- TRON’s weekly report revealed a number of promising developments

- Some metrics supported a worth surge, whereas RSI and different market indicators recommended in any other case

TRON [TRX] printed its weekly report on 10 December, which detailed all of the developments associated to the ecosystem over the past seven days.

🧐Take a look at #TRON Highlights from this week (Dec 03, 2022 – Dec 09, 2022).

🙌We’ll replace you on the principle information about #TRON and #TRON #Ecosystem. So keep tuned, #TRONICS! pic.twitter.com/1FF4IMpnlc

— TRON DAO (@trondao) December 10, 2022

Learn TRON’s [TRX] Worth Prediction 2023-2024

Probably the most notable developments included the formal adoption of the 79th Committee proposal. The principle content material of the committee proposal was to switch the No. 11 and No. 47 community parameters. The goal was additionally to extend the unit worth of vitality from 280 solar to 420 solar.

With its newest model, 4.4.3, ONTO Pockets added help for buying and selling belongings on the TRON community. Moreover, Tether introduced the launch of a brand new stablecoin named CNHT on the TRON blockchain.

Speaking about latest achievements, TRON additionally topped the listing of blockchains when it comes to chain exercise.

Is all the pieces in favor of TRON?

Justin Solar, the founding father of TRON, not too long ago expressed his ideas concerning TRON’s burn charge. This replace regarded fairly promising for the blockchain because it mirrored its deflationary traits.

He talked about,

“We’ll see 5 to 10 billion TRX burned yearly due to all of the use instances on TRON Community.”

This was excellent news, as it will assist the token enhance its worth in the long run. As of 10 December, over 22.8 million cash had been burned, with a internet manufacturing ratio of lower than zero -17,752,668.

tenth December: #TRON burns greater than 22,818,476 cash 🔥 with a internet manufacturing ratio lower than zero -17,752,668 🤯 pic.twitter.com/avDkpJdOop

— TRON Group 🅣 (@TronixTrx) December 11, 2022

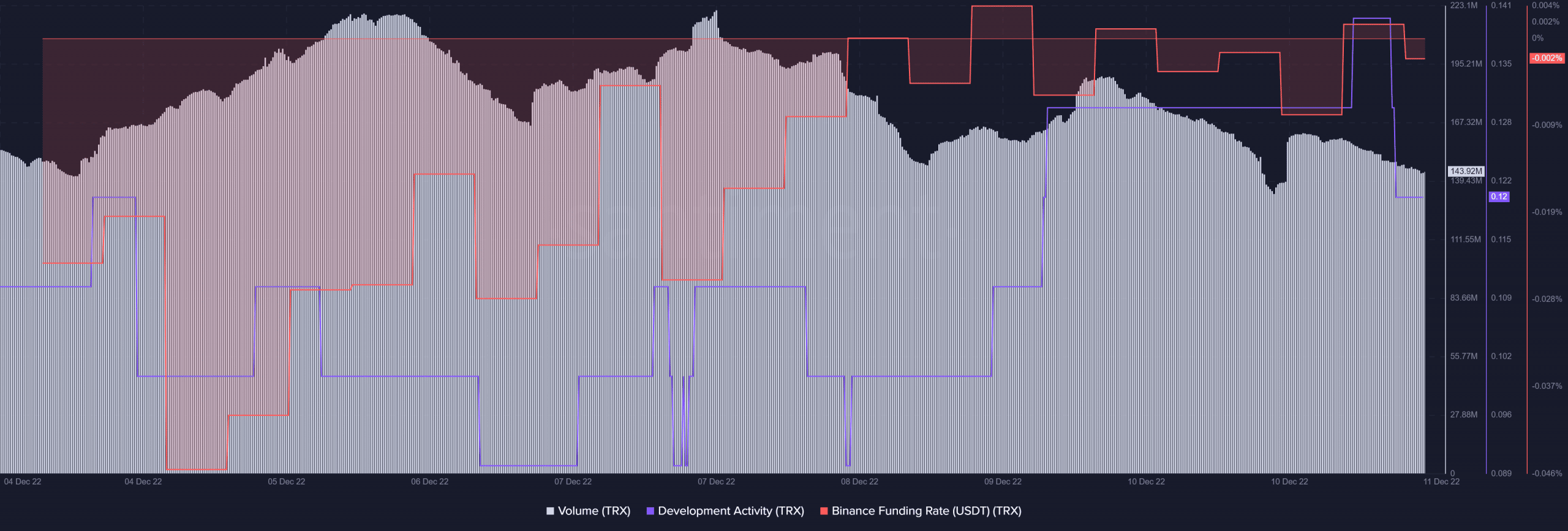

These aforementioned developments additionally affected TRON’s metrics positively over the past week. As an example, TRX’s quantity stayed constant over the past seven days, which was a optimistic sign.

