- TRX was in a bullish market construction.

- A break of the present assist resistance on the 38.2% Fib stage ($0.5345) is feasible.

- TRX noticed improved sentiment and a rise in funding charges from Binance Change.

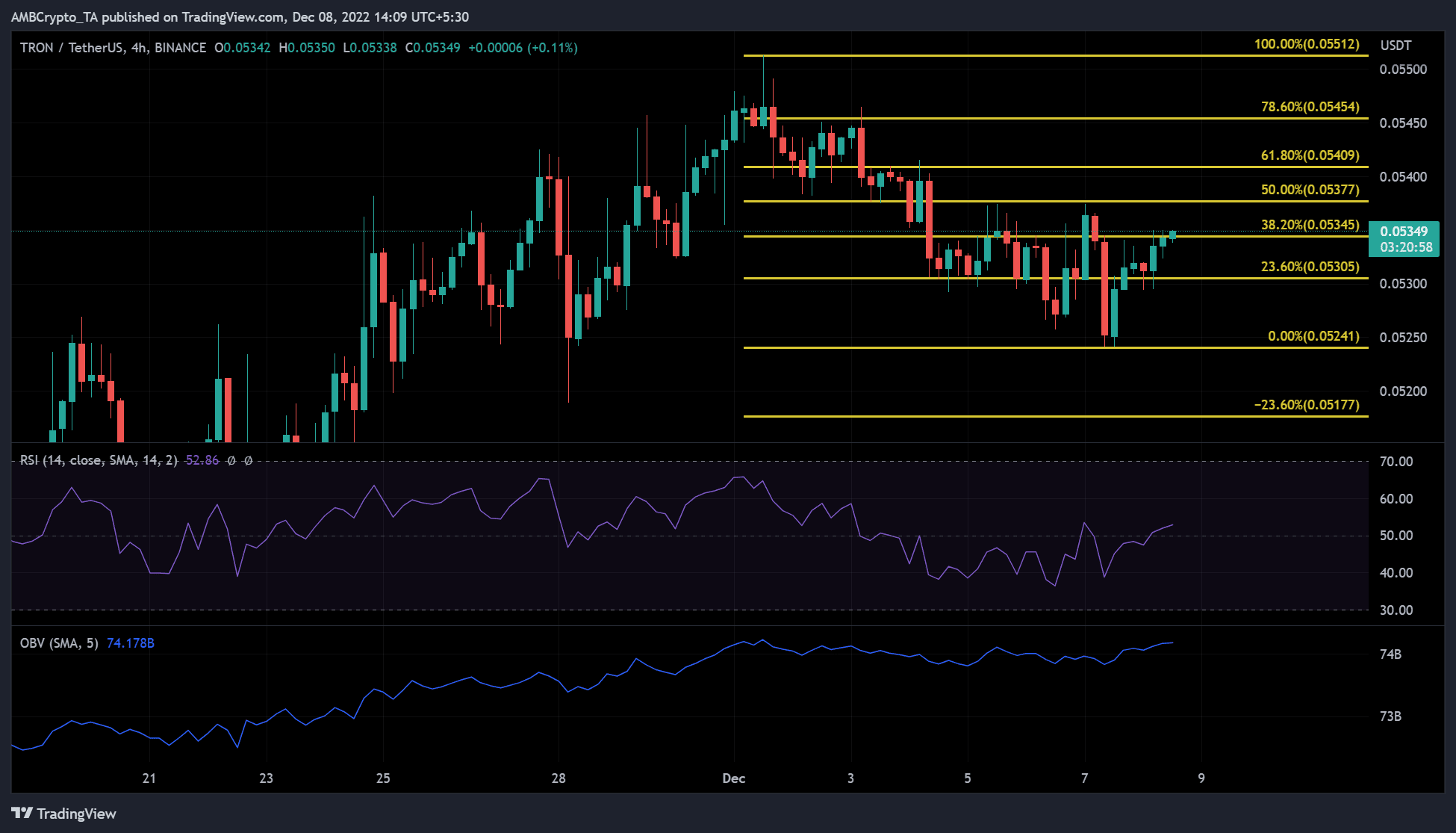

TRON (TRX) is poised to rally additional as technical indicators level to an enormous uptrend. At press time, TRX was buying and selling at $0.05349 and regarded primed to interrupt via present resistance on the 38.2% Fib stage.

In different information: Tether selected the TRON community for its newest Chinese language Yuan (CHNT) launch. Including this improvement to the spectacular metrics and technical indicators, TRX is going through huge positive factors within the close to time period.

TRX’s bulls face the present resistance: Will the uptrend proceed?

