- Volatility, or the shortage of it, can function a device for analyzing market traits

- The downtrend of Bitcoin is usually completed, however yet another leg downward might be painful

Bitcoin [BTC] buyers have confronted some tough occasions all through 2022. Traders and merchants who witnessed the Celsius, Terra, and FTX crises (amongst so many different occasions) have seen historical past unfold earlier than their eyes.

All of this historical past is laid naked on the value charts, and it’s potential that we will put together for the worst-case situation by learning these charts. Look to the previous to grasp the long run, as any individual well-known in all probability as soon as mentioned.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

The durations when volatility vanishes are price noting. For property like Bitcoin, a fall in volatility usually heralds a large transfer across the nook. One of many easier instruments to measure how unstable an asset is on the value charts is the Bollinger Bands.

Bollinger Bands width indicator findings

Bollinger Bands is a device developed by John Bollinger. It has two bands plotted with one normal deviation above and under the value (based mostly on the previous 20 durations). These bands modify based mostly on the volatility of the value of the underlying asset.

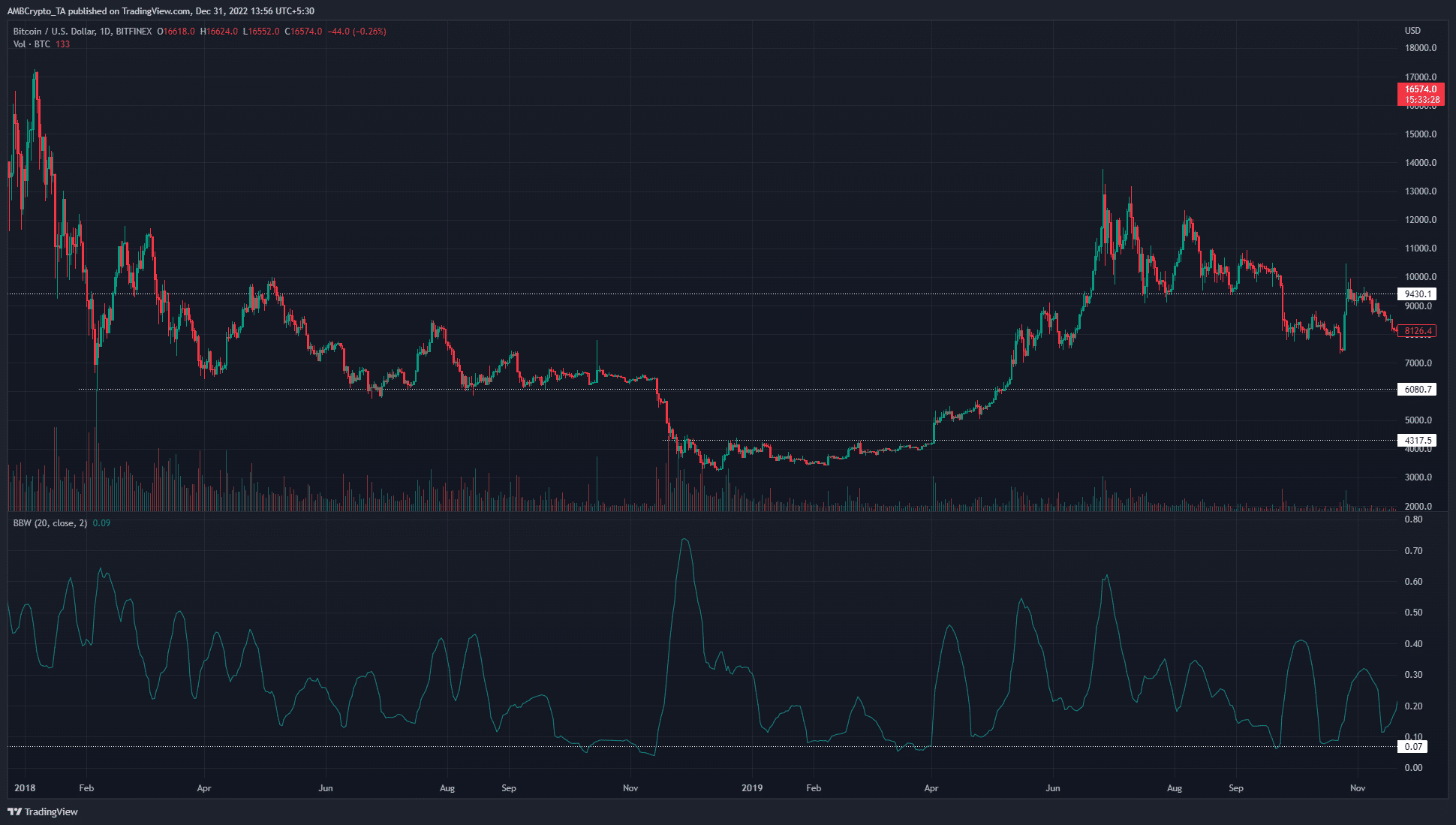

Supply: BTC/USDT on TradingView

When the Bollinger Bands’ width decreases, it signifies a interval of decrease volatility or contraction on the value charts. This usually highlights a interval of accumulation earlier than a powerful transfer upwards, particularly on greater timeframes. Nevertheless, it will probably additionally point out phases of distribution, earlier than one other transfer downward, as soon as consumers are exhausted.

