- Solana provides one more community downtime incident to its latest woes.

- SOL extends its decline for the fifth day in a row.

Solana customers had been unable to conduct transactions on the community in the previous few hours of press time. Preliminary reviews revealed that this was a network-wide drawback reportedly attributable to a long-forking occasion.

Life like or not, right here’s Solana’s market cap in BTC’s phrases

The Solana blockchain is actually not new to the technical challenges which have been triggered. A few of these community glitches resulted in halted operations for a while earlier than a community reboot is carried out.

The newest reviews about Solana’s community disruption within the final 24 hours didn’t disclose the supply of the issue. Nevertheless, it was revealed {that a} reboot and reversion to a earlier software program model had been among the many options being contemplated.

The Solana community skilled a forking occasion early Sunday morning New York time that throttled customers’ capability to execute transactions. It was not instantly clear what triggered the “lengthy forking occasion”. Validators and Solana engineers had been discussing a spread of choices,… https://t.co/GFd8AT6kV9

— Wu Blockchain (@WuBlockchain) February 25, 2023

Did Solana’s newest downtime have an observable affect?

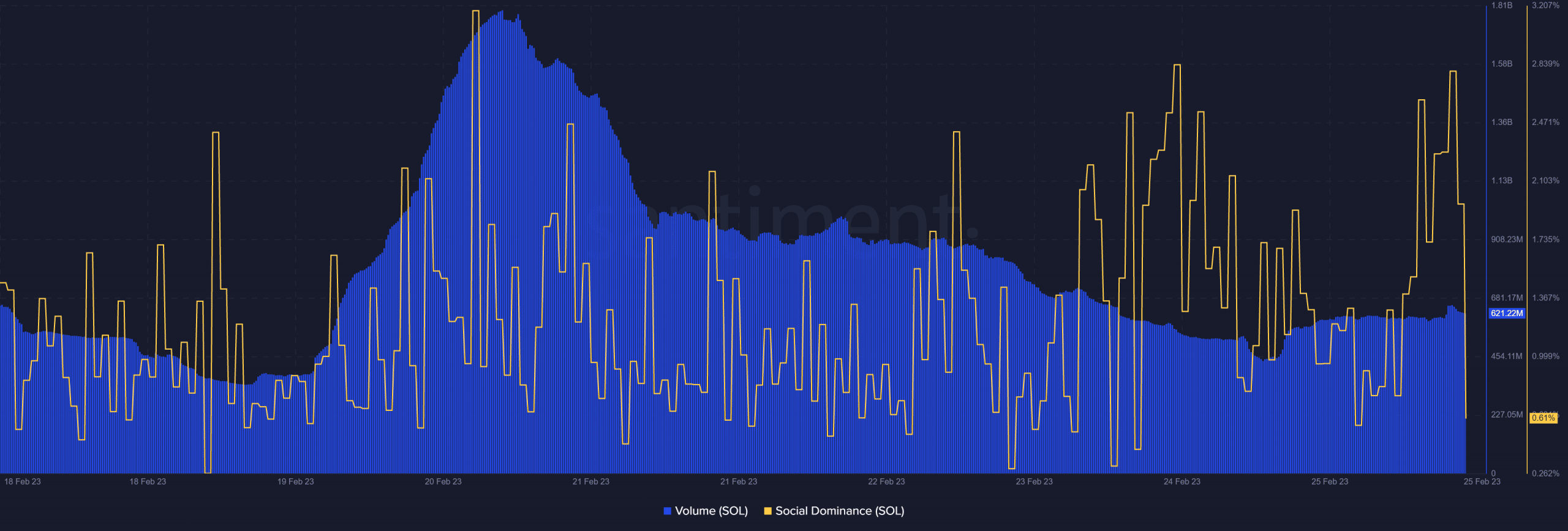

Solana’s newest community problem triggered a spike in social dominance, as information concerning the community outage unfold. Previous cases of community outages have triggered extra FUD amongst traders and this time not a lot of a change in quantity was noticed.

Supply: Santiment

That is probably as a result of Solana’s quantity fell considerably in the previous few days. Nevertheless, there was a slight enhance in quantity within the final 24 hours which can recommend that the market reacted to the transfer.

