- Justin Solar talked about that TRON could also be seen as a priceless digital asset for improvement in Hong Kong.

- TRX’s value registered a decline, however a couple of metrics and market indicators instructed a development reversal.

TRON [TRX] printed its weekly highlights on 25 February, by which it talked about all of the notable developments in its ecosystem over the previous seven days. Probably the most important replace was associated to its earlier-announced AI improvement fund. Furthermore, TRON Academy additionally introduced a partnership with BostonHacks final week.

🧐Take a look at #TRON Highlights from this week (Feb 18, 2023 – Feb 24, 2023).

🙌We’ll replace you on the principle information about #TRON and #TRON #Ecosystem. So keep tuned, #TRONICS! pic.twitter.com/2ZaA6Tahi6

— TRON DAO (@trondao) February 25, 2023

Learn TRON’s [TRX] Worth Prediction 2023-24

Moreover, Justin Solar, the founding father of TRON, posted a tweet by which he talked about that Hong Kong’s proposed laws for digital asset buying and selling might have a huge impact on TRON, and the blockchain can profit from it.

Hong Kong’s proposed laws for digital asset buying and selling might have a huge impact on #TRON.

Learn extra right here👇https://t.co/MAOo5aDtnm

— H.E. Justin Solar 孙宇晨 (@justinsuntron) February 24, 2023

As per the tweet, TRON can stand out from different digital belongings due to its potential to realize the admission necessities of the brand new laws, which goal to enhance investor safety and transparency within the digital asset market. Solar additional added that as a blockchain platform with modern options and progress potential, TRON could also be seen as a priceless digital asset for improvement in Hong Kong.

Although Solar expects TRON to achieve new heights within the coming years, the near-term situation was completely different, as a couple of metrics have been towards TRX, and so was its value motion.

These metrics will be troublesome

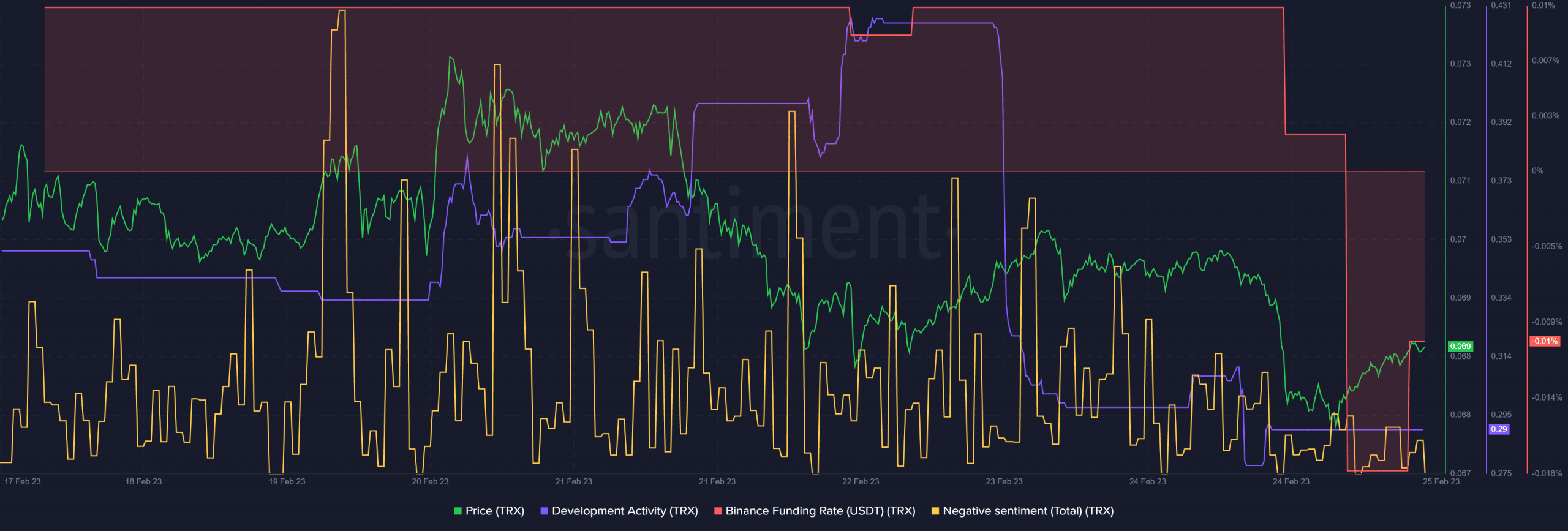

CoinMarketCap’s data revealed that TRX’s value declined by 2.5% within the final seven days, and on the time of writing, it was buying and selling at $0.06859 with a market capitalization of over $6.28 billion. TRX’s improvement exercise additionally registered a decline in comparison with final week, which was a destructive sign. Damaging sentiments round TRX spiked, reflecting much less confidence amongst buyers within the token.

