- Nomadic Labs has submitted a proposal for the thirteenth improve of the Tezos community.

- XTZ continued its bull run as value reversal was imminent at press time.

On January 17, Nomadic Labs proposed the thirteenth improve to the Tezos [XTM] community. The brand new improve will embody a number of new options, together with the flexibility to switch tickets between accounts, a shorter block time of 15 seconds, in addition to the addition of Epoxy on Mainnet.

Learn Tezos’ [XTZ] Worth Prediction 2023-24

The mainnet will additional strengthen instantaneous finality, because of SNARKs’ proof-of-validity. Moreover, two new RPC endpoints shall be added for higher visibility into ticket possession.

The thirteenth improve, referred to as the Mumbai protocol improve, shall be applied after a number of checks. Upgrading the system ought to deliver it nearer to Tezos’ goal of 1 million transactions per second, as said in Nomadic Labs’ report.

Doing so might improve curiosity within the community and, in flip, the worth of its native token, XTZ.

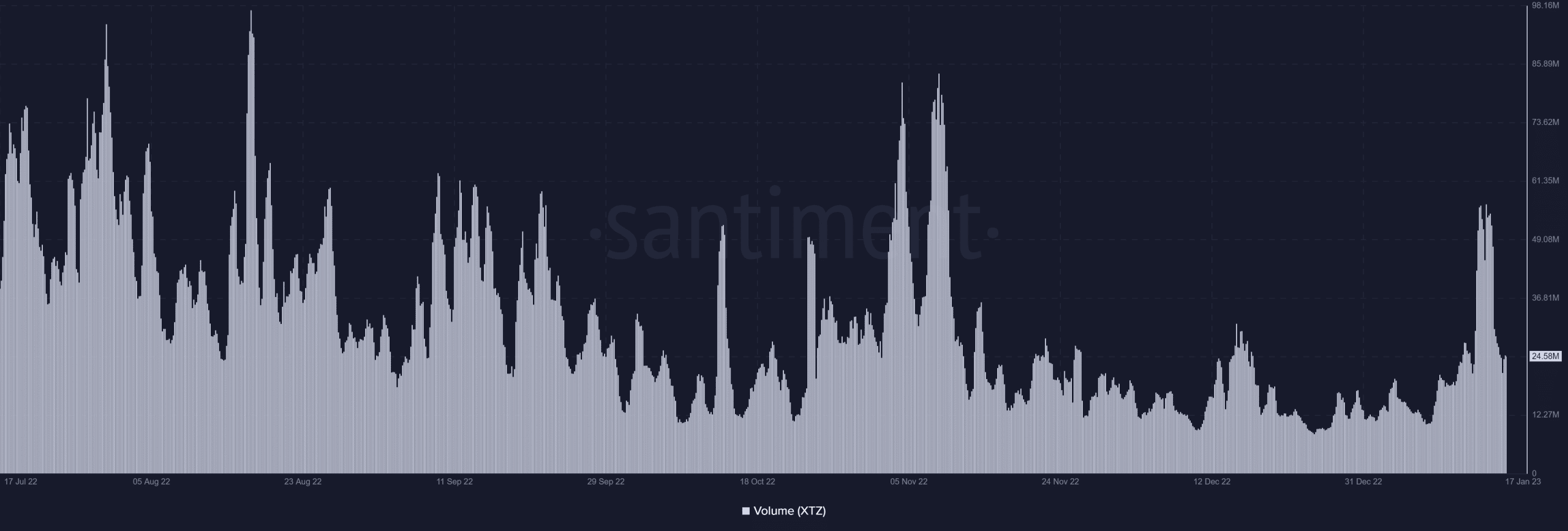

Tezos quantity sees decrease counts however dev exercise will increase

In response to the amount measure recorded on Santiment, Tezos failed to achieve 100 million transactions within the earlier six months, though January 2023 recorded a bigger quantity than November and December 2022. On the time of writing, the amount was roughly 24 million.

