- A glance into how Uniswap is planning to maintain development within the subsequent cycle.

- Recapping UNI’s efficiency and what the short-term and long-term might maintain.

Uniswap is reportedly seeking to exploit development alternatives after efficiently tapping into layer 2 networks. In accordance with a brand new Messari report, Uniswap is contemplating a brand new product line that can enable it to profit from future protocols within the blockchain phase.

Learn Uniswap (UNI) value prediction 2023-2024

Uniswap’s choice is right-minded contemplating the quick tempo at which the phase is rising. As well as, each cycle has traditionally introduced forth new alternatives.

Uniswap’s choice to organize prematurely underscores foresight and its means to adapt to future alternatives. This type of focus might put it forward of the competitors and permit it to totally faucet into the subsequent main alternative within the crypto market.

1/ With @Uniswap‘s deployment of V3 and enlargement into L2s, the protocol has efficiently saturated its present addressable market.

As Uniswap seems to be to broaden its addressable market, what methods and future initiatives is the protocol leaning on to proceed development?🧵 pic.twitter.com/QfPnIoo6HI

— Messari (@MessariCrypto) November 21, 2022

In accordance with the Messari report, Uniswap will use $165 million from its collection B funding to broaden its product line. The funds will reportedly be used to introduce swaps on Uniswap by means of the acquisition of Sudoswap and Genie XYZ.