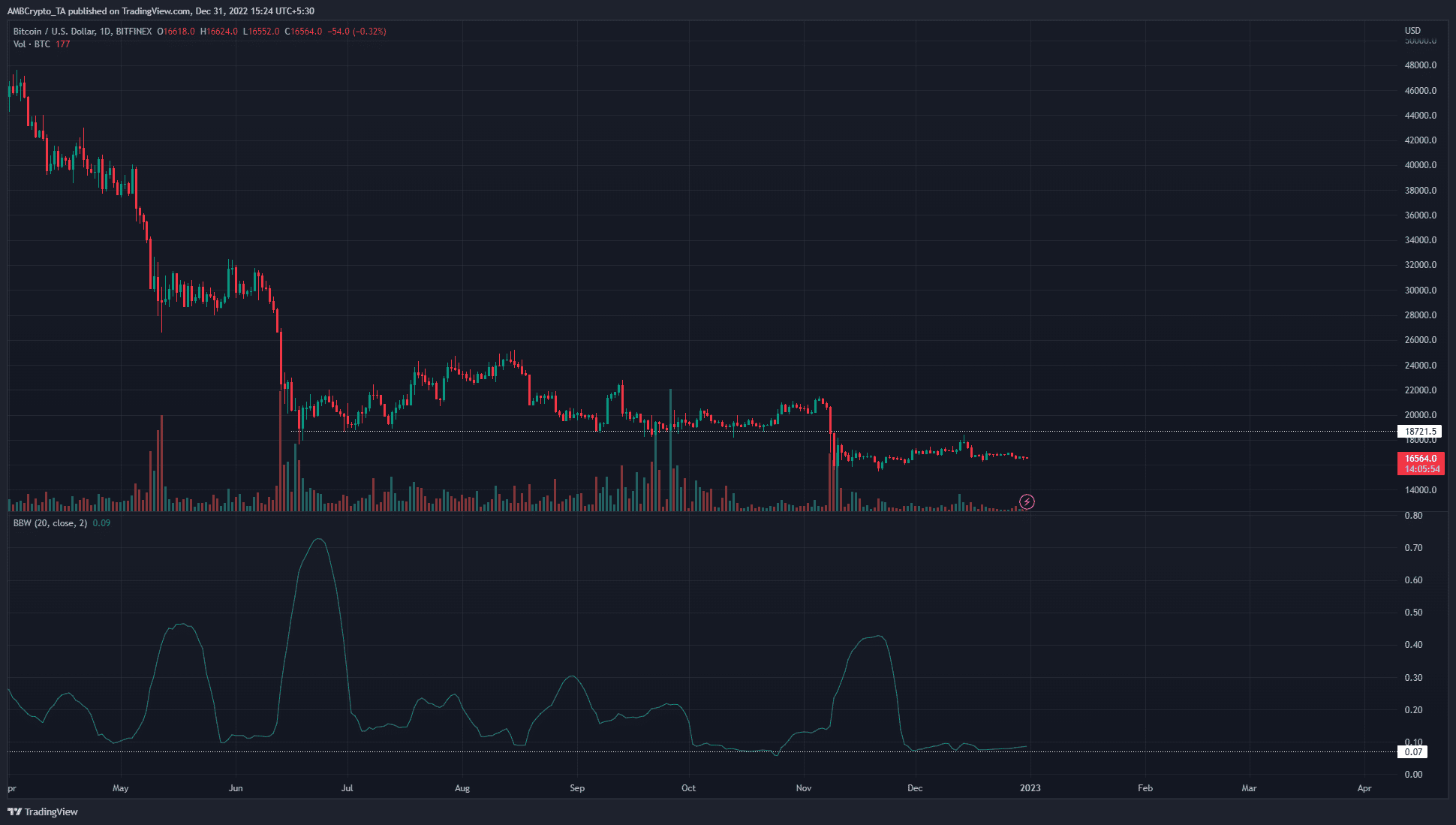

On the day by day timeframe, the Bollinger Bands width indicator confirmed a studying of 0.09 at press time. It had receded to a low of 0.07 on 1 December and 0.06 on 25 October. Beforehand, the BB width indicator touched these values on the day by day timeframe of 8 October, 2020.

Different dates in 2020, comparable to 26 August (0.07), 15 July (0.04), and 21 September, 2019 (0.06), additionally noticed extraordinarily low values registered.

Northward expansions adopted decreased volatility

Historical past doesn’t repeat, nevertheless it does rhyme. All technical evaluation is predicated on patterns that repeat themselves, over and over. The October, August, and July contractions in 2020 got here proper earlier than the latest bull run the place Bitcoin ripped as excessive as $69k.

