- The P/S ratio went up whereas the whole worth locked on SNX declined.

- Provide outdoors of exchanges elevated however the important thing metrics regarded bearish.

Synthetix [SNX] witnessed a serious surge in its Perps V2 alternate as its day by day quantity reached $100 million. This indicated an elevated variety of traders within the community, as crypto merchants typically use perpetual contracts to earn passive revenue by way of funding charges.

$100M day by day quantity for Synthetix Perps.

Congratulations to the front-ends integrating with Perps to make all of this attainable.

❤️⚔️ pic.twitter.com/qrsEK5BiKl

— Synthetix ⚔️ (@synthetix_io) March 9, 2023

Real looking or not, right here’s SNX market cap in BTC’s phrases

Synthetix Perps V2 recap

Synthetix launched Perp v2 final yr, which considerably decreased charges, bettering scalability, capital effectivity, and, most significantly, dealer satisfaction.

As per the official announcement, Synthetix Perps V2 decreased perps buying and selling charges to solely 5–10 foundation factors, a substantial discount from Perps V1, whereas sustaining optimum efficiency and execution effectivity. An ETH-PERP market grew to become accessible when Synthetix Perps V2 off-chain oracles launched.

Although SNX Preps v2’s quantity registered a large curiosity, the community’s P/S Ratio elevated.

The P/S ratio is a metric that’s used to find out whether or not an asset is undervalued or overvalued. Subsequently, a risk arises of a value correction of the token, which may result in a decline in traders’ curiosity.

Supply: Token Terminal

Not solely that, however the present bearish market additionally performed a job in pulling SNX’s value down. As per CoinMarketCap, SNX’s worth declined by greater than 13% within the final 24 hours.

At press time, it was buying and selling at $2.20 with a market capitalization of over $555 million. The worth plummet additionally negatively affected the community’s worth as its TVL went down after a constant uptick.

Is traders’ curiosity in SNX declining?

Although SNX’s value fell sufferer to the bears’ actions, traders’ curiosity in SNX elevated.

