Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

- STEPN rallied exhausting prior to now few days after discovering an area backside round $0.22.

- Bitcoin’s subsequent transfer might closely affect the route of GMT within the coming days.

Bitcoin [BTC] noticed a decrease timeframe rejection simply above the $17.3k mark. But it was doubtless that BTC would make one other push increased towards the $17.6k resistance mark. The gradual positive factors of the king coin inspired many altcoins on a near-term bullish trajectory.

Are your holdings in revenue? Examine the STEPN Revenue Calculator

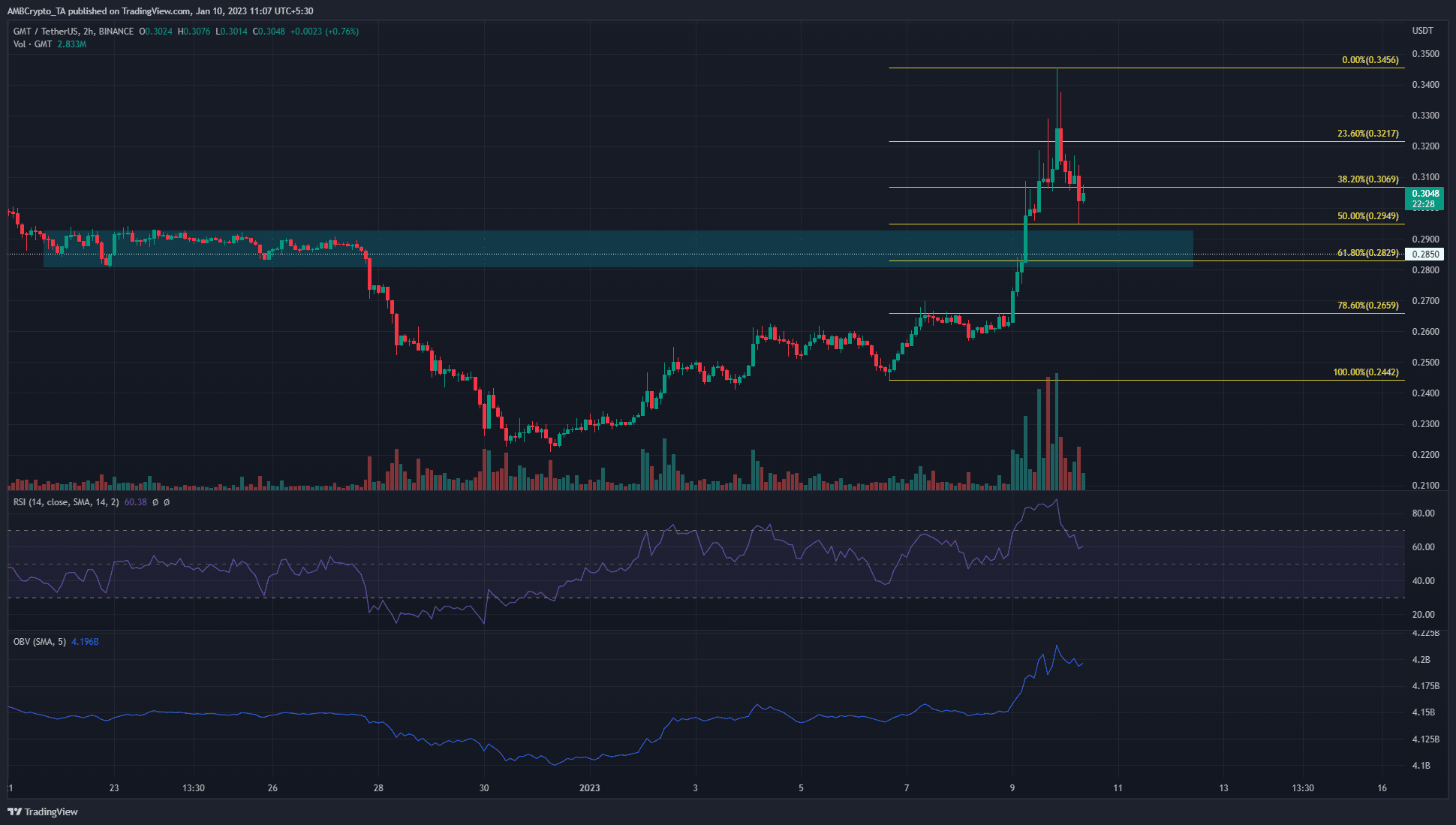

STEPN famous positive factors of fifty% from the lows at $0.228 to the swing excessive at $0.325 inside 9 days. Up to now few hours, GMT noticed a sizeable pullback and was prone to drop to the area of help close to $0.29.

