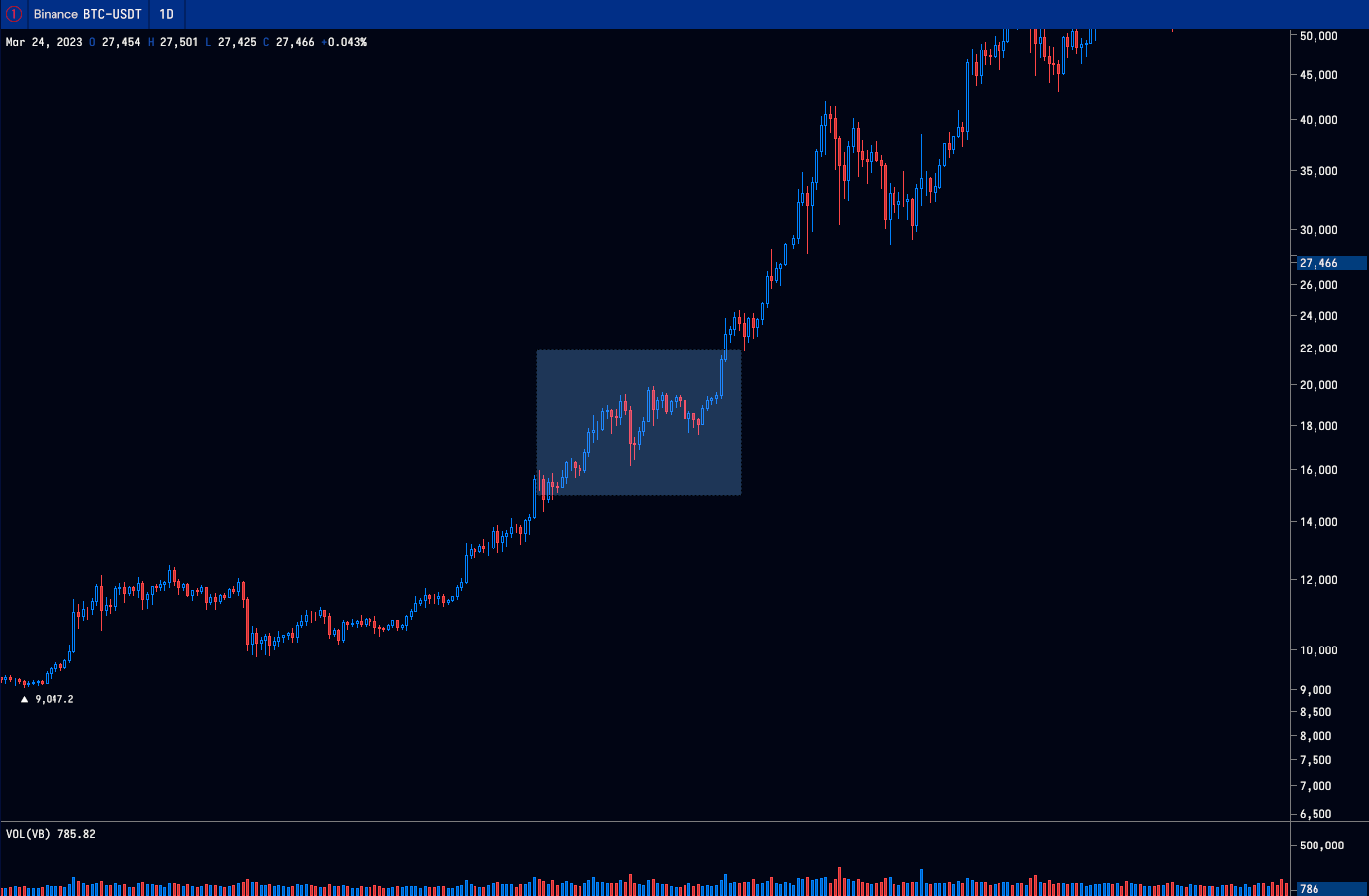

A intently adopted dealer believes that Bitcoin’s (BTC) present market construction appears to be like just like its worth motion within the second half of 2020 earlier than the king crypto convincingly took out the $20,000 degree.

Pseudonymous dealer Cantering Clark tells his 163,300 Twitter followers that Bitcoin appears to be like bullish after managing to soak up the sell-off final Friday.

In accordance with the analyst, BTC bulls have the higher hand so long as Bitcoin trades above help at $27,000.

“So we failed to interrupt out of the within day setup, and as an alternative it appears to be like like we accrued a little bit of panic promoting under. Coin margined OI (open curiosity) is up, most likely on account of hedging, and a few lengthy stablecoin margined OI is down, a part of the flush. I grabbed an extended so long as yesterday’s lows maintain.”

At time of writing, Bitcoin is buying and selling for $27,644, nicely above the dealer’s help space.

The dealer additionally highlights that Bitcoin’s four-hour chart seems to imitate a sample witnessed in November 2020 when BTC took a breather earlier than taking out the important thing psychological space of $20,000.

“I don’t prefer to lean on fractals, however this one from 2020 appears to be like nearly equivalent to what now we have now on the 4-hour chart. This occurred as worth consolidated underneath the 2017 excessive.”

Though Cantering Clark is bullish on BTC, he says that merchants ought to be affected person and await extra indicators. In accordance with the analyst, BTC nonetheless continues to commerce inside a slim vary between $27,000 and $28,868. A break of both the low or the excessive of the vary may decide BTC’s subsequent transfer, says Cantering Clark.

“I feel it’s value being affected person with Bitcoin right here, given the excessive timeframe break, however I do see the opposite aspect’s legitimate factors about attainable distributive worth motion. That being stated, there’s a fairly clear inside day break that’s arrange. Acceptance above or under yesterday’s vary ought to supply a short continuation play. If by the lows, all the way down to $26,5000, and a break above probably for much longer of a throw to $30,000.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Sensvector/EB Journey Images