Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- UNI chalked an ascending triangle with a possible bullish breakout.

- The altcoin recorded an uptick in open curiosity (OI) charges at press time.

Uniswap’s [UNI] rally in January provided 43% features to this point. It jumped from $4.963 to $7.109 by the point of publication. However extra features may very well be possible due to the underlying macroeconomics and fundamentals.

Learn Uniswap [UNI] Value Prediction 2023-24

At press time, the king coin, Bitcoin [BTC], threatened to shut above $23.5K on the decrease timeframe charts even earlier than the subsequent week’s official FOMC announcement. This underlies the constructive expectations from the assembly that would see BTC rally into February.

UNI shaped an ascending triangle: Is a bullish breakout possible?

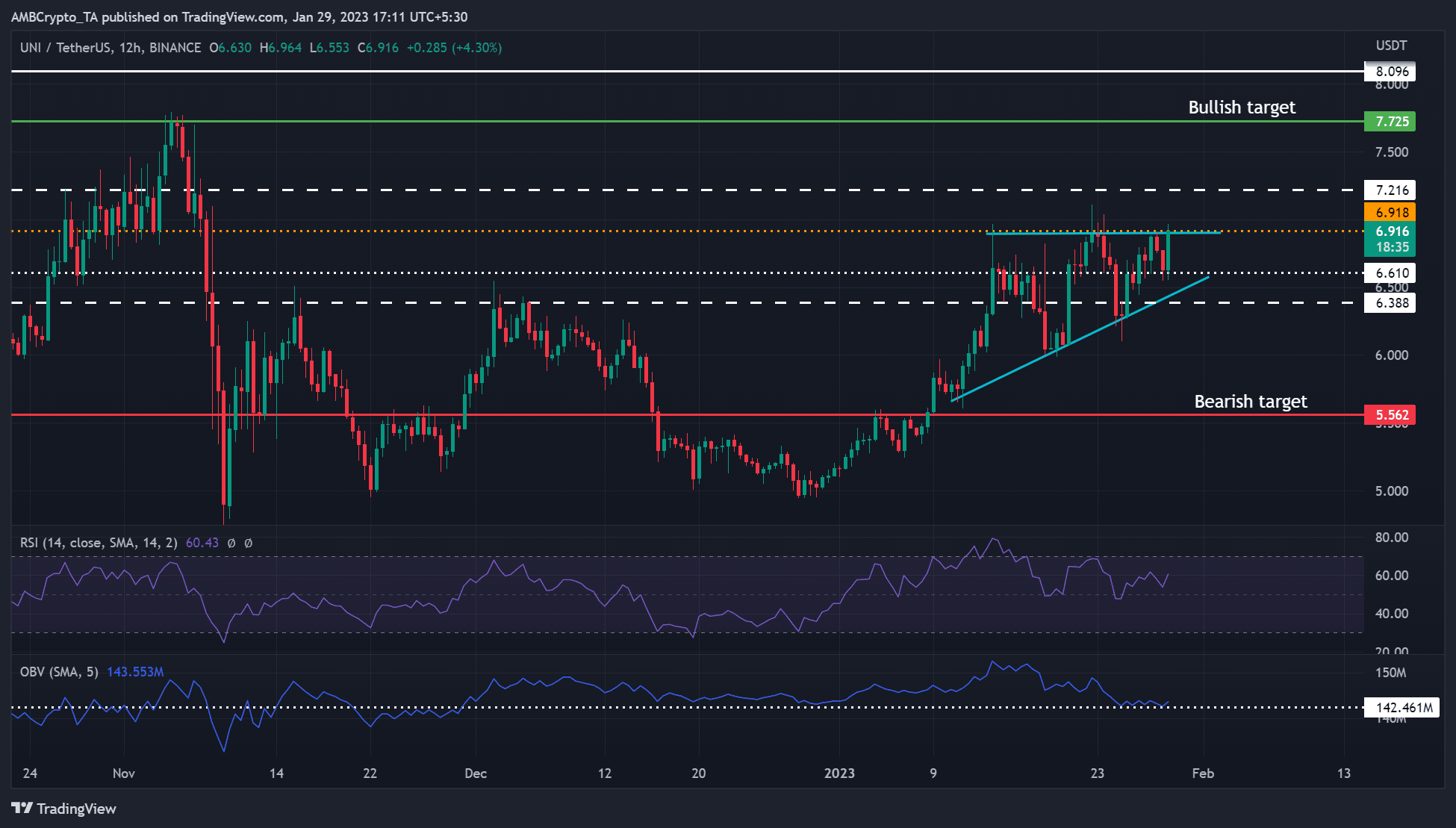

Supply: UNI/USDT on TradingView

Since January 10, UNI’s worth motion has chalked a bullish ascending triangle. The FOMC assembly and bullish BTC additional counsel a probable bullish breakout with $7.725 because the goal. The goal degree additionally acts as a pre-FTX degree; thus, UNI might achieve over 10% if the goal is reached.

Nonetheless, a bearish breakout would invalidate the above bias. Such devaluation might see UNI drop to the bearish goal of $5.562.

How a lot are 1,10,100 UNIs price at present?

UNI was extremely bullish on the 12-hour chart, with the Relative Power Index (RSI) valued at 60. Due to this fact, a bearish breakout may very well be extremely unlikely.

However, the low buying and selling volumes indicated by the On Stability Quantity (OBV) might delay the uptrend within the brief time period. However the volumes will choose up if BTC reclaims and surge above $23.5K.

