- Uniswap’s new cell pockets did not get clearance from Apple.

- Uniswap recorded a substantial drop in its buying and selling exercise since mid-February.

Uniswap [UNI], the biggest decentralized alternate (DEX), recorded a substantial fall in its buying and selling site visitors in February. Knowledge from Token Terminal highlighted that the buying and selling quantity tanked 46% since mid-February, whereas buying and selling charges nearly halved in the identical time interval.

Supply: Token Terminal

Sensible or not, right here’s UNI’s market cap in BTC’s phrases

To make issues worse, the Uniswap neighborhood had different unhealthy information to cope with.

Uniswap’s new providing faces a hurdle

Uniswap introduced the launch of a self-custodial cell pockets which is able to enable customers to swap tokens between Ethereum [ETH] mainnet and different layer-2 networks like Arbitrum [ARB], Optimism [OP] and Polygon [MATIC].

Uniswap added that the app can be accessible as a restricted early launch to 10,000 customers by way of the TestFlight beta platform as a result of Apple had rejected the ultimate construct of the product simply earlier than its deliberate December 2022 launch.

1/ Introducing the Uniswap cell pockets 🦄✨

A totally self-custodial, open-sourced cell app from probably the most trusted identify in DeFi.

Now accessible as a restricted early launch – by means of Apple TestFlight. pic.twitter.com/NmO8c0bXMs

— Uniswap Labs 🦄 (@Uniswap) March 3, 2023

So as to add to its woes, Uniswap recorded one of many greatest weekly drops within the complete worth locked (TVL) among the many prime DeFi protocols, information from DeFiLlama revealed. The TVL failed to point out a noticeable development in February.

Supply: DeFiLlama

Whales present ‘UNI’ty

UNI bought appreciable consideration from large addresses. Based on Whalestats, it was probably the most broadly held token by prime Ethereum whales on the time of writing.

Learn Uniswap’s [UNI] Value Prediction 2023-2024

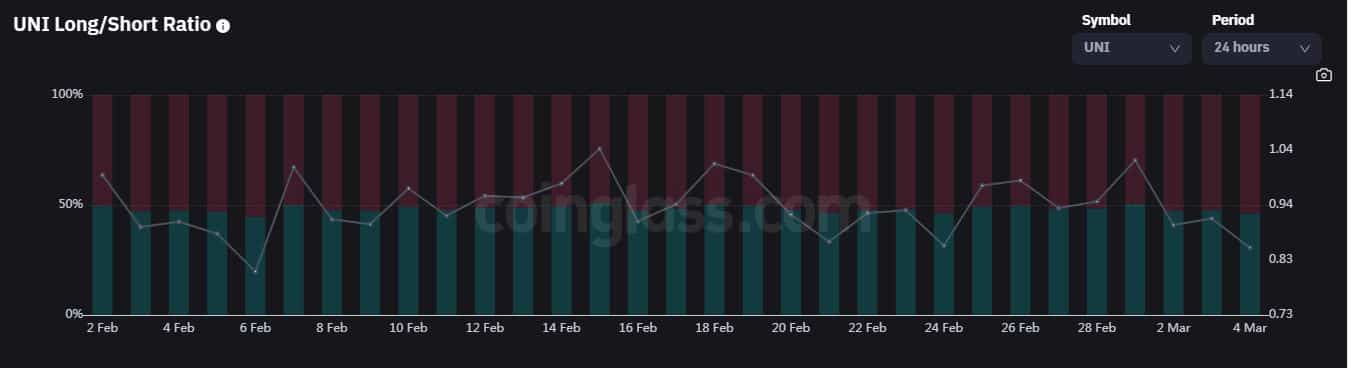

The whale accumulation, nevertheless, failed to enhance the token’s long-term prospects. Based on Coinglass, the variety of brief positions for UNI elevated significantly for the reason that begin of March.

This indicated that buyers had been cautious of UNI’s worth within the short-term. On the time of writing, it misplaced over 12% of its worth over the earlier month, information from CoinMarketCap confirmed.

Supply: Coinglass

![Uniswap [UNI] struggles to recover following multiple obstacles, more inside](https://ambcrypto.com/wp-content/uploads/2023/03/juliana-araujo-the-artist-l_EZkgghrg-unsplash-1000x600.jpg)