As anticipated, SOL’s value motion did face some draw back by as a lot as 2.64% over the past day. This provides to the promoting strain that prevailed within the earlier 4 days, therefore contributing to a 16% pullback from its weekly excessive.

Supply: TradingView

SOL sat on its 50-day MA at press time which could usually be thought of a possible pivot level.

Nevertheless, an prolonged draw back is feasible contemplating that the weekly pullback displays the bearish sentiment within the total crypto market.

As well as, the draw back could spoof traders regardless of the enticing value low cost.

The latest downtime incident could have additionally impacted SOL demand on the derivatives market. Each the Binance and DYDX funding charges dropped to their lowest ranges within the final 24 hours. Thus, confirming that the community downtime triggered a requirement shock.

The identical derivatives metrics did bounce again barely after the dip. This confirms a little bit of restoration again to pre-downtime ranges.

Is your portfolio inexperienced? Take a look at the Solana Revenue Calculator

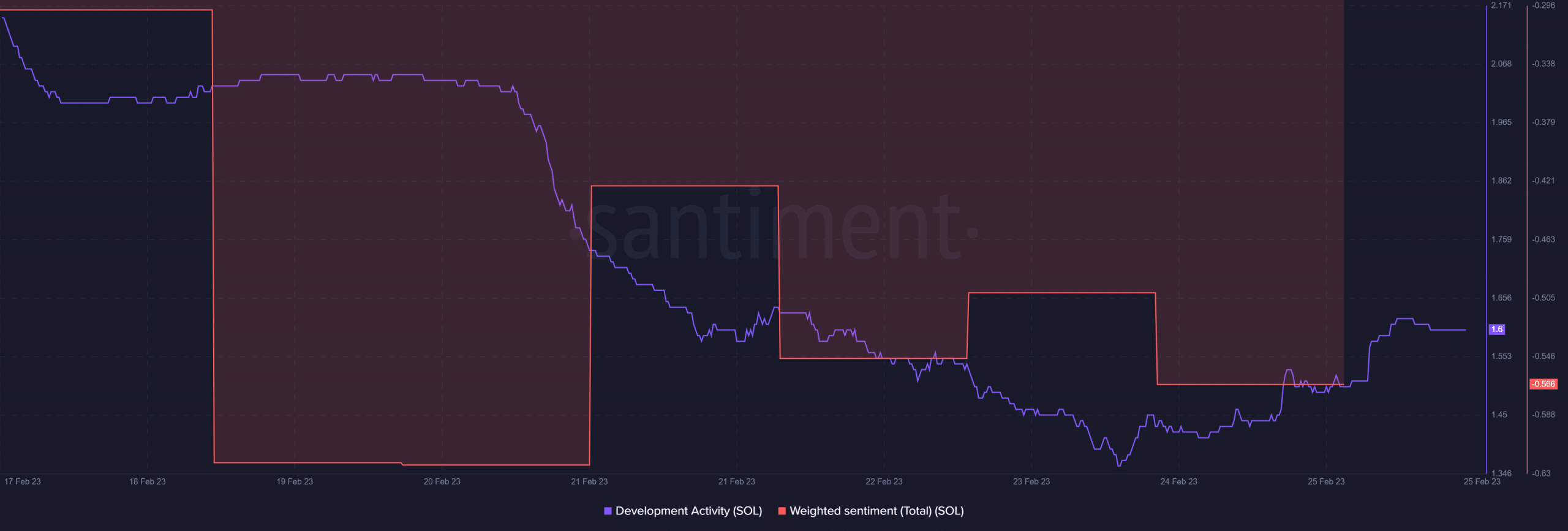

However, Solana’s improvement exercise bounced barely within the final 24 hours. This was a promising sign- builders had been working in direction of restoring the community. The weighted sentiment remained throughout the decrease vary though barely larger than its weekly low.

Supply: Santiment

Whereas this latest community draw back could have an effect on investor sentiment, we now have seen SOL bounce again a number of instances prior to now.

These cases have change into so frequent that traders is probably not as shocked as they had been in preliminary community downtime incidents.

![Solana [SOL] suffers yet another technical challenge, details inside](https://ambcrypto.com/wp-content/uploads/2023/02/hd-wallpaper-gae45acec9_1280-1000x600.jpg)