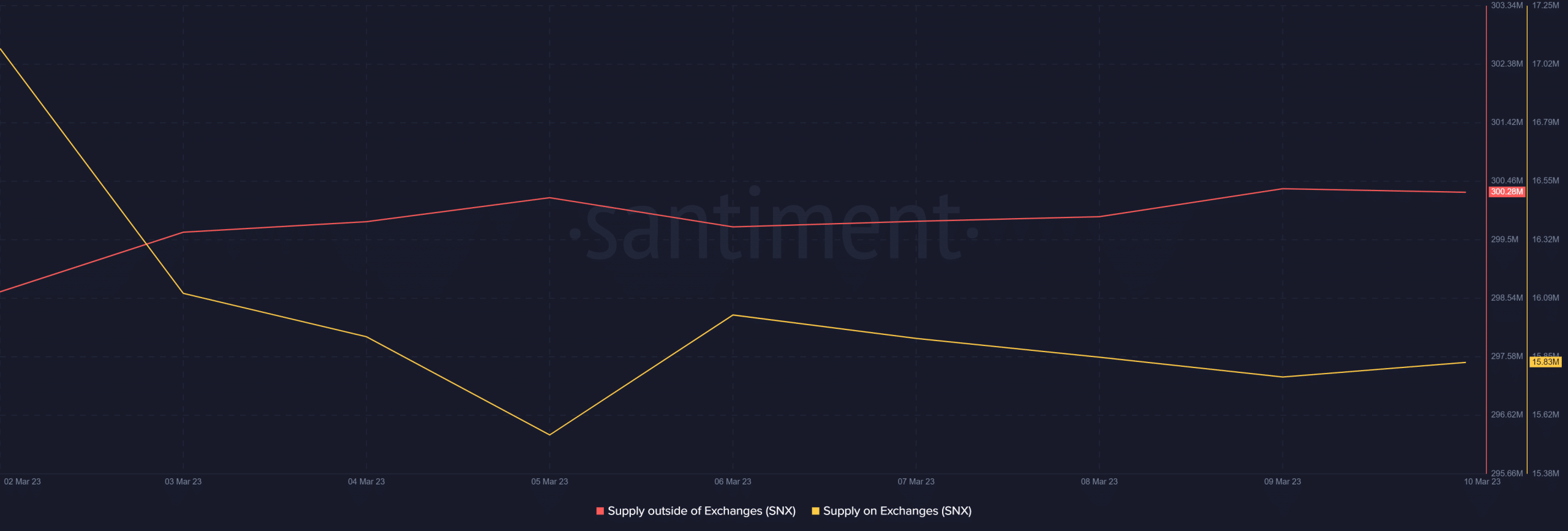

Contemplate this- SNX’s provide on exchanges registered a downtick. Nevertheless, its provide outdoors of exchanges went up, which by and enormous was a bullish sign.

CryptoQuant’s data additional revealed that SNX’s alternate reserve was lowering. Thus, revealing that the token was not beneath promoting stress, regardless of the value plummet.

Supply: Santiment

How a lot are 1,10,100 SNXs value immediately?

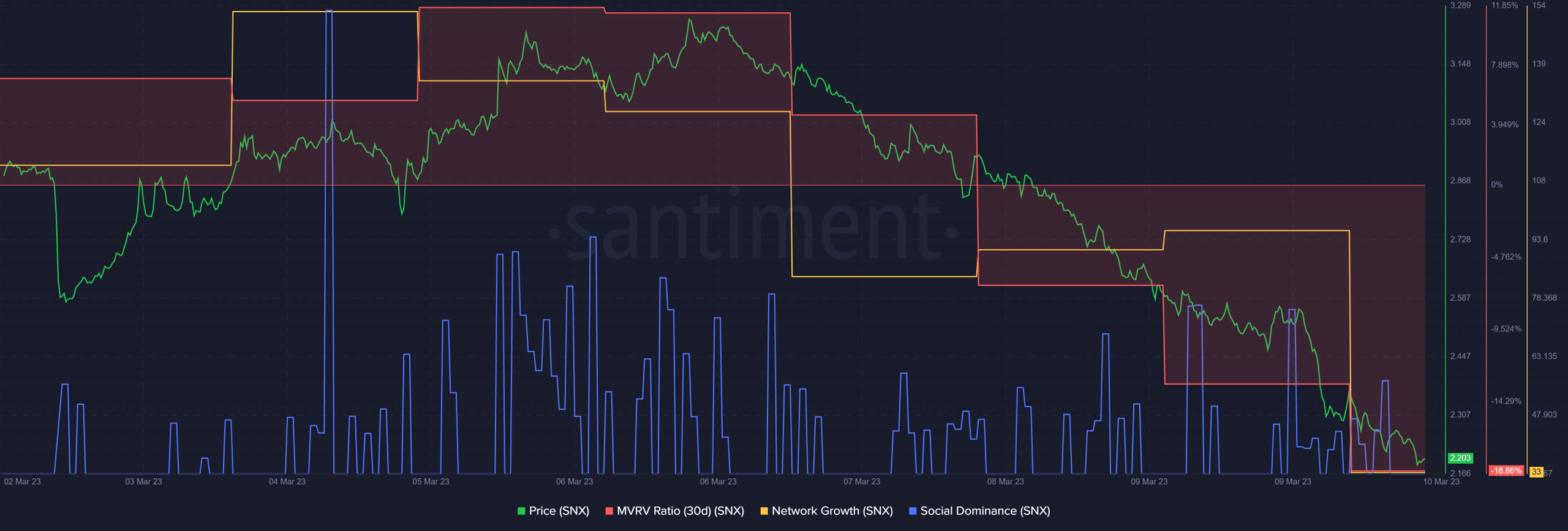

In the meantime, the community’s on-chain efficiency raised a couple of issues. Due to the value decline, SNX’s MVRV Ratio declined significantly.

The community’s social dominance additionally fell, reflecting its decreased recognition. Moreover, SNX’s community progress additionally went down.

Supply: Santiment