The potential contribution to Uniswap

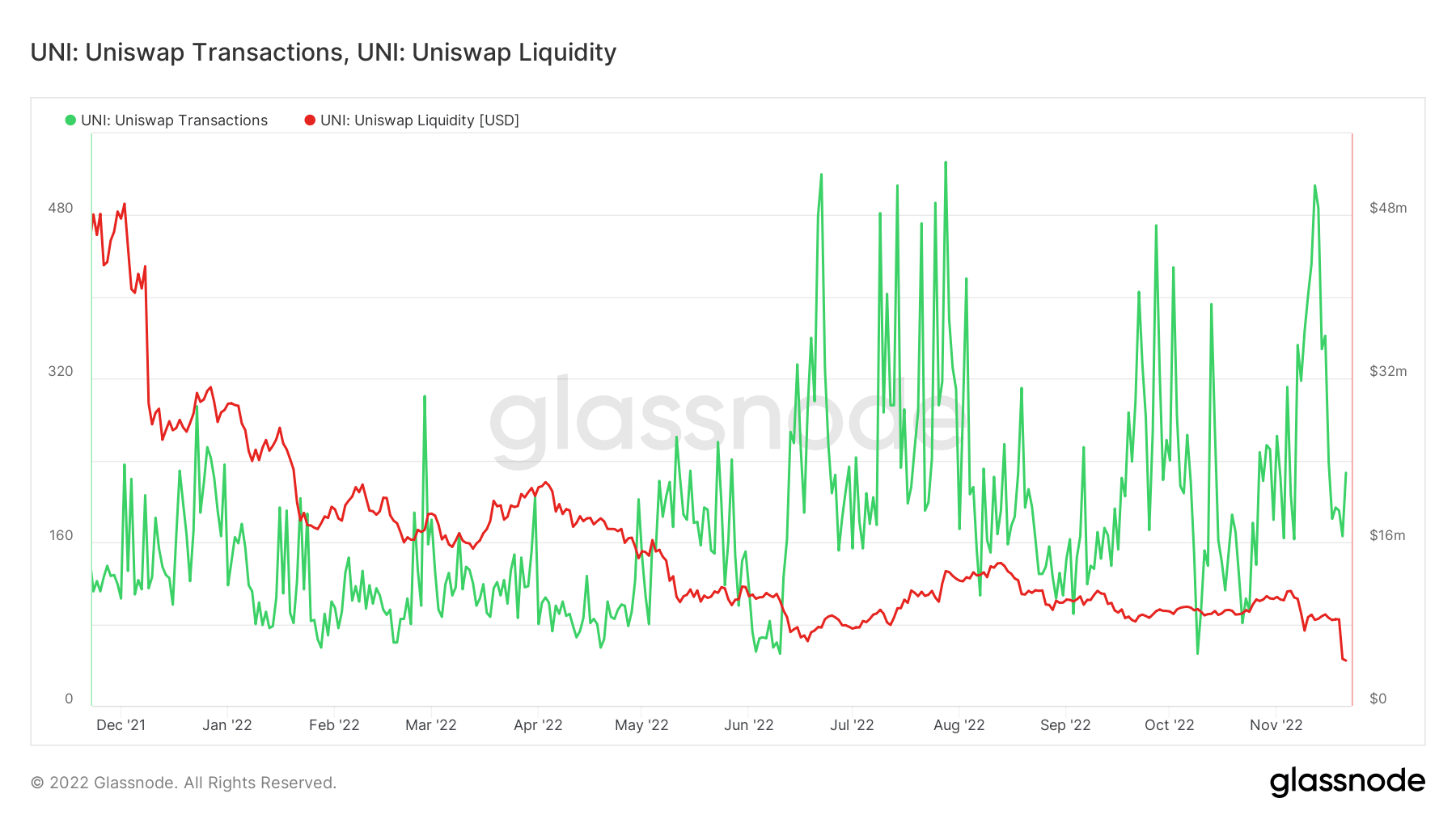

Uniswap’s development plans as highlighted by Messari might find yourself driving extra utility for UNI. The acquisitions and addition of swaps would possibly facilitate the restoration of Uniswap liquidity which has lowered considerably within the final 12 months.

Supply: Glassnode

An expanded product portfolio may increase transactions on the DeFi platform. Surprisingly, Uniswap maintained wholesome community transaction ranges regardless of the bearish market situations this yr.

An indicator that it loved wholesome utility even because the market confronted bearish stress. Nevertheless, this indication of power and respectable exercise couldn’t protect UNI from the bearish reign.

