NFT

Blockchain information platform Dappradar launched a report on Wednesday exploring the aftermath of the Silicon Valley Financial institution (SVB) collapse and its affect on non-fungible token (NFT) buying and selling exercise and quantity.

On March 10, California state regulators seized startup-focused Silicon Valley Financial institution as a result of liquidity issues, handing it off to the Federal Deposit Insurance coverage Company (FDIC). On March 13, the FDIC stated it could assist financial institution clients entry their funds, because the regulatory company makes an attempt to public sale off the bancrupt financial institution. Many buyers who held digital property from firms that had publicity to the financial institution made strikes to dump their property.

In response to Dappradar, there have been solely 12,000 energetic NFT merchants on Saturday, March 11 – the day after the financial institution was shut down – a quantity not seen since November 2021. Saturday additionally noticed the bottom variety of single NFT trades in 2023 to date, totaling 33,112.

Because the starting of March, NFT buying and selling volumes have fallen 51%, with gross sales declining about 16%, Dappradar says.

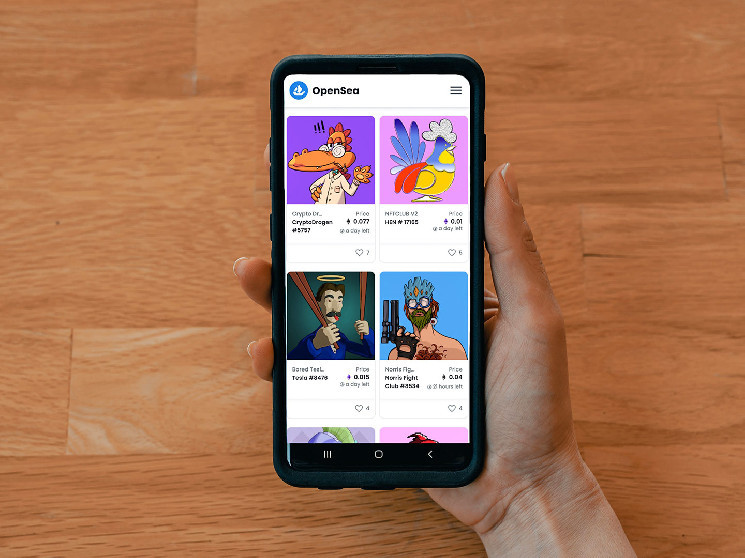

Nevertheless, not all NFT collections had been impacted in the identical method. Initiatives from NFT big Yuga Labs, together with Bored Ape Yacht Membership and CryptoPunks, noticed their flooring costs dip barely on Saturday however rapidly recovered. One Twitter consumer in contrast CryptoPunks to USDC, claiming it was extra steady than the stablecoin, which misplaced its peg to the U.S. greenback after SVB’s collapse.

Sara Gherghelas, a analysis analyst at DappRadar, advised CoinDesk that Yuga Labs’ success has been amplified by its funding in CryptoPunks in addition to its potential to construct neighborhood. Though the corporate stated it had restricted publicity to SVB, its token holders didn’t make main strikes on the information.

“They’ve a really clear roadmap, the staff is seen, and so they determined to ship an excellent venture after the Ape ecosystem,” stated Gherghelas. “They maintain constructing, they’re exhibiting that when you’re a part of their neighborhood, they’ve so many perks and advantages.”

Not all collections made it by way of the SVB collapse unscathed. Shortly after the information broke on March 10, Proof, the NFT collective behind the favored assortment Moonbirds, took to Twitter to share that the corporate had some funds invested in SVB, sparking uncertainty amongst holders.

Over the weekend, Moonbirds misplaced about 18% of its worth, in line with Dappradar. One whale bought 500 Moonbirds on March 11, incurring losses between 9% and 33% totaling over 700 ETH, or about $1.1 million.

Gherghelas advised CoinDesk that whereas the information of Proof’s publicity to SVB contributed to uncertainty within the venture, individuals had been prompted to promote due to the corporate’s shortcomings in current months. After canceling its Proof of Convention set to happen in Might, the neighborhood has been left feeling unsure concerning the firm’s potential to maintain its guarantees.

“Folks, customers and shoppers have gotten pickier and so they don’t desire hype, they need the perks, the advantages and the utility behind that NFT assortment,” stated Ghergelas.