Supply: TRX/USDT on TradingView

The fast hurdle for TRX is the present resistance on the 38.2% Fibonacci retracement stage ($0.05345). Nonetheless, the technical indicators on the 4-hour charts recommend that the bulls might break this stage.

Specifically, the Relative Power Index (RSI) climbed out of the decrease vary and was barely above the impartial level with an uptick. This exhibits that promoting stress has been steadily easing, and the bulls have vital leverage within the present market.

Accordingly, the On Stability Quantity (OBV) recorded rising buying and selling volumes indicating rising shopping for stress. Due to this fact, TRX might get away above the present resistance at $0.05345. Then, bulls can concentrate on the brand new goal on the 50% Fib stage ($0.05377).

Nonetheless, a candlestick shut beneath the present assist at $0.05305 would negate this prediction. On this case, new helps might be discovered at $0.05372 and $0.05341 if TRX drops decrease.

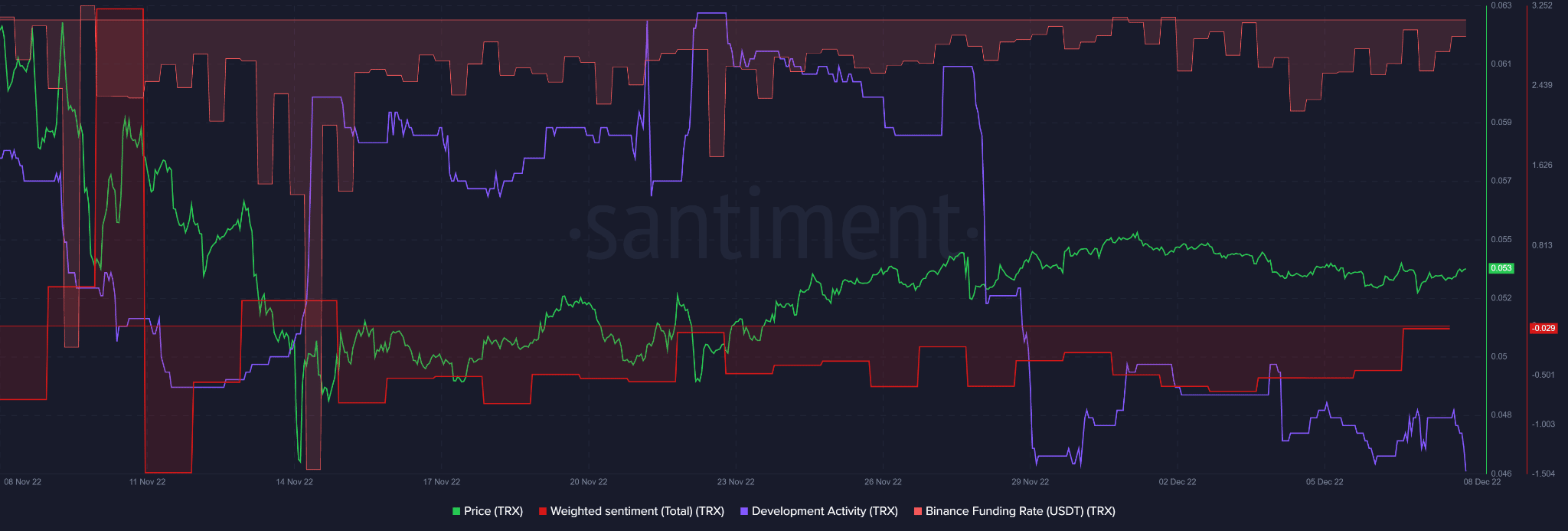

TRX noticed improved weighted sentiment however a decline in improvement exercise

Supply: Santiment

TRX additionally recorded an enchancment in weighted sentiment. In response to Santiment, weighted sentiment pulled again from adverse territory and was impartial on the time of publication.

This means a change in sentiment from bearish. A powerful bullish outlook might additional increase TRX’s value rally if sentiment turns constructive and strikes greater.

Accordingly, the Binance Funding Charge rose from deeply adverse territory and climbed to the impartial stage. This exhibits that the TRX derivatives market can also be shifting in direction of a bullish outlook. Taken collectively, these metrics point out further room for an extra TRX value rally.

Nonetheless, TRX’s improvement exercise took a nosedive on the time of publication. Furthermore, any bearish sentiment on BTC might undermine an extra value rally. Due to this fact, TRX buyers ought to carefully monitor BTC’s efficiency.

![TRON [TRX] is ready for a further rally; investors can profit from this level](https://ambcrypto.com/wp-content/uploads/2022/12/bert-b-b6f7WaA-NZk-unsplash-1000x600.jpg)