The Bitcoin long-term holder SOPR could counsel that the crypto has nonetheless solely gone one-third of the best way by means of the most recent bear market.

Bitcoin 20-day SMA Lengthy-Time period Holder SOPR Has Solely Been 86 Days Into Bottoming Zone

As identified by an analyst in a CryptoQuant post, the crypto remains to be only one/third of the best way into the 260 days common historic bottoming interval.

The related indicator right here is the “Spent Output Revenue Ratio” (or SOPR briefly), which tells us about whether or not the common Bitcoin investor is promoting at a revenue or at a loss proper now.

The metric works by trying on the historical past of every coin being bought on the chain to see what value it was final moved at. If this earlier promoting value was lower than the most recent BTC worth, then the coin has simply been bought at a revenue. Whereas if the final worth was greater than the present one, then that specific coin realized some loss.

When the worth of the SOPR is bigger than one, it means the market as an entire is promoting at a revenue proper now.

However, the indicator being lower than one implies the common holder is shifting cash at a loss for the time being.

The “long-term holders” (LTHs) is the Bitcoin cohort that features all traders who’ve held onto their cash for at the very least 155 days with out promoting or shifting them.

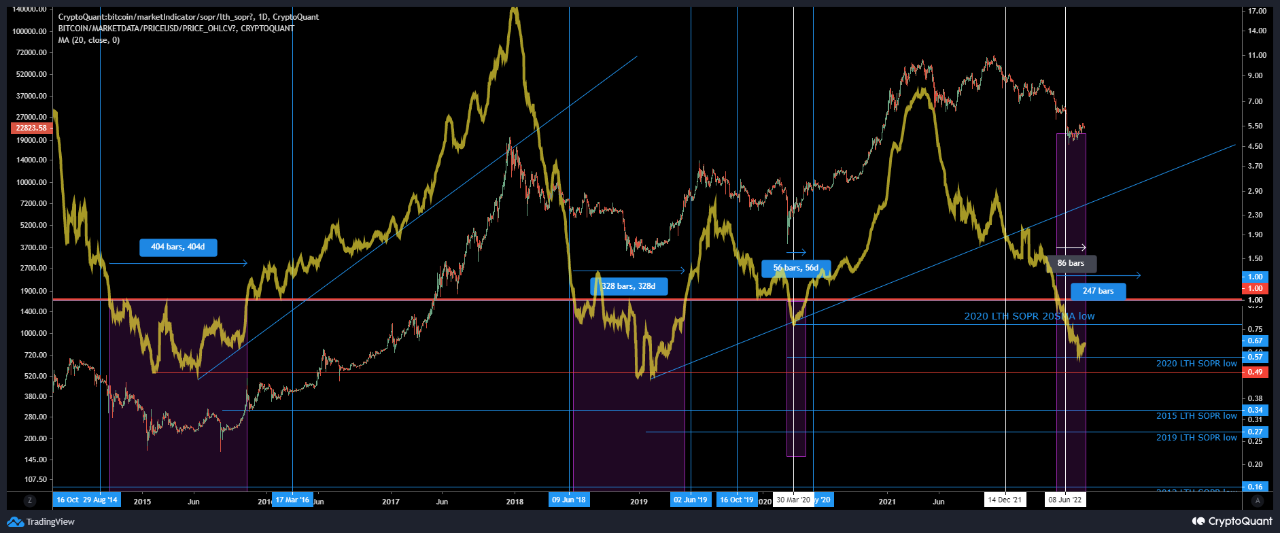

Now, here’s a chart that reveals the pattern within the BTC SOPR (20-day MA) particularly for these LTHs over the the final a number of years:

Appears like the worth of the metric has been fairly low just lately | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin LTH SOPR (20-day SMA) dipped beneath the “one” mark some time again.

Additionally, within the chart the quant has marked all of the related zones of pattern for the indicator in relation to the bear market.

It looks as if historic bottoming durations have lasted each time the metric has been caught beneath the breakeven level.

On common, previous bear markets have lasted round 260 days based mostly on the LTH SOPR. Within the present cycle, the coin has to date been 86 days into the bottoming zone.

This could counsel that if Bitcoin ends this bear market in about the identical time as the common, then the crypto remains to be solely one-third of the best way by means of.

BTC Worth

On the time of writing, Bitcoin’s value floats round $23k, down 2% within the final week. Over the previous month, the coin has gained 13% in worth.

The worth of the crypto appears to have been shifting sideways throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com