Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- TRX may commerce sideways within the subsequent few days.

- Growth exercise dropped barely.

The current TRON [TRX] rally supplied buyers over 30% positive aspects. Nonetheless, the height ushered in a value consolidation that might lengthen till Bitcoin [BTC] makes main strikes.

At press time, TRX was buying and selling at $0.06205 because it sought to achieve its present buying and selling vary’s mid and upper-range boundary.

Learn TRON [TRX] Value Prediction 2023-24

The $0.06120 – $0.06354: Is a breach seemingly?

Supply: TRX/USDT on TradingView

TRX has traded throughout the $0.06120 – $0.06354 vary since 14 January, after reaching an overhead resistance at $0.6580.

On the 12-hour chart, although the Relative Power Index (RSI) retreated from the overbought zone and moved sideways, it was nonetheless at 66. Thus, TRX was nonetheless bullish, however fluctuating shopping for stress may set it for an extra sideways market construction.

As well as, the On Stability Quantity (OBV) fell barely however fluctuated because it dropped. As such, the fluctuating buying and selling volumes may additional reinforce a sideways construction. Due to this fact, TRX may proceed to commerce throughout the $0.06120 – $0.06354 vary or goal the overhead resistance within the subsequent few days.

Buyers can goal the higher and decrease boundary of the vary for income. The mid-range at 78.6% Fib stage of $0.06238 is a vital impediment value noting.

Nonetheless, if bears push TRX beneath the vary, it will invalidate the above sideways construction. The 61.8% Fib stage may maintain the downtrend in such a case, particularly if BTC was bearish.

Furthermore, buyers ought to be careful for the tip of January’s FOMC assembly, which will probably be a market set off for BTC and conventional markets.

TRX noticed a decline in weighted sentiment, however …

Supply: Santiment

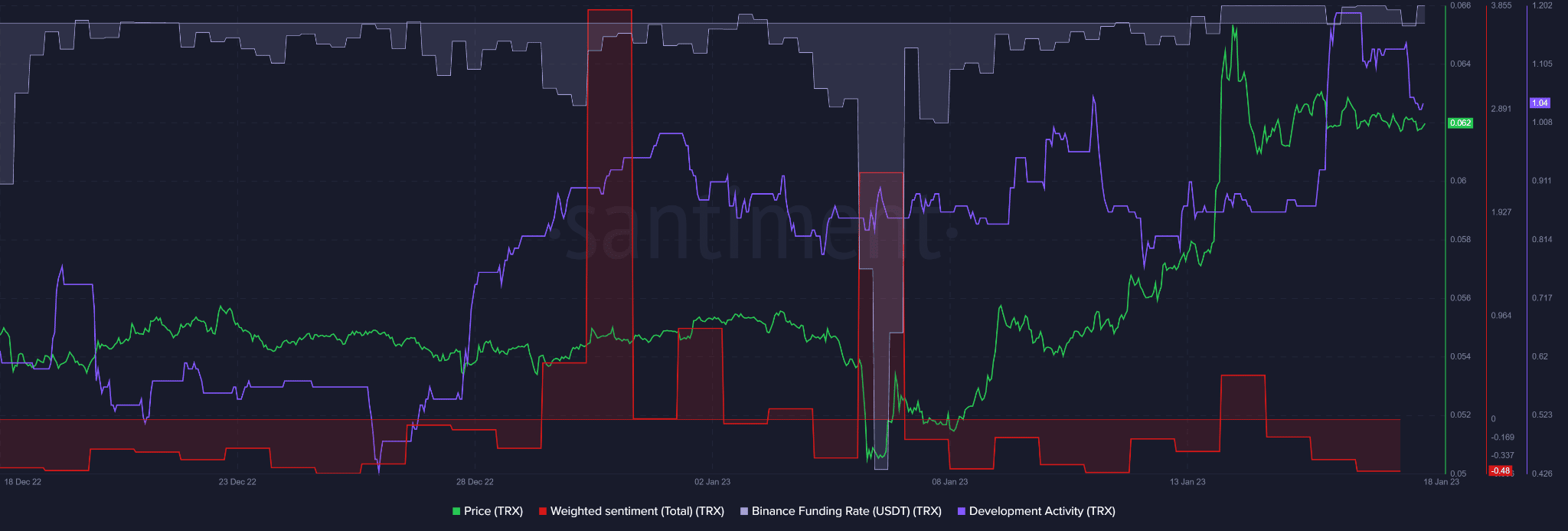

In accordance with Santiment, TRX’s growth exercise peaked in a couple of days earlier than dropping sharply on the time of writing. The drop was mirrored in a decline in investor confidence as evidenced by the damaging weighted sentiment.

Is your portfolio inexperienced? Try the TRX Revenue Calculator

Nonetheless, the Binance Funding Fee for the TRX/USDT pair remained comparatively constructive, indicating that demand for TRX remained unchanged after a current value decline. Further demand may tip TRX to realize uptrend momentum.

The above metrics provide countering results, so buyers can monitor BTC’s value motion too.