- USDC’s market cap fell from $43.56 billion to $38.9 billion, a drop of over 11%.

- As per Nansen, Circle burned $2.34 billion value of USDC within the final 24 hours.

USD Coin [USDC], misplaced its greenback peg on some exchanges, over considerations that reserves backing the second-largest stablecoin by market cap, have been caught within the failed Silicon Valley Financial institution (SVB).

Circle, the corporate that manages the favored Stablecoin, disclosed that $3.3 billion of the $40 billion of USDC reserves remained locked up at SVB. Thus, triggering important FUD concerning the state of its reserves.

1/ Following the affirmation on the finish of immediately that the wires initiated on Thursday to take away balances weren’t but processed, $3.3 billion of the ~$40 billion of USDC reserves stay at SVB.

— Circle (@circle) March 11, 2023

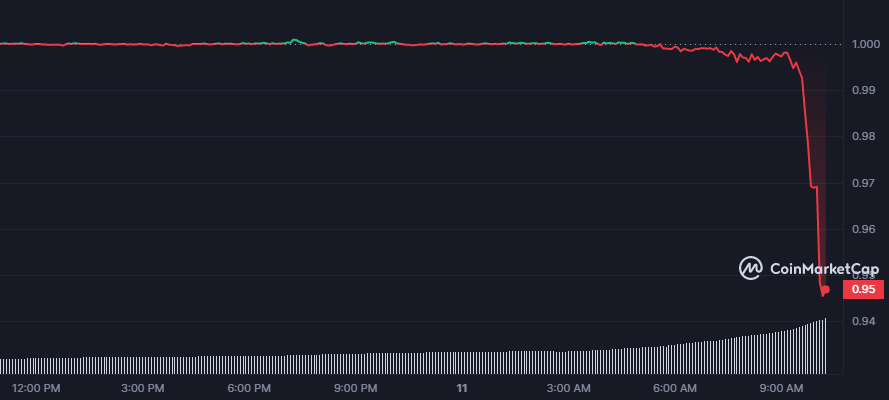

USDC, which is meant to keep up a 1:1 peg with the USD, fell to $0.946 on the time of writing, knowledge from CoinMarketCap confirmed. Moreover, its market cap declined from $43.56 billion to 38.9 billion, a drop of over 11%.

Supply: CoinMarketCap

Silicon Valley Financial institution contagion

SVB, one of many largest retail sector banks in the US, was shut down by regulators on Friday (10 March), because the cash-strapped lender struggled with falling deposits, compounded by rate of interest hikes by the Federal reserve.

Based on Circle’s transparency report, Silicon Valley Financial institution was considered one of six banking companions the place it held a portion of its money reserves backing the USDC stablecoin.

This represented about 7.5% of the whole reserves, which aside from money, included the portfolio of the Circle Reserve Fund, consisting of short-dated U.S. treasuries.

As per blockchain analytics agency Nansen, Circle burned $2.34 billion value of USDC within the final 24 hours, as jittery traders rushed to redeem {dollars} for his or her falling USDC.

Prime exchanges pause USDC conversions

In the meantime, Coinbase, the most important cryptocurrency alternate in the US, mentioned that it was pausing the conversions between USDC and USD over the weekend and the identical will re-commence on Monday.

We’re briefly pausing USDC:USD conversions over the weekend whereas banks are closed. During times of heightened exercise, conversions depend on USD transfers from the banks that clear throughout regular banking hours. When banks open on Monday, we plan to re-commence conversions.

— Coinbase (@coinbase) March 11, 2023

Then again, Binance, the world’s largest cryptocurrency alternate, adopted swimsuit and introduced the suspension of USDC to BUSD conversions as a consequence of ‘present market circumstances’.

That mentioned, one analyst on Twitter, Adam Cochran, opined that issues, at press time, had began to stabilize as USDC moved in direction of its greenback peg and the FUD was more likely to subside.

It needs to be famous right here that USDC grew to become the most recent sufferer of the stablecoin household. Properly, the BUSD saga preceded it- the time when issuer Paxos stopped minting new Binance USD [BUSD] tokens on the course of a New York regulator final month.