After being in fixed demand within the derivatives market, issues modified on 25 February as TRX’s Binance funding price dipped.

Supply: Santiment

As per LunarCrush, TRX’s bullish sentiment declined by 8% final week, which instructed that its value would possibly fall additional. Although many of the metrics have been destructive, TRX’s Galaxy Rating elevated significantly in the previous few days, which is a large bullish sign.

Supply: LunarCrush

Is your portfolio inexperienced? Verify the TRON Revenue Calculator

Bulls to take over the market quickly?

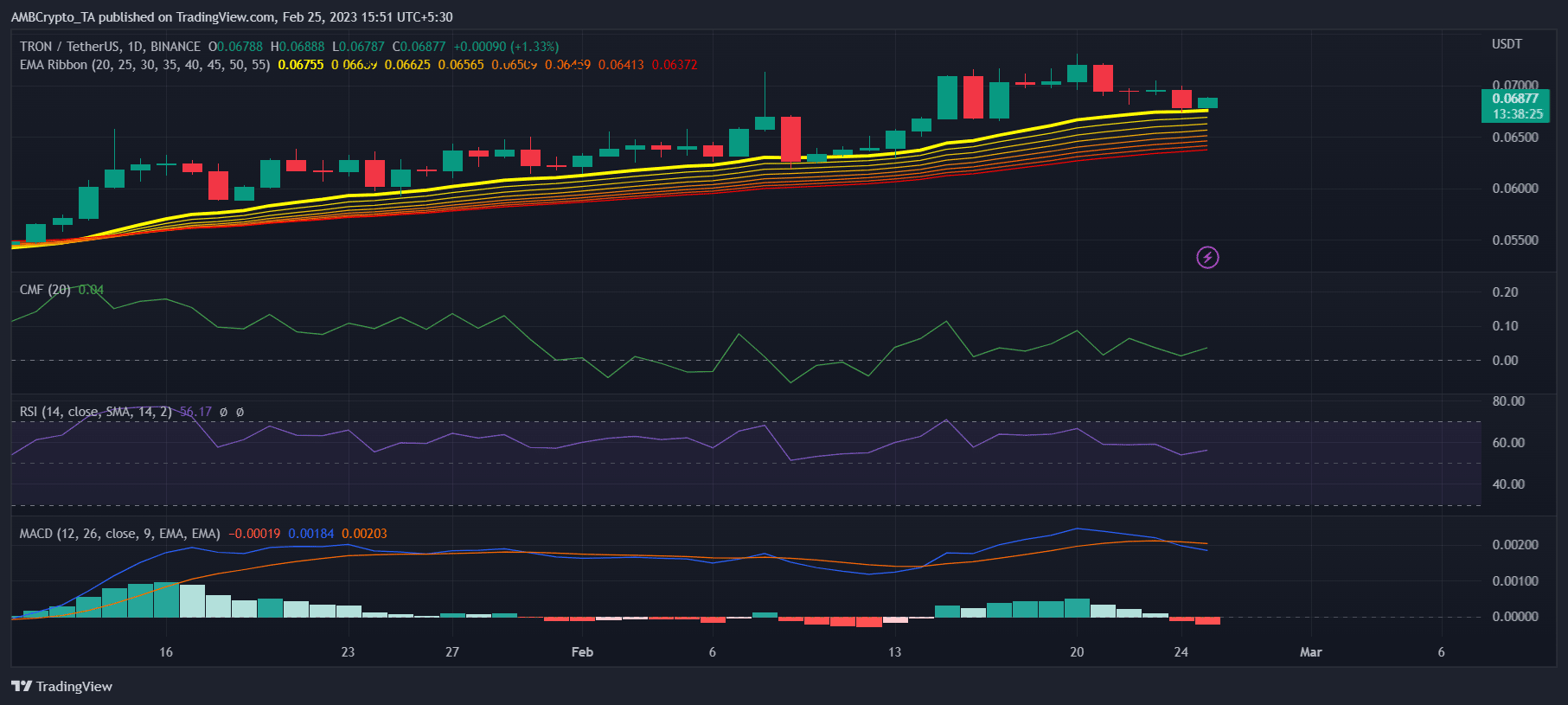

A take a look at TRX’s every day chart instructed that the bulls would possibly achieve a bonus out there, growing the possibilities of a value uptick within the coming days. For example, TRX’s Relative Energy Index (RSI) registered an uptick and was heading additional up from the impartial zone. The Chaikin Cash Circulate (CMF) additionally adopted an identical development, which appeared bullish.

Moreover, the Exponential Shifting Common (EMA) Ribbon revealed that the bulls had the higher hand, because the 20-day EMA was nicely above the 55-day EMA. Nonetheless, the MACD gave causes for concern because it displayed a bearish crossover.

Supply: TradingView