TRX’s improvement exercise additionally elevated, reflecting the elevated efforts of the builders. The Binance funding charge revealed that TRX gained curiosity from the derivatives market because the graph went up.

Supply: Santiment

Alongside these developments, TRX’s worth motion additionally aligned in favor of buyers, because it registered 2% weekly positive aspects. On the time of writing, TRX was trading at $0.05462, with a market capitalization of over $5 billion.

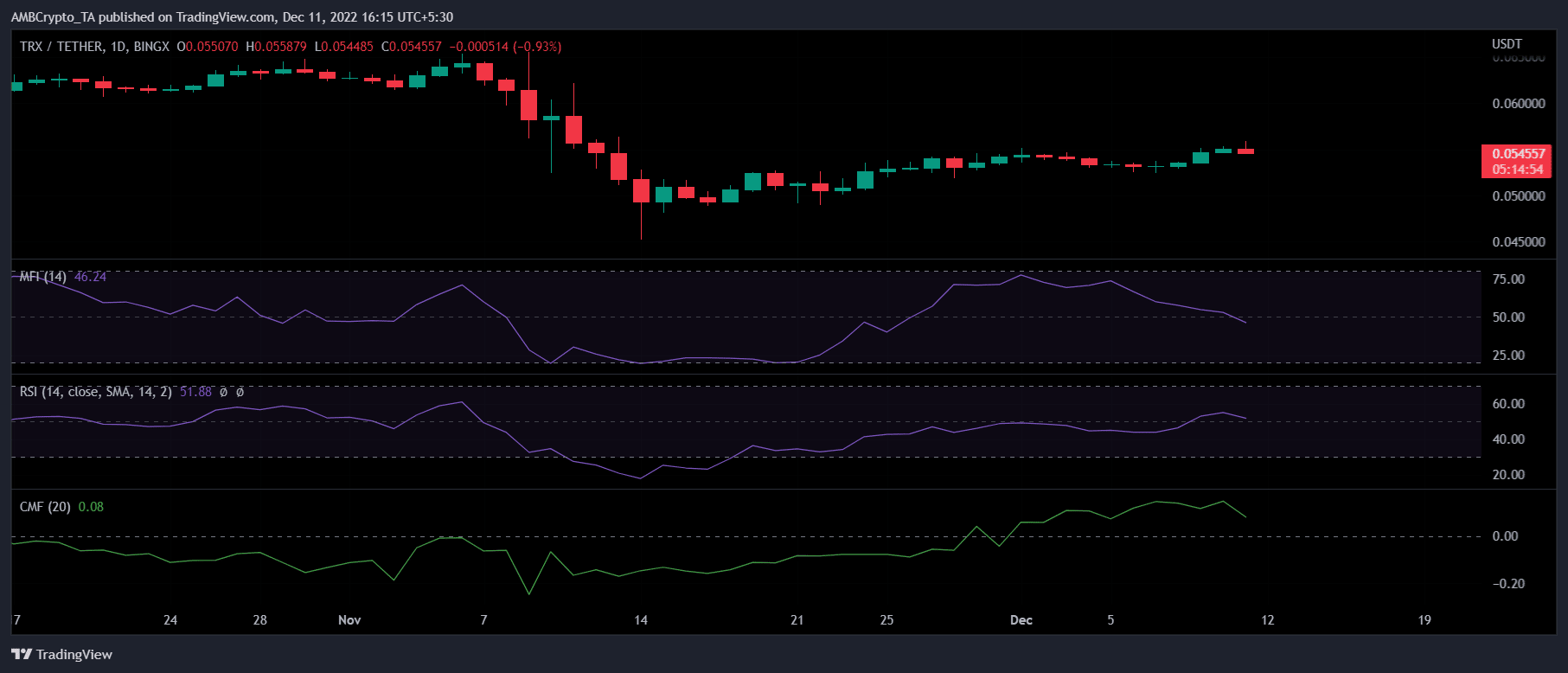

Nevertheless, earlier than going gaga over the optimistic metrics and TRX’s worth motion, it is very important think about the market indicators.

The bears are right here

A take a look at TRX’s day by day chart painted a bearish image, as most market indicators recommended a bearish edge. As an example, TRX’s Relative Energy Index (RSI) registered a slight downtick and was on the impartial mark. This was a powerful destructive sign.

TRON’s Chaikin Cash Movement (CMF) and Cash Movement Index (MFI) additionally plummeted, which could carry hassle within the coming days.

Supply: TradingView