NFT

The decline of the nonfungible tokens (NFT) market doesn’t appear to be an issue for the Swiss cryptocurrency-focused financial institution Seba because the agency now permits its prospects to retailer NFTs.

Seba Financial institution has launched a regulated custody platform permitting its purchasers to retailer NFTs, the agency formally introduced on Oct. 26. The NFT custody resolution permits Seba Financial institution’s retail and institutional purchasers to retailer any Ethereum-based NFTs, together with tokens from world-famous NFT collections like Bored Apes and CryptoPunks, the agency stated.

There isn’t a market integration with Seba Financial institution presently, a spokesperson for the agency advised Cointelegraph. The corporate will even carry out due diligence by consumer’s request earlier than deciding whether or not to supply custody for a sure NFT or not. The custody service supplied is on no account restricted to prime collections, the agency’s consultant acknowledged.

Seba’s new NFT custody platform is designed to supply its prospects with safe storage of their NFTs with out managing the personal keys themselves. The function is built-in into prospects’ financial institution accounts, permitting purchasers to incorporate their NFTs within the whole wealth image and handle them like every other digital asset.

A consultant on the agency identified that Seba Financial institution is the primary regulated financial institution to supply NFT custody, expressing confidence in a vibrant way forward for NFTs, stating:

We imagine that within the coming years, digital belongings, together with NFTs, will achieve adoption and will likely be more and more accepted even by conventional finance operators.

Urs Bernegger, co-head of markets and funding options at Seba Financial institution, harassed that Seba is regulated by Swiss Monetary Market Supervisory Authority (FINMA) and has “core competence” in cryptocurrencies.

Headquartered in Zug, Seba Financial institution is a significant crypto-focused monetary establishment in Switzerland, recognized for its shut cooperation with native regulators. In 2019, Seba Crypto AG obtained a Swiss banking and securities vendor license from FINMA. In 2021, the regulator additionally granted Seba Financial institution AG with a Licensed Data Methods Auditor license, permitting the agency to facilitate an institutional-grade custodian service.

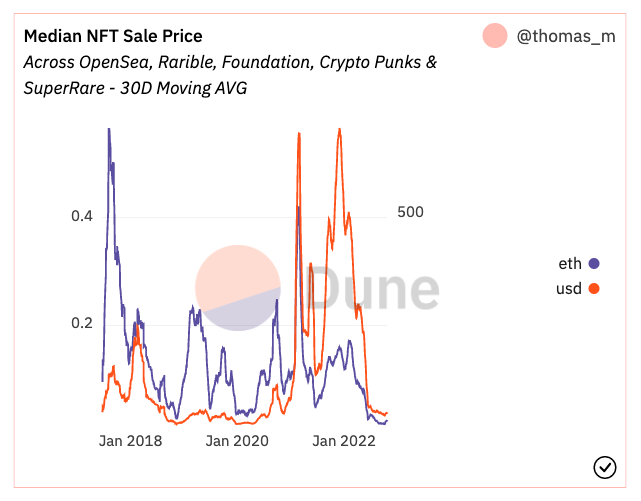

Seba Financial institution’s NFT custody launch comes amid powerful instances for the NFT market. The weekly NFT buying and selling volumes plummeted as a lot as 98% from the start of the 12 months as of late September 2022. The median value of an NFT has additionally fallen sharply, whereas the general NFT market continued to worsen additional as the common NFT weekly buying and selling quantity fell by about 30% In September versus its August.

Supply: Dune Analytics

Then again, the variety of NFT wallets has been rising this 12 months, with the quantity of such wallets virtually doubling from 3.4 million in January to six.1 million in September.

Associated: Institutional crypto custody: How banks are housing digital belongings

Regardless of the NFT market downturn, many platforms and firms have been rolling out NFT-related options not too long ago. Final month, MetaMask Institutional — the institution-compliant model of the MetaMask crypto pockets — introduced the NFT addition to its custodial providers choices.

Plenty of buyers who held NFTs have continued to remain available in the market displaying conviction regardless of the market downturn, a spokesperson for Seba famous. In response to the agency, the NFT area has continued to mature, with institutional buyers launching NFT funds and financing new tasks. SEBA Financial institution is addressing the necessity for a regulated custodian that may assure the safety and integrity of NFTs for skilled and institutional buyers, the individual added.