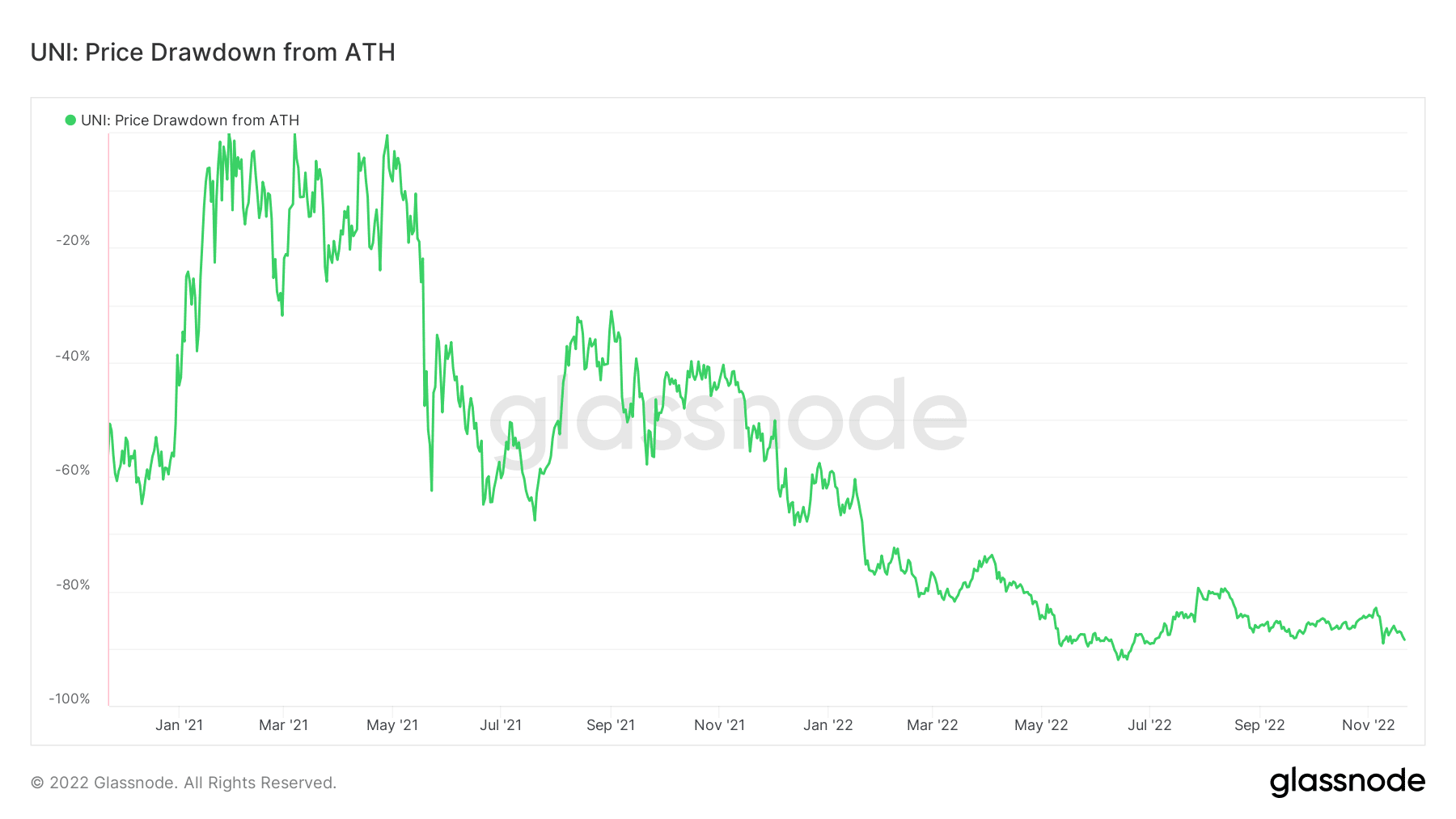

UNI continues to be closely drawn down from its ATH by as a lot as 87% at its present value stage. The promoting stress has been notably extra forgiving between June and November, versus earlier months in 2022.

Supply: Glassnode

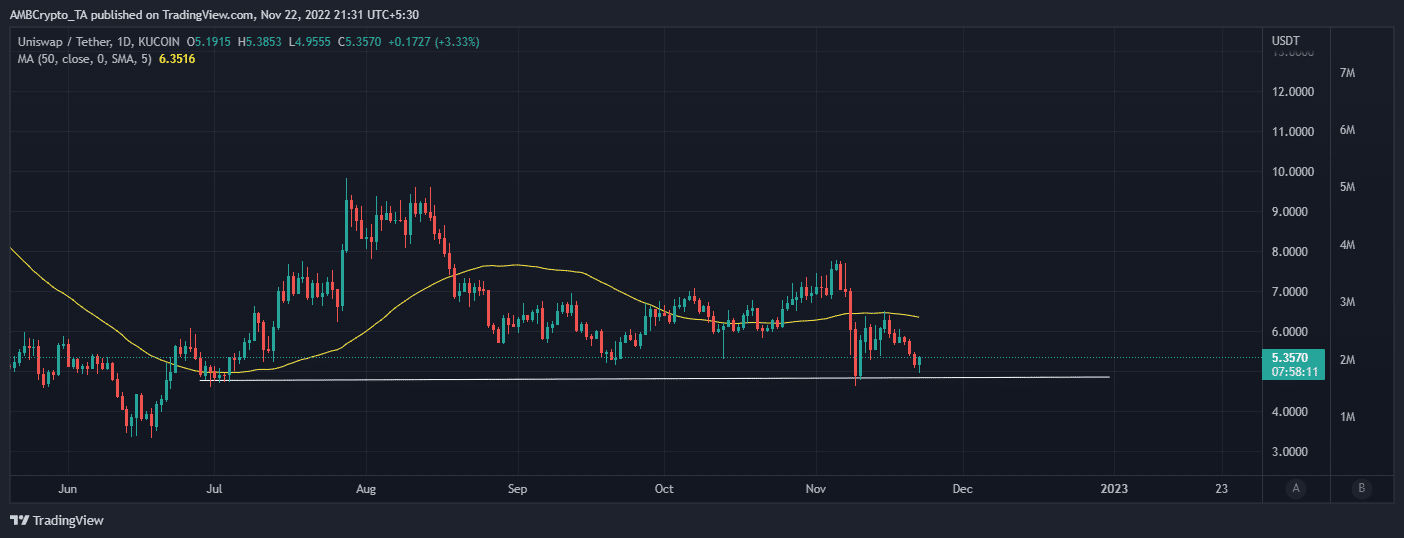

UNI skilled extra value slippage to this point this month, leading to a retest of a short-term assist stage throughout the $5 value vary. The worth tried to bounce off the identical assist stage within the second week of November however will it handle to do the identical this week?

