An analyst who appropriately referred to as Bitcoin’s collapse this yr is warning BTC holders, saying {that a} capitulation occasion for the king crypto is in sight.

The pseudonymous analyst recognized within the trade as Capo tells his 692,200 Twitter followers that Bitcoin continues to flash indicators of weak point.

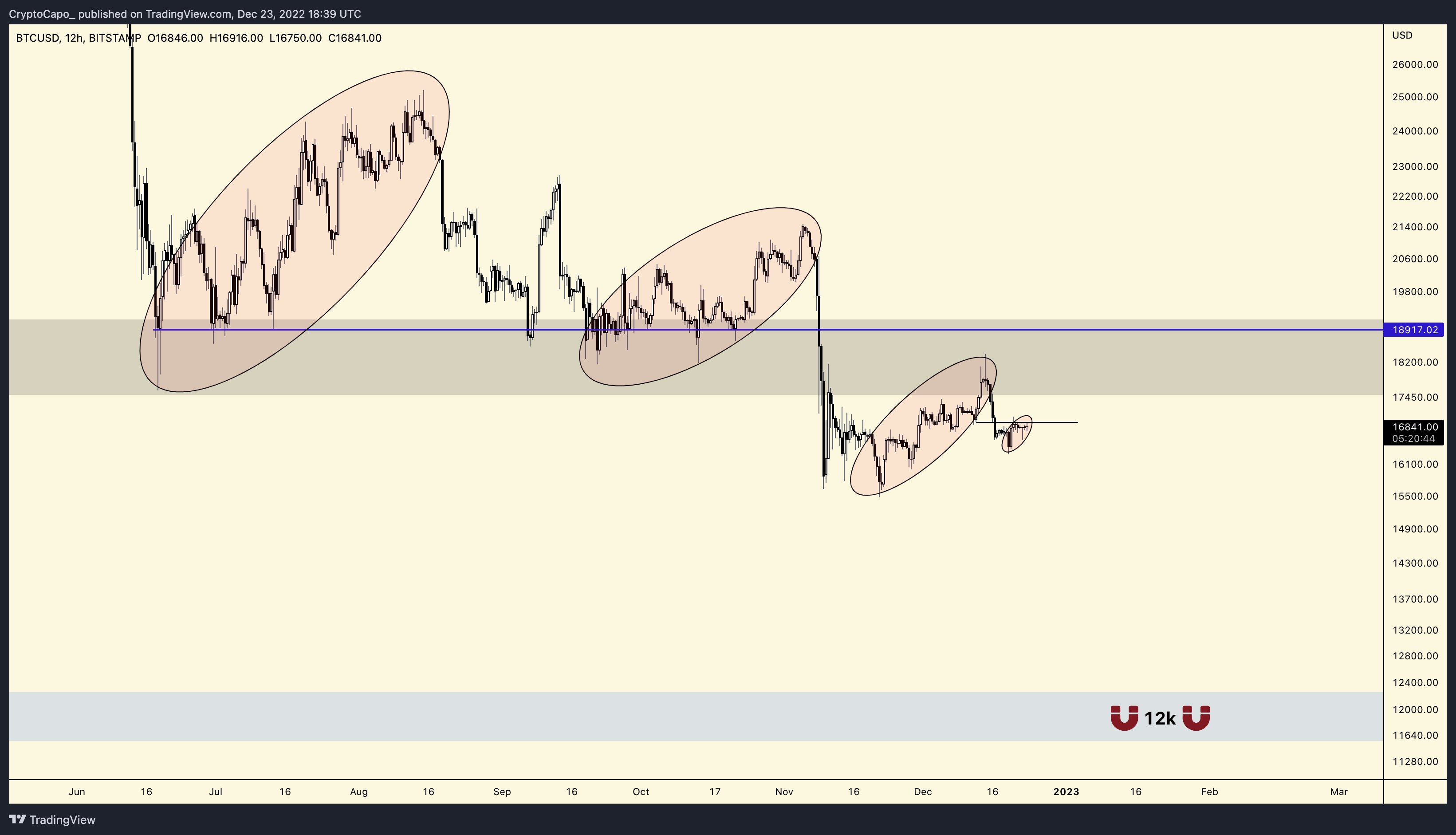

Whereas Bitcoin bulls have managed to ignite a rally from the present bear market low of round $15,700, Capo says that the latest bounce is notably smaller in comparison with BTC’s earlier surges since June.

“Each bounce is smaller. Decrease lows and decrease highs. Help changing into resistance. $12,000 is sort of a magnet.”

At time of writing, Bitcoin is altering fingers for $16,840. A transfer to Capo’s $12,000 goal signifies an over 28% decline for the king crypto.

Capo additionally says that merchants are possible not ready for the drastic transfer down.

“Simply learn the feedback right here and you’ll get a second affirmation (first one is the evaluation and indicators) that most individuals are trapped above $17,000 or greater and couldn’t take one other drop. Like I mentioned earlier than, most individuals are usually not ready for what’s coming and it exhibits.”

He adds that the present buying and selling setting in crypto and the inventory market seems to be making a “good state of affairs for a correct capitulation.”

“Inventory market bleeding, altcoins breaking key helps, indicators pointing down, bulls getting euphoric and cocky for tiny pumps.”

Trying on the equities market, Capo says the S&P 500 (SPX) stays in a downtrend after respecting its diagonal resistance.

“Clear bearish retest. Downtrend intact.”

Merchants keep watch over the efficiency of the SPX as a weak index means that traders stay cautious of threat property like shares and crypto.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Roman Sakhno