- The entire DEX buying and selling quantity surged to a four-month excessive of $15.12 billion on 11 March.

- Complete charges collected on Uniswap hit its highest worth since 10 Could.

Decentralized exchanges (DEXes) registered an exponential rise in buying and selling exercise within the final 24 hours after the collapse of Silicon Valley Financial institution (SVB) triggered FUD within the broader crypto market and depegged the USD Coin [USDC].

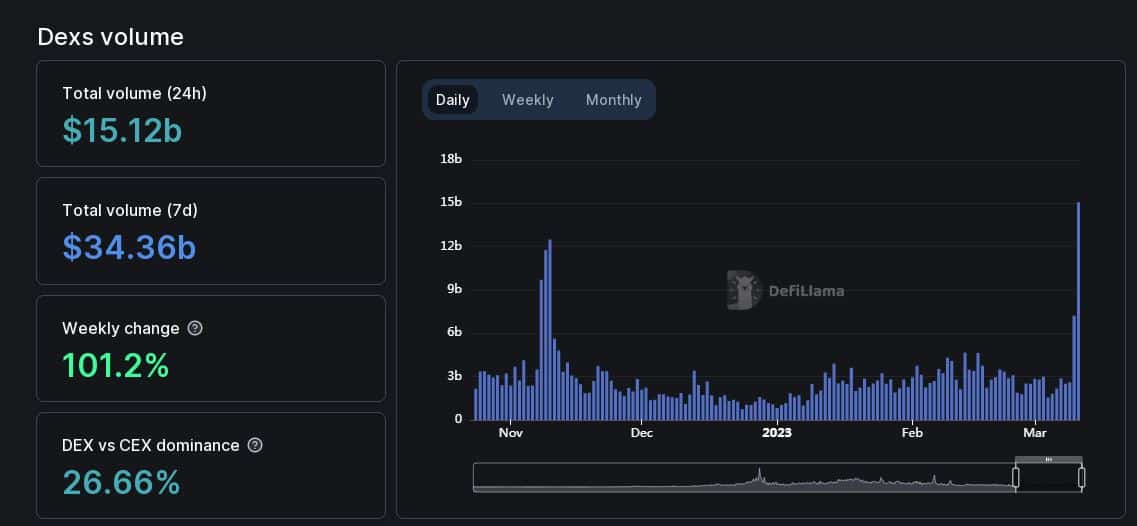

As per DeFiLlama, the whole DEX buying and selling quantity surged to a four-month excessive of $15.12 billion on 11 March, with a weekly progress price of greater than 100%.

Supply: DeFiLlama

The DEX dominance over aggregated DEX and centralized change (CEX) quantity rose to 26.66% on the time of writing.

In style DEXes register spectacular progress

The autumn of centralized entities has acted in favor of DeFi protocols prior to now. It was exemplified through the post-FTX collapse interval when customers began to want self-custody over centralized exchanges.

Curve Finance [CRV], a DEX designed for stablecoin swapping, recorded its biggest daily trading volume, practically $8 billion within the final 24 hours.

Resulting from excessive buying and selling site visitors, the whole charges collected on the platform jumped to $952,000, the very best in 4 months, as per Crypto Fees.

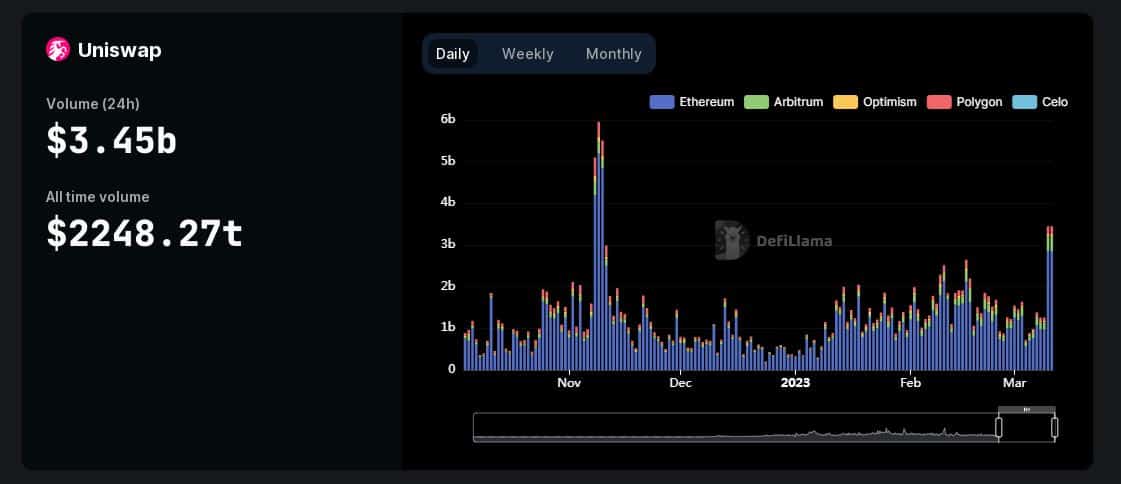

Equally, the most important DEX when it comes to buying and selling quantity, Uniswap [UNI] posted its greatest efficiency in 4 months after its quantity surged to $3.45 billion within the final 24 hours.

The transaction charges paid by the customers hit a 10-month excessive of $8.75 billion at press time.

Supply: DeFiLlama

One other in style DEX, SushiSwap [SUSHI] additionally witnessed a bounce in exercise and it grew to become one of the used sensible contracts by high Ethereum whales within the final 24 hours.

JUST IN: $SUSHI @sushiswap one of many MOST USED sensible contracts amongst high 100 #ETH whales within the final 24hrs🐳

Verify the highest 100 whales right here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see knowledge for the highest 5000!)#SUSHI #whalestats #babywhale #BBW pic.twitter.com/JtN7rwz8zX

— WhaleStats (monitoring crypto whales) (@WhaleStats) March 12, 2023

The longer term is DeFi!

DEXes have grown by leaps and bounds over the previous 3-4 years. The event exercise throughout totally different initiatives has elevated manifold as per a tweet by Token terminal, with builders engaged on as many as 20 totally different initiatives as of 10 March.

This argues properly for the way forward for decentralized finance (DeFi).

Bullish on the way forward for DEXs pic.twitter.com/0ITgzUo7n3

— Token Terminal (@tokenterminal) March 11, 2023

Lastly, USDC misplaced its greenback peg on some exchanges, over considerations that reserves backing the second-largest stablecoin by market cap, have been caught within the failed Silicon Valley Financial institution (SVB). On the time of writing, USDC recovered to $0.95 as per CoinMarketCap.