- Avalanche just lately introduced the launch of the cell model of its Core Pockets.

- Avalanche’s newest developments have triggered AVAX to rally by over 5% within the final 24 hours.

Avalanche has just lately began rolling out new options and forming new alliances to influence the ecosystem. Homeowners of AVAX have been compelled to know onto hope regardless of these actions as a result of the consequences have been minimal if any in any respect. Nevertheless, the newest developments revealed by the ecosystem might entice new customers and influence AVAX.

Cellular core pockets

On 13 December, Avalanche announced the discharge of its Core Pockets app for cell gadgets. In its preliminary launch in June of this yr, the Core pockets had native Avalanche bridging capabilities, permitting customers to attach with dApps on the Avalanche community.

Up to now, customers who wished to switch their property to the community needed to resort to third-party instruments like MetaMask, which supplied an identical Ethereum-Avalanche bridge.

Avalanche’s newest change might pave the best way for the corporate to draw extra customers. This has the potential to spice up each ecosystem participation and consumer depend.

The community claimed that the Core pockets’s different distinctive options included the power to commerce Avalanche, Bitcoin simply, and Ethereum property. Additionally, the switch of Bitcoin and Ethereum to take part in Avalanche DeFi dApps, and observe real-time asset value actions in a unified watchlist.

Avalanche’s latest partnership

Avalanche has additionally just lately launched a learn-and-earn program in collaboration with Robinhood. By incorporating Robinhood’s “study and earn” function, the ecosystem would be capable of onboard a greater diversity of customers.

In associated information, Avalanche had additionally just lately established a relationship with Alibaba Cloud. On account of the collaboration, the platform would offer Node-as-a-Service. This service would enable any operator involved in operating a node to take action by merely connecting to an already-built structure with no complicated set-up.

AVAX in every day timeframe

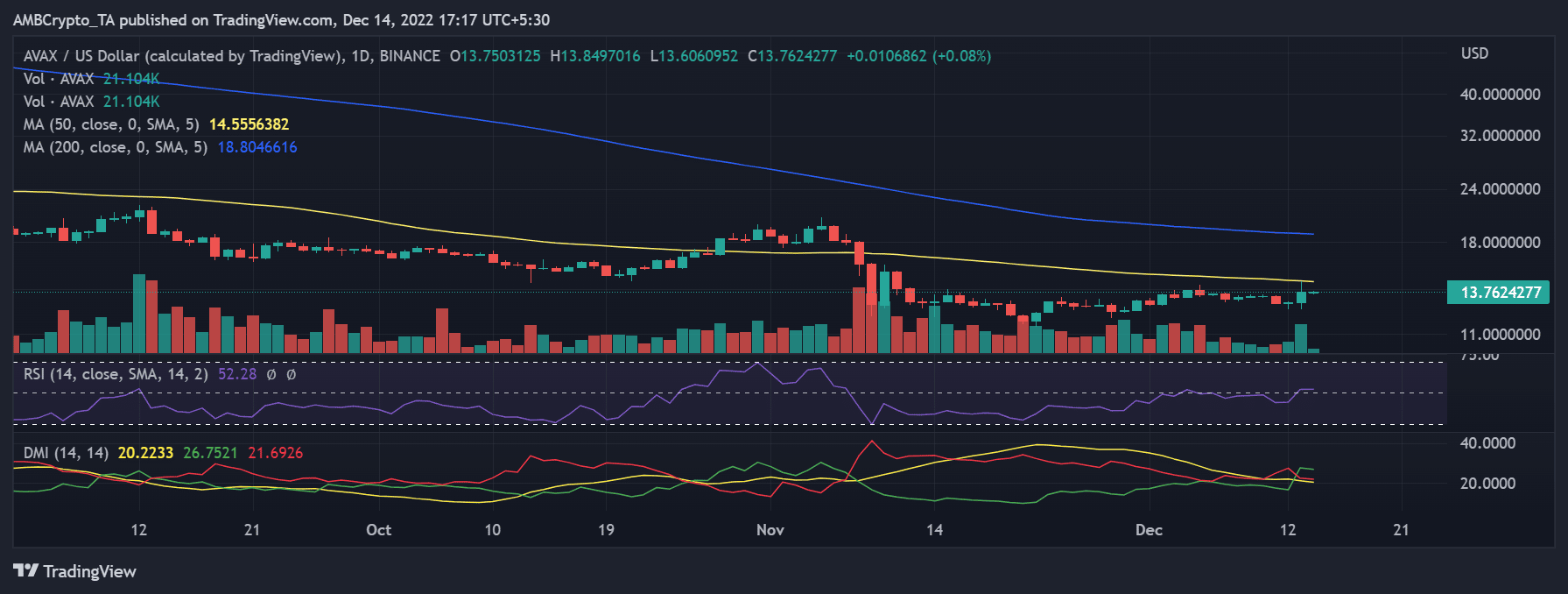

By taking a look at AVAX in a every day timeframe, it was attainable to see extra clearly how these function enhancements and partnerships are but to have the anticipated influence.

The asset’s value motion development was underwhelming when examined. However it was clear that it had elevated by greater than 5% over the previous buying and selling interval.

This is able to indicate a good response to the community’s most up-to-date information. On the time of this writing, the asset was buying and selling with lower than a 1% improve in worth, and it gave the impression to be rising.

Supply: TradingView