- Solana’s key DeFi indicators confirmed indicators of restoration in an in any other case below par February

- SOL’s excessive volatility saved traders on their toes

In keeping with an 18 February tweet by Kamino Finance, Solana’s [SOL] decentralized trade (DEX) exercise was higher than different chains in 2023 if a specific metric was put into consideration.

DeFi velocity has lately proved an attention-grabbing metric in gauging the vitality of @solana DeFi

In keeping with current statistics, Solana has displayed by far the best velocity of all DeFi ecosystems

Here is why it issues👇

— Kamino Finance (@Kamino_Finance) February 17, 2023

How a lot are 1,10,100 SOLs value in the present day?

Referred to as ‘DeFi Velocity’, the metric mainly measures the buying and selling quantity versus whole worth locked (TVL) on a blockchain. The report highlighted that Solana’s common DeFi velocity for January stood at 0.25, greater than twice of the second-ranked Polygon [MATIC] on the record.

DeFi restoration on the playing cards?

Solana witnessed an uptick in its DeFi exercise with its TVL registering a 6% soar over the past week, information from DeFiLlama identified. This improvement got here whilst Solana underperformed within the month of February, impacted by a waning curiosity in its bold meme coin, BONK.

Supply: DeFiLlama

The chain’s every day DEX buying and selling quantity additionally confirmed indicators of a rebound after it greater than doubled on the time of writing, plunging to a month-to-month low on 11 February. Regardless of this, the cumulative weekly quantity dropped by 2.3%, highlighting the stress Solana has been in February.

Supply: DeFiLlama

What does SOL’s worth say?

SOL has come out of the FTX-induced negativity to an incredible extent in 2023. In keeping with information from CoinMarketCap, the token locked good points of 112% for the reason that begin of 2023. Of late, the value has exhibited increased volatility with wild inter-day swings. At press time, it was valued at $22.99 with a 1.69% soar from the day before today.

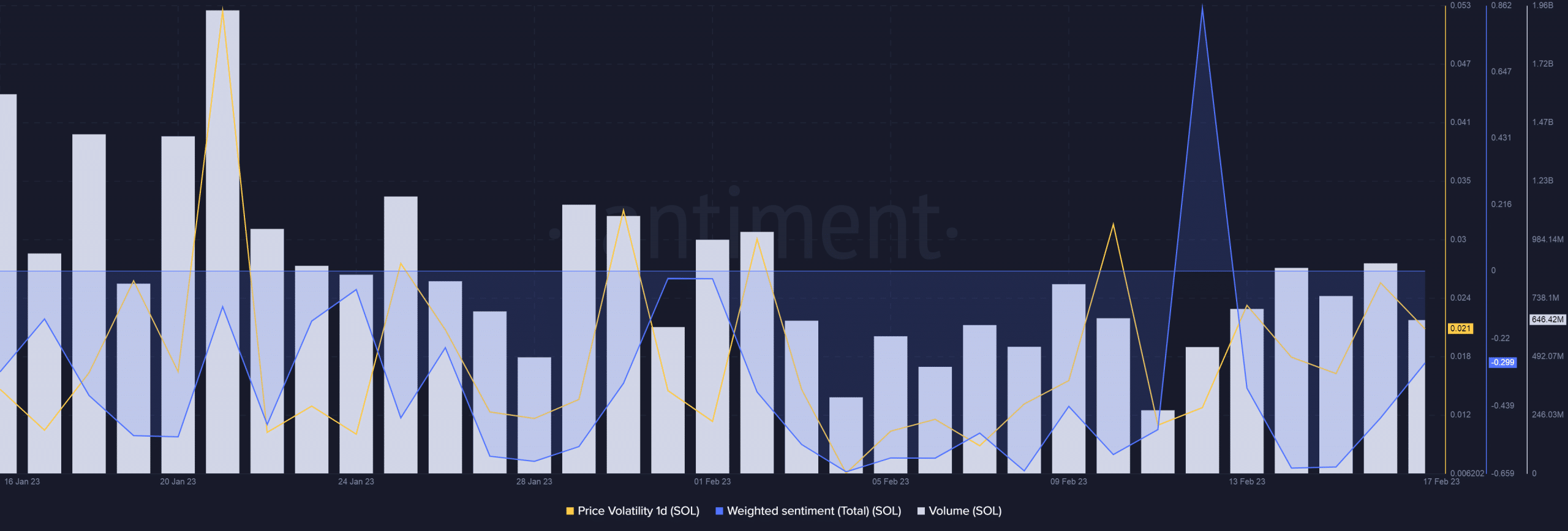

Information from Santiment complimented the above declare. The worth volatility steadily elevated over the previous week, which positioned the weighted sentiment in adverse territory. Excessive volatility may have prompted risk-averse merchants to keep away from buying and selling the coin.

Is your portfolio inexperienced? Try the Solana Revenue Calculator

The transaction quantity, which recorded a virtually 60% month-over-month drop, was a testomony to the declining investor’s sentiment.

Supply: Santiment

Solana’s Open Curiosity (OI) steadily declined over the past 30 days, information from Coinalyze identified. A decline in Open Curiosity indicators diminished buying and selling exercise and market curiosity for the coin. With the OI forming a bearish divergence, SOL’s worth may face additional downsides within the quick time period.

Supply: Coinalyze