- Uniswap had the very best community penetration amongst main DEXes on Ethereum.

- UNI was probably the most extensively held token by high Ethereum whales, on the time of writing.

Uniswap [UNI], the most important decentralized change (DEX) by buying and selling quantity, made promising good points because the begin of 2023. In reality, the native token recorded a development of 44% on a year-to-date (YTD) foundation till mid-February, after which market uncertainties bought the higher of the coin.

Towards this backdrop, a blockchain analytics agency, Messari, said that Uniswap had the very best ‘community penetration’ amongst main DEXes on Ethereum [ETH].

Community penetration, which measures the variety of customers that interacted with a protocol out of its whole person rely, was 46% for Uniswap on the time of writing, nicely over different DEXes like Sushiswap [SUSHI] and Curve Finance [CRV].

1/ With elevated competitors throughout #ethereum, @optimismFND, & @arbitrum, can @Uniswap keep its dominance?

To measure market share and development potential, we analyze ‘community penetration’, which compares a selected protocols engaged customers to a community’s whole person rely.🧵 pic.twitter.com/26m9jZweDf

— Messari (@MessariCrypto) March 9, 2023

The evaluation additionally identified that regardless of the entry of extra opponents, Uniswap’s community penetration continued to extend and even eclipsed the person development on Ethereum from July 2020 to July 2021.

Learn Uniswap’s [UNI] Worth Prediction 2023-2024

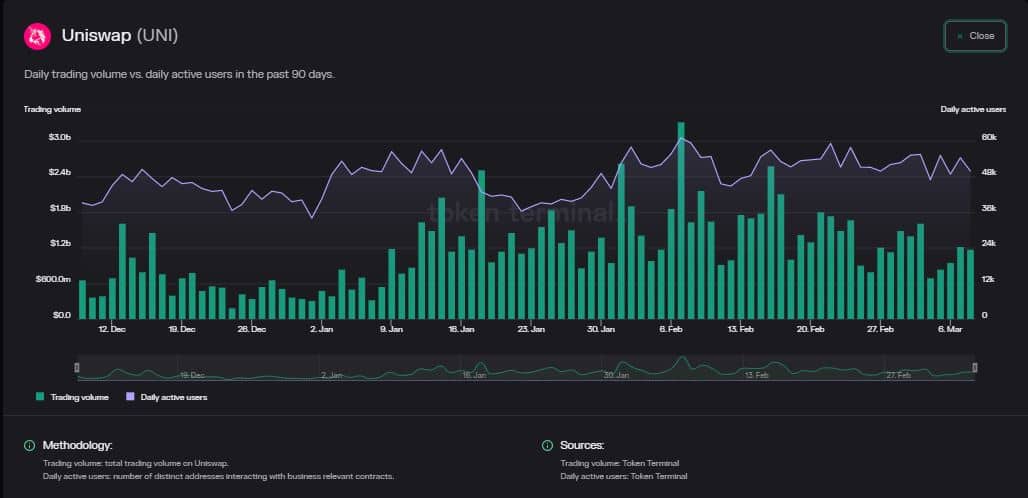

Buying and selling exercise slows down

Uniswap was the popular computerized market maker (AMM) after the FTX contagion as customers rushed in direction of DEXes to safe their funds. The beginning of 2023 noticed a pointy enhance within the buying and selling exercise on the protocol with the quantity reaching its peak in February.

Nonetheless, as regulator uncertainties and liquidity disaster got here again to chew the crypto markets, Uniswap too felt the pinch. Since mid-February, the buying and selling quantity halved till press time whereas the each day energetic customers fell by greater than 18%, as per Token Terminal.

Supply: Token Terminal

On the whole worth locked (TVL) entrance too, Uniswap confronted a decline. Within the final seven days, the TVL declined by almost 10%, which was among the many largest drops amongst main DEXes.

Supply: DeFiLlama

UNI stays the primary desire of Whales

However, as per user distribution trends throughout DEXes, Uniswap managed to retain the vast majority of completely different person segments, together with a retention price of 80% for whales.

This was backed up by knowledge from WhaleStats which confirmed that UNI was probably the most extensively held token by high Ethereum whales on the time of writing.

Lifelike or not, right here’s UNI’s market cap in BTC’s phrases

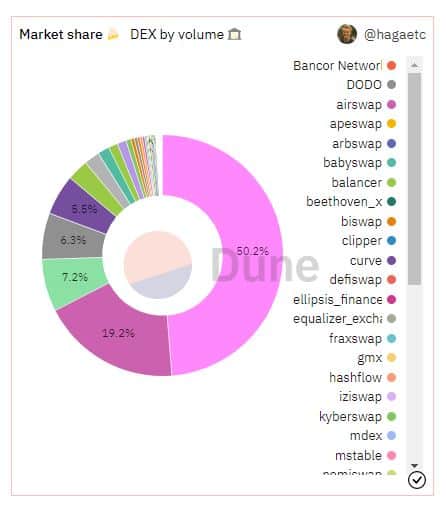

In line with Dune Analytics, Uniswap accounted for half of the whole DEX quantity within the final seven days at press time.

Within the final 24 hours, nevertheless, it misplaced its place to Sushiswap, which generated greater than $1.9 billion in quantity as in comparison with Uniswap’s $1.7 billion.

Supply: Dune Analytics

![Uniswap [UNI] surpasses SUSHI and CRV on this front](https://ambcrypto.com/wp-content/uploads/2023/03/Uniswap-1000x600.png)