UNI’s sentiment improved because the Open Rate of interest elevated

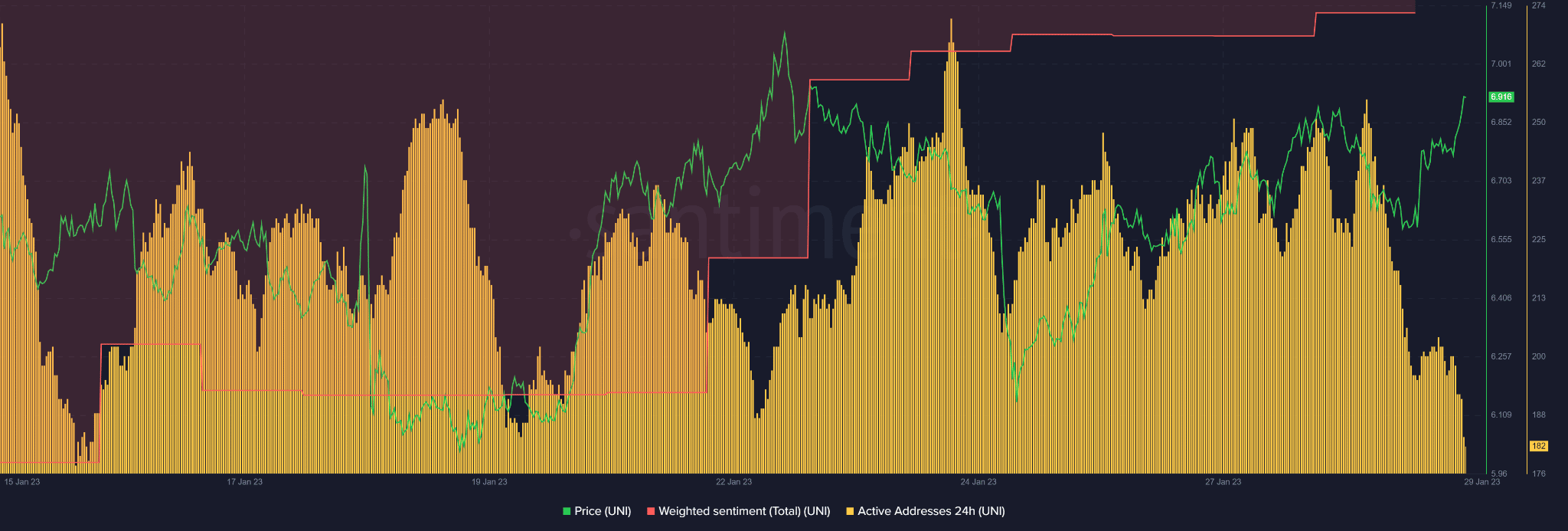

Supply: Santiment

As per Santiment knowledge, UNI’s weighted sentiment has retreated from the deep detrimental aspect and was near touching the impartial line. This exhibits traders’ outlook on the DEX asset has improved over the previous few days and will bolster its uptrend momentum.

Nonetheless, UNI’s energetic addresses have declined considerably by press time. However the variety of energetic addresses buying and selling the asset will change as BTC surges, boosting UNI’s buying and selling volumes and shopping for stress.

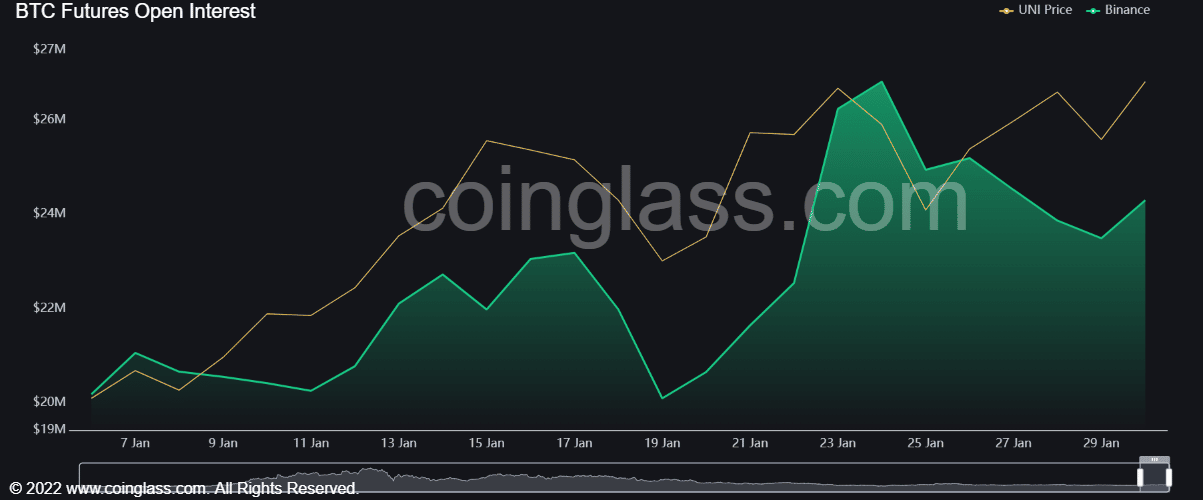

As well as, there was an uptick in open rates of interest at press time, exhibiting more cash was flowing into the UNI’s futures market.

The development exhibits a change in momentum as OI has declined over the previous few days. Due to this fact, the rising OI would additional increase UNI’s uptrend momentum.

Supply: Coinglass