- Uniswap [UNI] witnessed a spike in social mentions

- Its weighted sentiment metric additionally famous a surge

- Nevertheless, its community development and every day lively addresses declined

In accordance with new information offered by LunarCrush, a social media analytics agency, the social mentions of Uniswap reached an all-time excessive, because of the elevated curiosity in DEXes after the FTX collapse. However the pertinent query remains- Is there greater than meets the attention?

Learn Uniswap’s [UNI] Worth Prediction 2022-23

One thing price mentioning

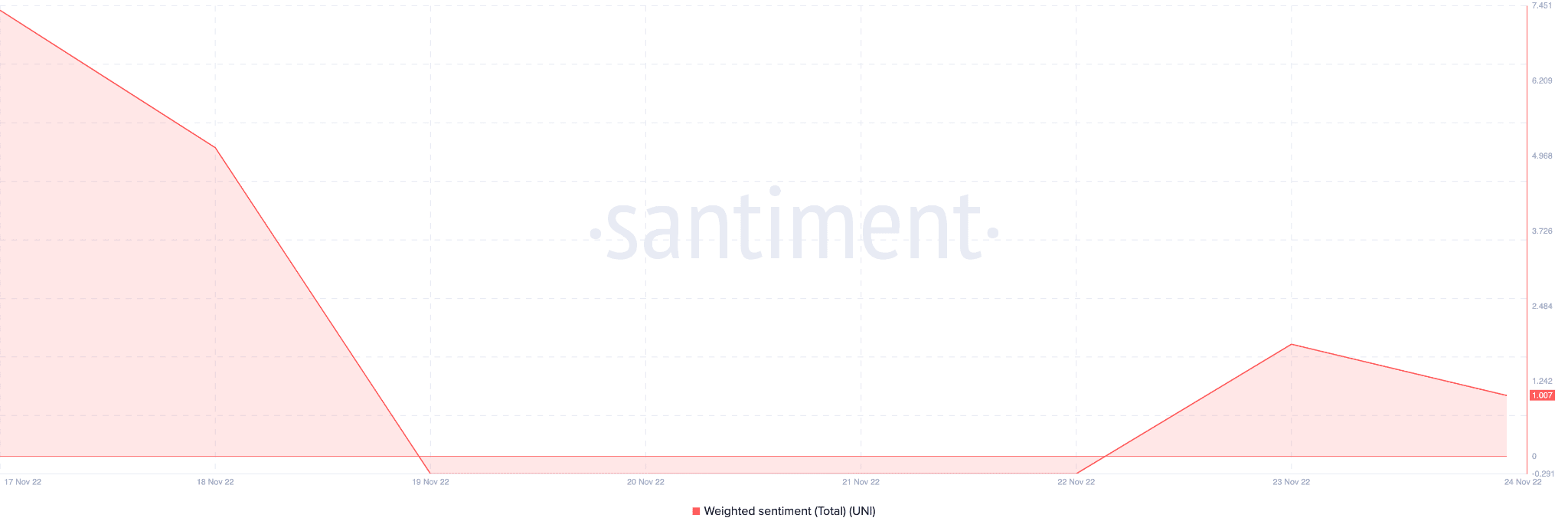

The spike in social mentions is also attributed to Uniswap’s newest developments within the NFT space. The weighted sentiment metric of Uniswap was constructive over the previous couple of days. And, the general outlook of the crypto neighborhood in direction of the DEX has been fairly favorable.

Supply: Santiment

Though Uniswap has been capable of capitalize on traders’ pursuits, there are different areas the place UNI wants to point out enchancment.