Supply: Santiment

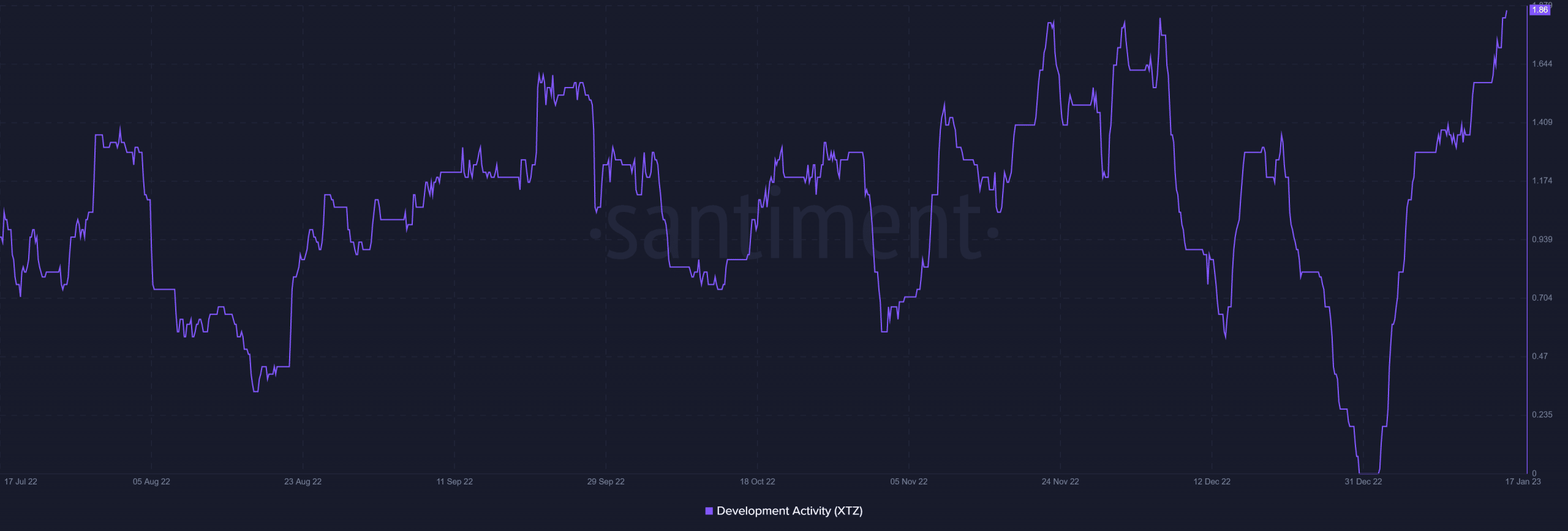

Nonetheless, a assessment of the community’s developer exercise revealed that there had been a major rise. The Improvement Exercise indicator had reached its highest stage within the earlier six months. As of the time of writing, it stood at 1.86.

Supply: Santiment

Is your portfolio inexperienced? Try the Tezos Revenue Calculator

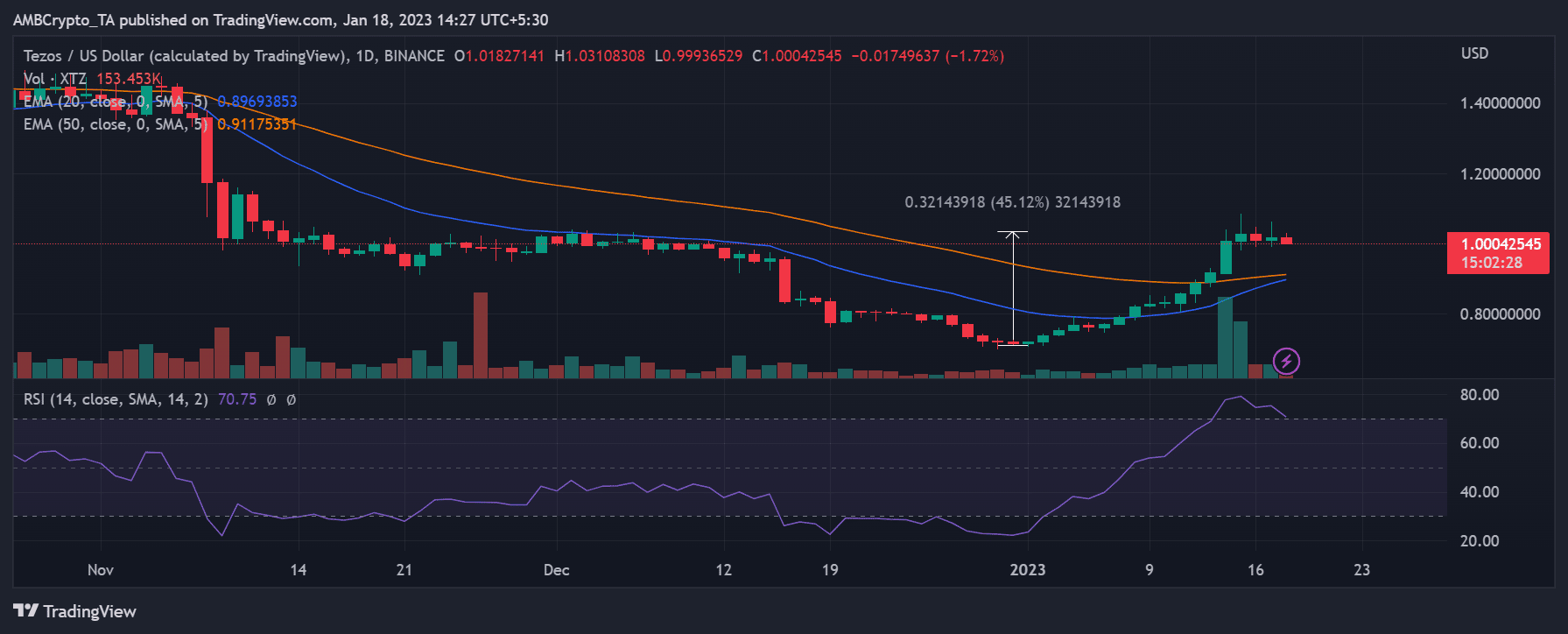

XTZ in a day by day timeframe

In response to the day by day timeframe chart, XTZ was on a bull run at press time. The asset had grown by 45% from the start of its rally in December 2022. As of this writing, XTZ had fallen by 1% and was buying and selling within the $1.00 space.

Supply: Buying and selling View

Moreover, as per the Relative Power Index (RSI) line, the asset had surged into the overbought area. A possible value reversal was additionally indicated by the RSI line being over 70, along with a bull development.