Nevertheless, Bitcoin was within the depths of a bear market winter on the time of writing. All through 2023, Bitcoin won’t embark on a powerful greater timeframe pattern, as was seen in late 2020 till mid-2021.

Due to this fact, there’s the necessity to discover time limits when volatility dried out after Bitcoin had retraced most of its positive factors from a bull run. This occurred in late 2018 and early 2019.

Supply: BTC/USDT on TradingView

The above chart showcases the late 2017 rally to $19.5k, and the following retracement in 2018. In the course of the downtrend, the volatility was practically lifeless in September and October 2018.

The BB width indicator confirmed values of 0.08 and 0.09 persistently. Nevertheless, one other steep drop from $6k to $3,3k adopted. From December 2018 to March 2019, the bulls fought for his or her lives to push costs again above $4.3k.

Lastly, when this resistance was damaged, a rally to $13k ensued. Hindsight tells us that this was not a real bull market rally. Nonetheless, it was a powerful transfer, north of 220% in below 90 days, as soon as the $4.3k stage was damaged.

Due to this fact, the inference was that low volatility doesn’t routinely translate right into a long-term backside. On the time of writing, Bitcoin has misplaced the $18.7k stage, and one other drop towards $10k might happen, similar to it did again in late 2018.

Supply: BTC/USDT on TradingView

This rally reached a peak at $13.7k in June 2019 and receded within the months that adopted. September 2019 noticed volatility drop to 0.06, nevertheless it took till the COVID-19 crash earlier than the markets discovered a long-term backside and reversed.

Market construction breaks might be key to figuring out rallies

Regardless of the bounce from $4.3k, BTC was not in a reversal. That took until the upper timeframe bearish market construction was damaged, as highlighted within the chart above. A transfer again above $9k flipped the longer-term bias in favor of the bulls, and a breakout above the $10.5k stage confirmed bullish power.

What can we be taught from this collection of occasions? In comparison with the current, the volatility has been low, and the pattern has been downward, similar to August – October 2018. From June – November 2018, the $6k stage was rock-solid, till it wasn’t, and costs crashed one other 46%. Can the identical develop over 2023?

Supply: BTC/USDT on TradingView

Is the $18.7k stage the road within the sand that $6k was again in 2018? $18.7k was defended as help from June – November 2018, for 144 days.

This was just like the protection of $6k from June to November 2018, however the distinction was that the $6k mark had already been examined as help as early as February 2018.

Now that $18.7k was misplaced, it was seemingly that extra losses might comply with. Lengthy-term BTC bottoms are likely to type abruptly after months of foreshadowing.

One other crash, just like the one we noticed throughout the outbreak of the coronavirus pandemic, or November 2018, can be essential to power billions of {dollars} of liquidation earlier than the markets can march upward.

Utilizing Liquidation Levels Heatmap knowledge from Hyblock, an nameless analyst hypothesized on 29 December that $15k and $13k are the 2 main liquidation ranges, with $50 billion price of liquidation to be hunted within the neighborhood of the $13k stage.

$BTC – the @hyblockcapital warmth map exhibits 2 main liquidation ranges between that 13k & 15K I beforehand talked about.

As proven within the earlier tweet, if we will wipe out all that liquidity in a wedging style I actually like the chances for a big bounce.

13k to 30k hopefully. https://t.co/dm78uFuH40 pic.twitter.com/3HiqRCmG49

— TradingHubb (@TheTradingHubb) December 29, 2022

The value seeks liquidity, and this space might be too juicy to go away unattended. A descent under $15.8k might see the already fearful market circumstances ripen right into a panic.

Pressured sellers, each within the spot and futures markets, might trigger costs to drop additional and additional, and finish with a liquidation cascade.

Endurance will seemingly be rewarded, however all-time highs are unlikely to be reached in 2023

Within the occasion of a drop to $13k-$13.8k, consumers can await a transfer again above $15.8k and $17.6k and anticipate a rally, presumably a mirror of the one in mid-2019. As ever, it won’t precisely replicate, and warning can be key.

Are your BTC holdings flashing inexperienced? Examine the Revenue Calculator

It was not sure and even mandatory that $13k would mark the underside. The heatmaps and the highs of the rally from mid-2019 present confluence at this stage.

If, as a substitute, BTC dumped one other 46% beneath the $18.7k help, buyers might take a look at $10k as a area the place the underside might type. Which means the die would roll was unsure.

There have been 641 days between Bitcoin’s breakdown beneath the $6k help stage in late 2018 and the retest of $10.5k as help in Q3 2020. 641 days after November 10, 2022 offers us 12 August, 2024. Nevertheless, every cycle is totally different, and all {that a} dealer or investor can management is the chance they assume.

Laid out above is one situation whose central theme is liquidity and volatility. When volatility goes on a vacation, so does liquidity. A big, violent transfer might be essential to shake even the fanatics out of their positions.

Solely then may the market reverse. On this sport of shark eat shark, the affected person and the ready survive and revenue.