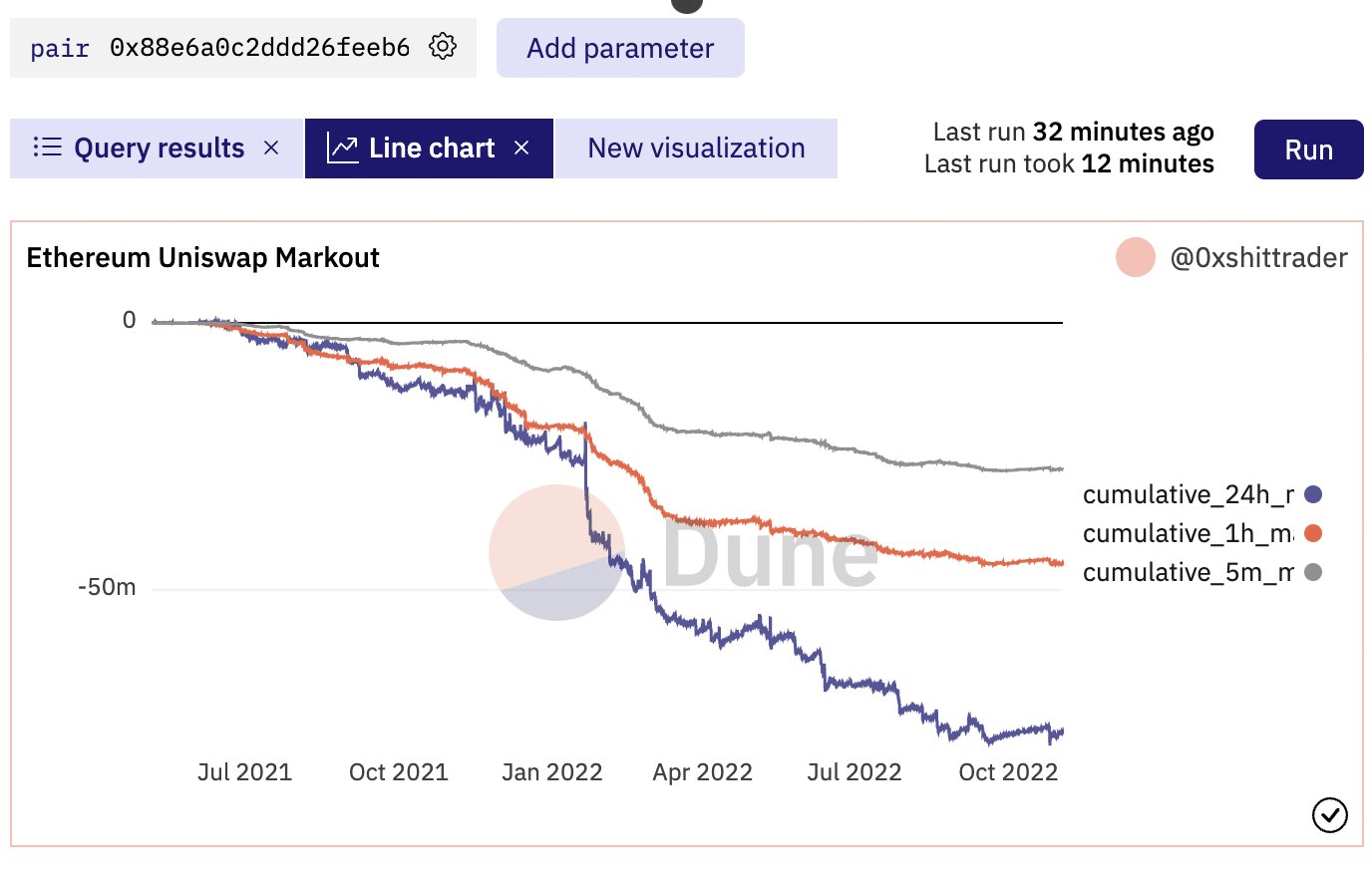

The chart beneath reveals excessive ranges of order circulation toxicity for Uniswap. Poisonous circulation refers to a state of affairs the place the worth of an asset market to the long run is worse than the worth of execution after contemplating charges and value affect.

This means that it might be tough for retail traders to generate substantial income from liquidity swimming pools on Uniswap.

Supply: Dune

Regardless of this, Uniswap‘s income elevated by 64.82% during the last 30 days, in keeping with information offered by Messari. Together with that, there was additionally development noticed by way of transactions, which grew by 66% throughout the identical time interval.

