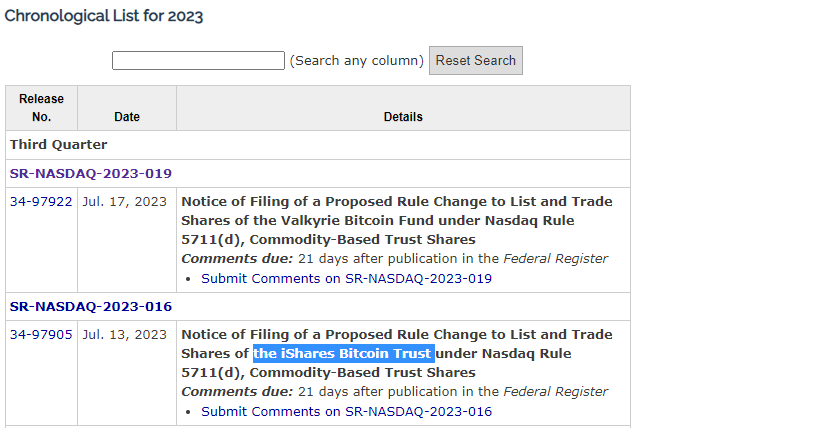

The Federal Register of the U.S. Securities and Alternate Fee reveals {that a} second spot Bitcoin ETF submitting was added for official evaluate. Certainly, Valkyrie’s submission to checklist a Bitcoin exchange-traded fund on the NASDAQ is now listed on the fee’s calendar.

The SEC additionally accepted the iShares Bitcoin Belief for evaluate on July 13.

Valkyrie is one among a number of monetary juggernauts like BlackRock within the race to supply U.S. clients entry to a fund that invests straight in Bitcoin. The corporate’s ETF named the Valkyrie Bitcoin Fund underneath the proposed ticker ‘BRRR’ – a nod to a meme about mimicking the sound of cash printing – was added to the SEC’s docket on July 17.

In keeping with the SEC’s evaluate process, a 21-day remark interval has opened for Valkyrie’s software. Throughout this time, different establishments and the general public are welcome to submit opinions on how Valkyrie’s spot Bitcoin ETF may affect monetary markets, the fund’s threat to buyers, and different doable outcomes ought to the SEC approve the applying.

Spot Bitcoin ETF Marathon

Valkyrie’s resubmission was an replace to its unique ETF filed in 2021. The amended software filed on July 21 named Coinbase as its companion for a contentious market surveillance settlement shortly after wall avenue titan BlackRock opened the floodgate with its personal spot Bitcoin ETF submitting on June 15.

Since BlackRock’s transfer, different would-be ETF issuers like WisdomTree, Constancy, and Invesco have made a punt with their very own respective functions. Former SEC Chair Jay Clayton opined bullish sentiment concerning the possibilities of a profitable submitting from no less than one among these gamers.