A pullback to the 61.8% retracement stage might supply a shopping for alternative

Supply: GMT/USDT on TradingView

Based mostly on the transfer up from $0.24 to $0.345, a set of Fibonacci retracement ranges was drawn. It confirmed the 61.8% retracement stage to lie at $0.283, which was near the $0.285 help stage.

Furthermore, this space was the place GMT consolidated for near per week in late December. Therefore, it was doubtless that patrons could have some energy upon a retest of this belt.

What number of GMTs are you able to get for $1?

On the rally upward, buying and selling quantity was additionally vital. The RSI and OBV confirmed sturdy bullishness within the near-term. The RSI was above impartial 50 and regardless of the pullback, the studying of 60 confirmed upward momentum. Moreover, OBV had not fallen considerably regardless of the sharp pullback.

Mixed with the bullish decrease timeframe market construction, patrons can look to enter a superb risk-to-reward commerce close to the $0.285 stage. A drop beneath the 61.8% retracement stage can invalidate this concept.

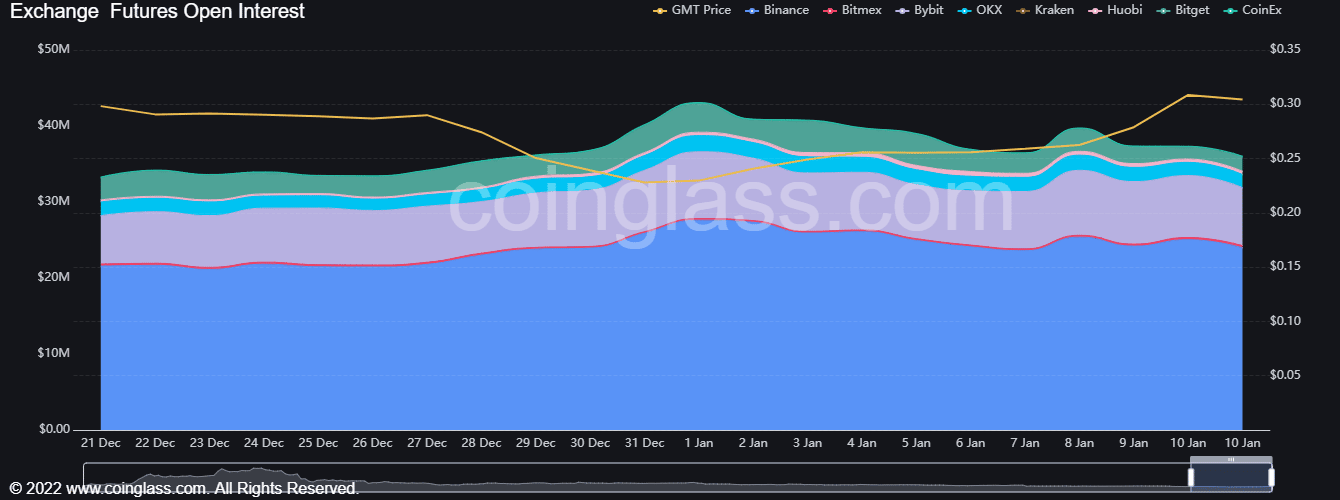

Open Curiosity has been falling regardless of the swift rally to $0.34

The dearth of a optimistic response on the Open Curiosity chart steered that STEPN could possibly be near discovering its native prime. Due to this fact, patrons should be cautious. Whereas the OBV confirmed sturdy shopping for quantity, futures market members didn’t have a lot bullish sentiment.

The funding rate remained optimistic after the rally, and this has been the case since 7 January. A drop into unfavourable territory can additional sign bearish intent.

As issues stand, bulls can look to bid on the $0.285 space as a result of confluence of help in that zone. Nevertheless, the falling Open Curiosity was an indication of warning. A drop beneath the $0.28 mark will doubtless sign additional losses to observe.