The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- Till press time, the bulls had efficiently defended Uniswap’s $4.95 help degree.

- Nonetheless, long-term traders ought to wait some time earlier than making their subsequent transfer.

Uniswap [UNI] didn’t have a bullish bias on the time of writing. The bulls had valiantly defended the $5 help degree. It was a major degree from the psychological perspective as properly.

What number of UNIs are you able to get for $1?

For the reason that sellers had the higher hand, merchants may search for alternatives to comply with the bigger development. A transfer upward into the $5.3 area may provide one such alternative.

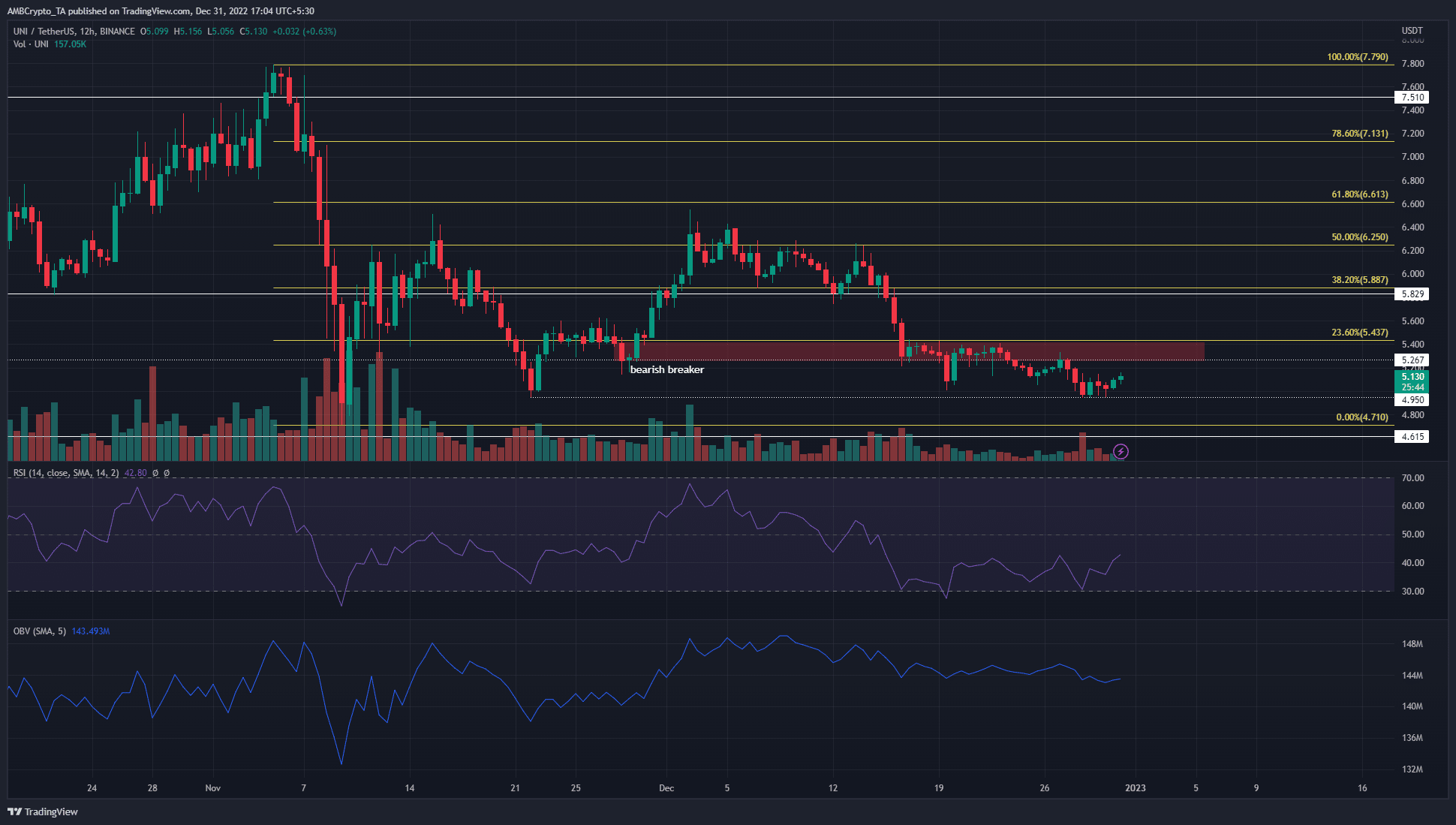

An H12 bearish breaker impedes progress, and shopping for stress can also be in decline

Supply: UNI/USDT on TradingView

The market construction on the 12-hour chart was firmly bearish for Uniswap. This confirmed that merchants can search for shorting alternatives. The previous 10 days have seen low quantity traded, however the On-Stability Quantity (OBV) confirmed that even then, the sellers have been the dominant power.

