The Bitcoin Coinbase Premium Index suggests US traders have been promoting extra closely than others in the course of the newest crash within the crypto.

Bitcoin Coinbase Premium Index Has Turned Deep Purple Lately

As identified by an analyst in a CryptoQuant post, whales on Coinbase Professional appear to have been behind the most recent dump.

The “Coinbase Premium Index” is an indicator that measures the share distinction between the Bitcoin value listed on Coinbase Professional (USD Pair) and the one listed on Binance (USDT pair).

Coinbase Professional is popularly recognized for use by traders based mostly within the US (particularly massive institutionals), whereas Binance will get a extra international site visitors.

Subsequently, the worth gaps listed on these two crypto exchanges can trace at which traders are promoting or shopping for extra.

When the metric has a constructive worth, it means the worth of BTC on Coinbase is greater than on Binance proper now, suggesting that US traders have offered extra shopping for strain just lately.

Alternatively, unfavourable values of the premium recommend American holders are dumping greater than international traders for the time being.

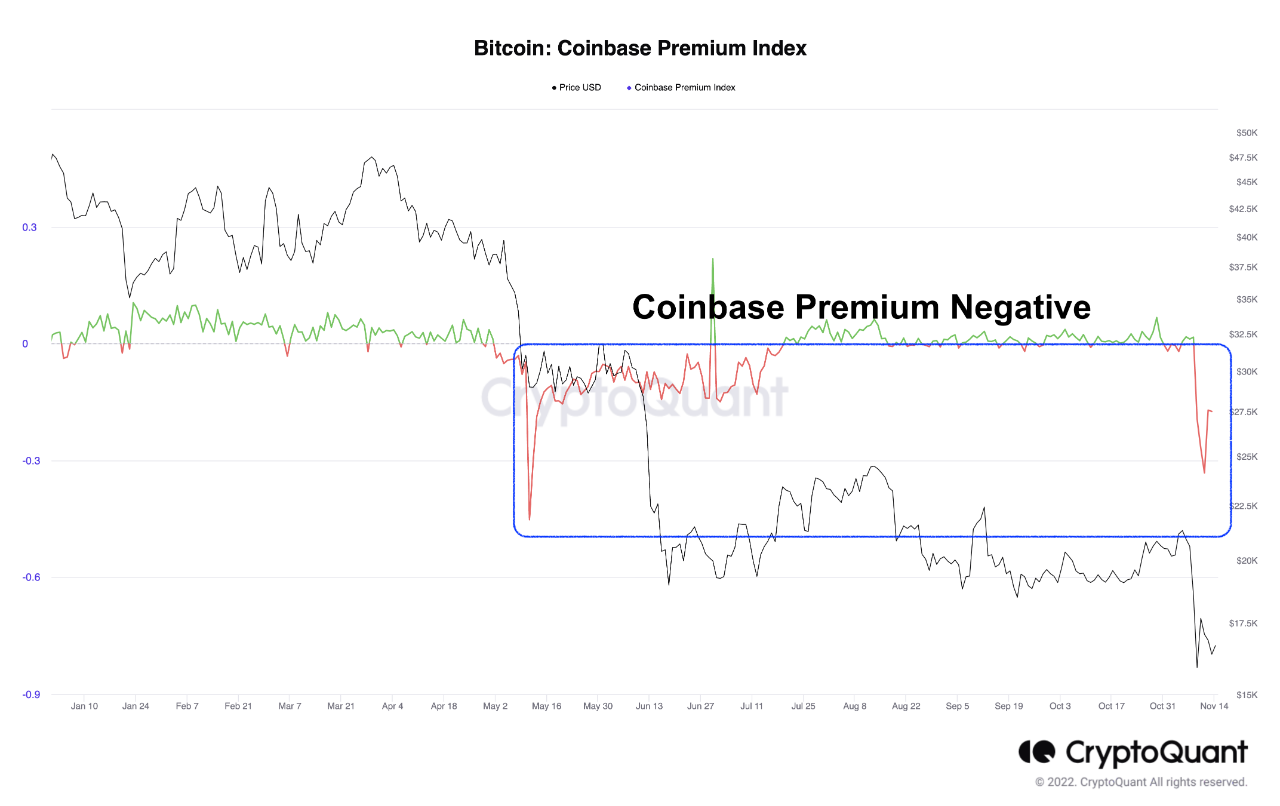

Now, here’s a chart that reveals the pattern within the Bitcoin Coinbase Premium Index over the previous 12 months:

The worth of the metric appears to have been crimson in latest days | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin Coinbase Premium Index has plunged into unfavourable values just lately together with the crash.

Which means US traders have been dumping extra aggressively than traders from the remainder of the world up to now week.

Additionally, as is clearly seen within the chart, an identical pattern was additionally seen again in early Could, when BTC’s value crashed from $40k to $30k.

The quant notes that whereas Coinbase noticed this promoting, the Bitcoin Korea Premium Index confirmed an attention-grabbing conduct. The under chart highlights this pattern.

Appears to be like like this metric had a inexperienced worth just lately | Supply: CryptoQuant

The Korea Premium Index measures the hole between the costs listed on South Korean crypto exchanges, and that on different exchanges.

From the graph, it’s obvious that in each the present crash in addition to the one in Could, the indicator confirmed constructive spikes.

This means that whereas the US traders have been dumping, the Korean traders have been specializing in “shopping for the dip.”

BTC Worth

On the time of writing, Bitcoin’s value floats round $16.8k, down 15% within the final week. Over the previous month, the crypto has shed 11% in worth.

BTC has been caught in consolidation below $17k in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com