Uniswap metrics decline

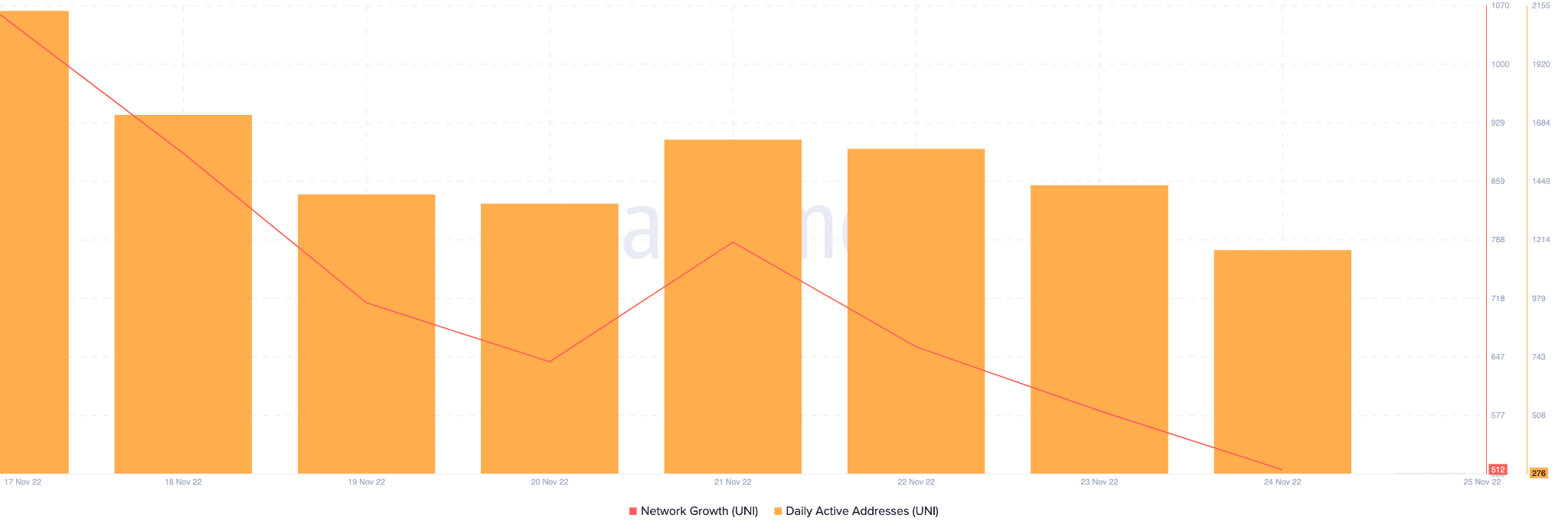

The DEX’s community development, nevertheless, continued to say no, indicating that new addresses making a transaction for the primary time had diminished during the last seven days.

Moreover, the every day lively addresses on the Uniswap community decreased, in keeping with the picture beneath. Thus, exercise on Uniswap additionally declined prior to now week.

Supply: Santiment

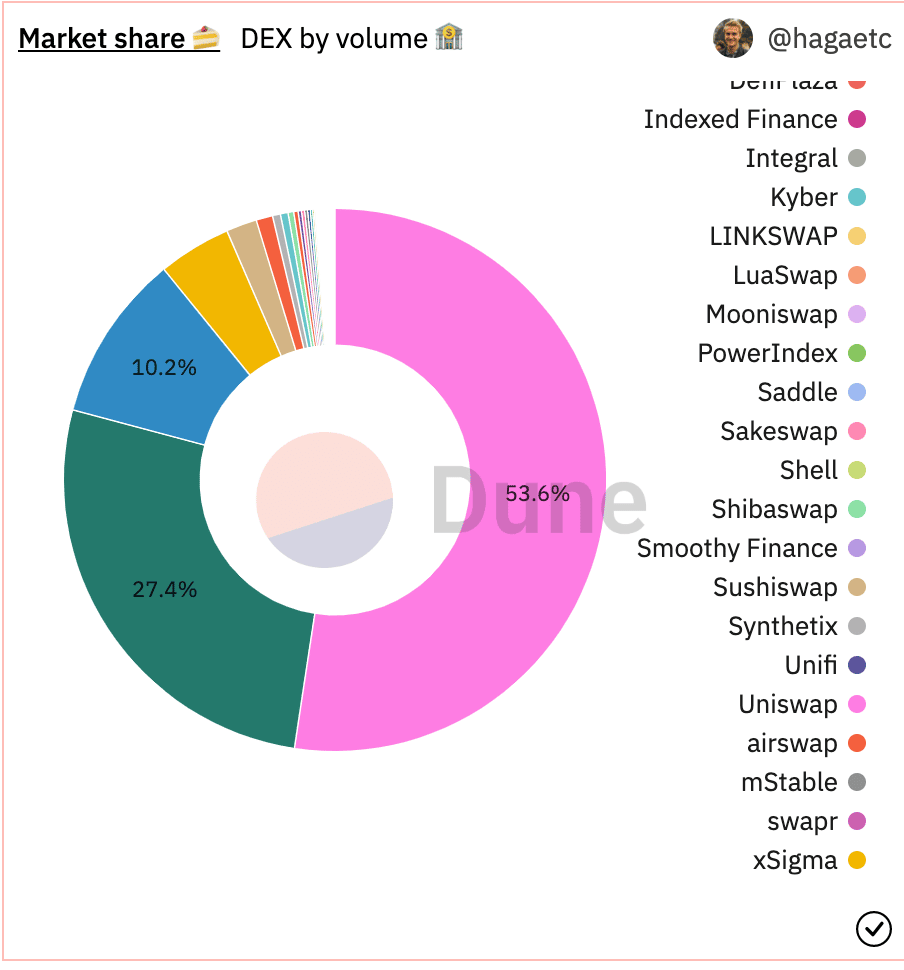

Regardless of this, Uniswap had the most important market share amongst all different decentralized exchanges. As may be seen from the picture beneath, UNI accounted for 53.6% of the general quantity of DEXes.

Supply: Dune

That stated, on the time of writing, UNI was buying and selling at $5.38. Its value had depreciated by 3.11% within the final 24 hours, in keeping with information offered by CoinMarketCap and that its quantity additionally fell by 34.32% throughout the identical interval.