The OBV had shaped decrease highs prior to now three weeks. The Relative Power Index (RSI) was additionally shifting beneath the impartial 50 marks to indicate bearish situations. Nonetheless, with the RSI threatening to type larger highs with the worth forming decrease highs since 19 December, a bearish divergence may develop within the coming days.

This is able to reinforce the bearish stress behind UNI. It was already buying and selling beneath the 12-hour timeframe bearish breaker within the $5.26-$5.43 area (highlighted in crimson).

A retest of this zone may provide a great risk-to-reward shorting alternative. In the meantime, a session shut above $5.43 would point out that bulls can push towards the $5.82-$5.88 space.

A 80.66x hike on the playing cards if Uniswap hits Bitcoin’s market cap?

The Fibonacci retracement ranges (yellow) confirmed that till the $6.6 degree was damaged, the upper timeframe development would stay bearish. But, this doesn’t exclude minor strikes upward. Lengthy-term consumers can watch for a transfer again above $6.6 earlier than assessing the market as soon as extra.

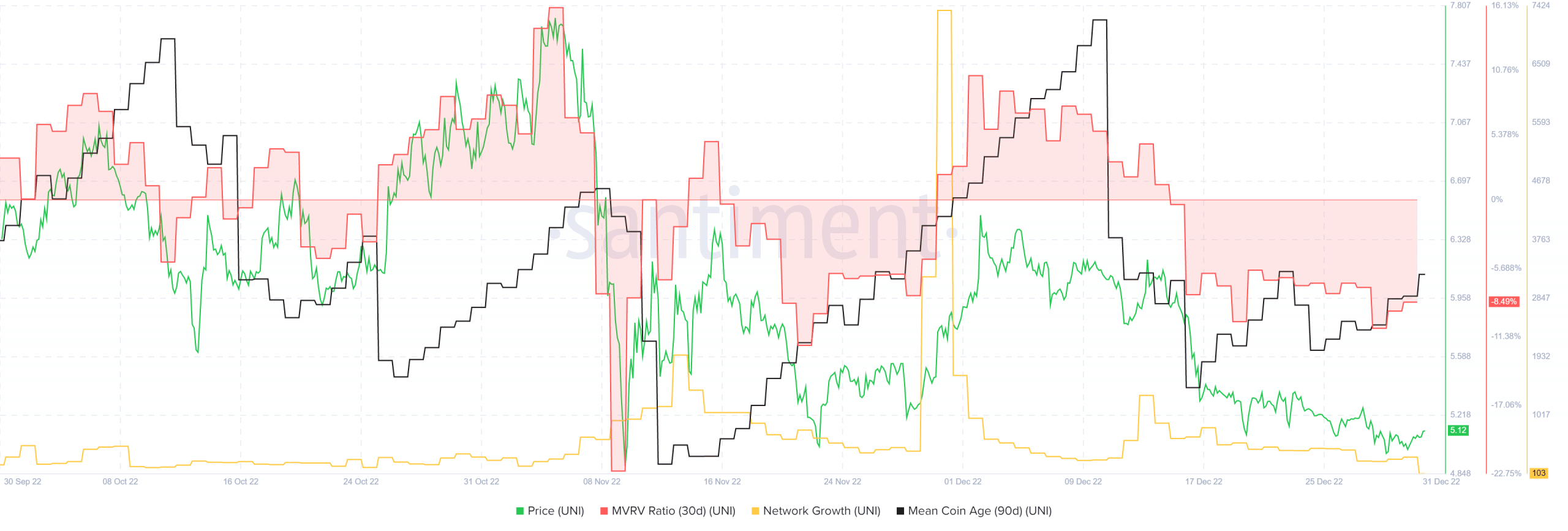

Imply coin age and MVRV ratio take a success to spotlight the power of the sellers

Santiment’s information confirmed that Uniswap’s community development was quiet all through the festive season. However, it remained larger than the expansion witnessed in October. The droop within the 30-day Market Worth to Realized Worth (MVRV) ratio meant that shorter timescale holders took revenue on the $6.3 mark. The asset was undervalued, in response to the MVRV metric, however it doesn’t warrant a purchase sign by itself.

The 90-day imply coin age additionally slumped through the wave of promoting earlier in December. This outlined a flurry of motion of the token between addresses, and will have been as a result of exercise of sellers. Up to now few days, regardless that the metric climbed, it didn’t present a gradual uptrend at press time. Accumulation within the subsequent week or two may precede a value rally.

![Uniswap [UNI] defends $4.95, but bulls are slowly losing ground. Here’s why…](https://ambcrypto.com/wp-content/uploads/2022/12/PP-2-UNI-cover-1000x600.jpg)