Supply: TradingView

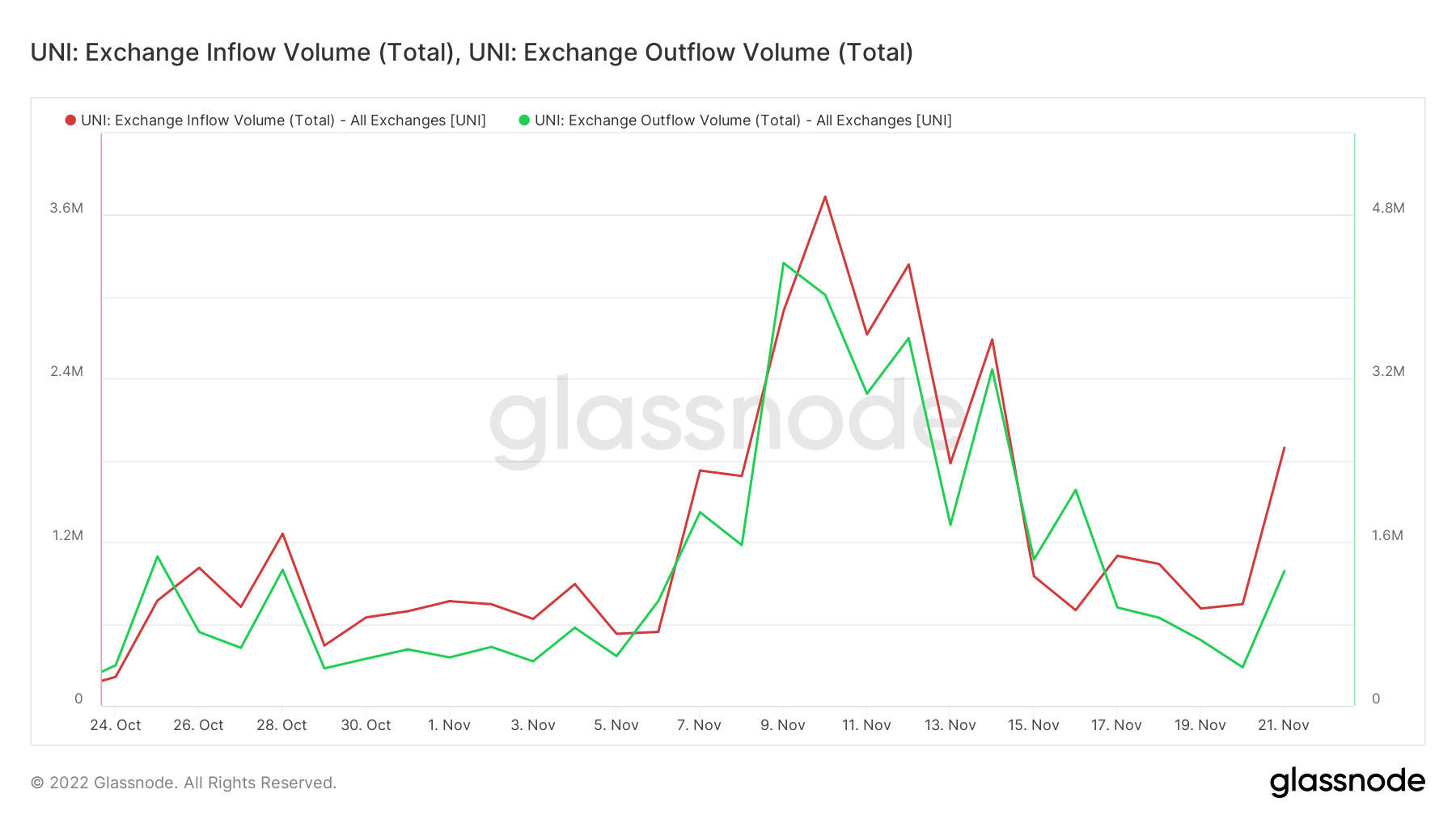

The draw back in the previous few days didn’t fairly push for a full retest of the identical assist. This implies there’s nonetheless an opportunity of extra draw back which might result in sub $5 value ranges. The potential for extra draw back is at present supported by greater trade inflows than outflows.

Supply: Glassnode

Though trade inflows at present outweigh outflows, it’s value noting that they’ve each elevated within the final two days. That is affirmation that traders’ sentiment is enhancing and that purchasing stress has resumed.

We might even see a short-term restoration within the second half of this week particularly if the shopping for quantity outweighs the promoting stress. That is assuming that there is not going to be one other black swan occasion to disrupt the recovering bullish sentiment.