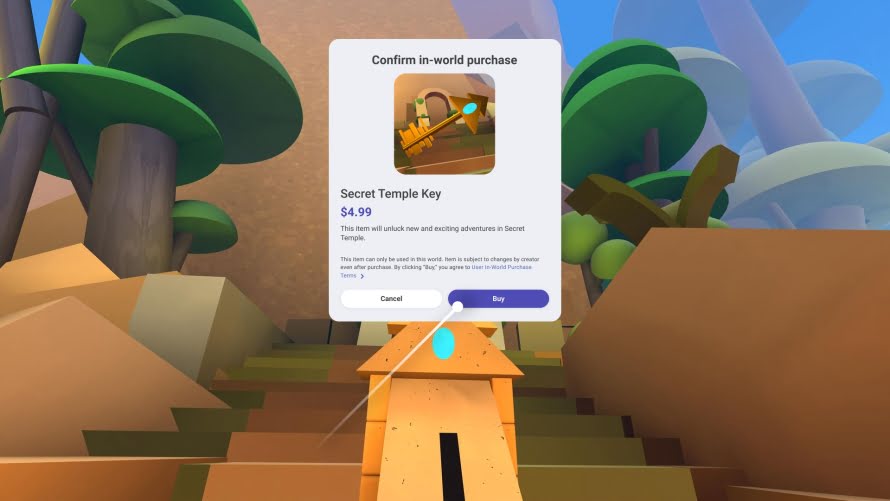

In April of 2022, Meta made headlines when the corporate introduced particulars about forthcoming instruments for Horizon Worlds, a digital actuality online game created by the corporate. Meta is growing new options for the sport that may allow creators to promote digital objects and artwork. In a blog post revealed on April 11, the corporate revealed that it might be taking a reduce of 47.5 p.c from all gross sales.

First, they cost a “{hardware} platform charge” of 30 p.c for any gross sales accomplished by way of the Meta Quest Retailer (a market for VR-enabled apps and video games). Second, there’s a 17.5 p.c charge that comes from Horizon Worlds itself.

Six months later, Apple made related headlines. The company announced that it might enable creators to promote NFTs however cost its commonplace 30 p.c “Apple Tax” on all such purchases.

This announcement ruffled quite a lot of feathers. It looks like one other case of main firms with billions of {dollars} profiting from smaller creators.

But, sizeable charges aren’t new to these commonly interacting with the blockchain. Almost each outstanding NFT market has a wide range of charges, and lots of NFT marketplaces are additionally rolling in wealth. So, is there actually that massive of a divide between Meta’s 47.5 p.c reduce, Apple’s 30 p.c, and that of different marketplaces? Are folks proper to be indignant?

Interacting with the blockchain prices cash

This received’t be new data to most, however blockchain transactions at all times value cash. How a lot cash they value is dependent upon the blockchain and the kind of transaction.

For instance, Ethereum (like many different blockchains) fees charges to customers after they conduct transactions — after they mint an NFT, swap cash, record NFTs on the market, and so forth. These gasoline charges, as they’re referred to as, are mainly funds made by customers to compensate for the computing vitality required to course of and validate transactions.

In the end, the gasoline charges fluctuate from blockchain to blockchain as a result of all of them use completely different consensus mechanisms. However all this will get a bit technical and complicated, so we received’t get into the completely different consensus mechanisms and why some value extra and others value much less. To raised serve this text, the charge quantities are what actually matter.

Traditionally, the Ethereum blockchain has modified essentially the most charges for NFT transactions. In 2021, fees ranged from as little as $9 to as excessive as round $300 per transaction. But, Solana and Tezos, the second and third hottest NFT blockchains, commonly reported transaction charges amounting to simply fractions of a greenback. What’s extra, Ethereum modified its consensus mechanism in September of 2022, so transactions on the blockchain now value far, far much less.

There’s no method to inform what share of the earnings gasoline charges equate to till an NFT sells. If an NFT sells for some huge cash and the gasoline charge was low, the gasoline charge could also be lower than one p.c of the sale value. However let’s say an NFT sells for simply $15 and the gasoline charge was $50. Which means the charges will likely be properly over one hundred pc of the earnings. And sure, this does occur.

Nevertheless, these gasoline charges is probably not the most effective factor to match with Meta’s and Apple’s charges.

Critically, blockchain gasoline charges don’t go to blockchain corporations. Ethereum and Solana aren’t taking cash from customers and giving it to themselves. Slightly, these gasoline charges go to different blockchain customers who’re verifying the transactions. Conversely, when a consumer sells an merchandise on Horizon Worlds, Meta takes a reduce. When a consumer sells an merchandise in Apple’s retailer, Apple takes a reduce.

So, for a greater comparability, we now have to have a look at the precise act of buying and selling NFTs — we now have to take market charges into consideration.

What’s the price of buying and selling NFTs?

Due to how they construction their charges, we are able to inform instantly the quantity that will likely be taken off the highest by {the marketplace} by which an NFT is listed. Right here’s the breakdown.

Zora: Zero charge platform. When minting an NFT, customers simply pay gasoline charges. They take no fee on gross sales.

LooksRare: No minting charge, customers simply pay gasoline charges. Takes two p.c of each closing sale value.

OpenSea: No minting charge, customers simply pay gasoline charges. Takes 2.5 p.c of each closing sale value.

Rarible: No minting charge, customers simply pay gasoline charges. Takes 2.5 p.c of each closing sale value.

SuperRare: No minting charge, customers simply pay gasoline charges. Takes three p.c of each closing sale value.

Basis: No minting charge, customers simply pay gasoline charges. Takes 15 p.c of each closing sale value.

From these figures, it’s clear that Meta and Apple have increased charges than virtually each NFT market. Loads increased charges. However the issues that people have with Meta and Apple are about extra than simply charges.

Meta, Apple, and Web3

Of their announcement, Apple said that creators can’t use NFTs to “unlock options or performance inside the app.” In response, people said that Apple was banning utility NFTs. Nevertheless, these guidelines aren’t new. Apple needs to maintain all purchases inside its ecosystem so it may take a reduce — that 30 p.c charge — from all gross sales. Nonetheless, many people within the NFT house take severe challenge with the stance that Meta and Apple have chosen. Detractors say that the NFT ecosystem, and Web3 generally, is constructed on the ideology of decentralization. They are saying that the positions that the businesses have taken make Web3 really feel an excessive amount of like Web2.

The issue with this place is that Apple and Meta don’t really feel Web2. They’re actually Web2. They’re completely totally centralized.

When folks say that we’d like Web3 as a result of the infrastructure it’s constructed upon will allow customers to get away from the intermediaries that decide when and the way customers and companies work together and interact, they’re actually speaking about getting away from Meta and Apple. The purpose of Web3 was by no means to persuade Fb or Apple to adapt. The purpose of Web3 was to construct new programs and infrastructure and make Web2 out of date.