Cryptocurrency analyst and dealer Tone Vays is detailing the long-term bull case for Bitcoin (BTC) after the flagship digital asset reached two-year lows triggered by FTX founder and crypto outcast Sam Bankman-Fried.

In a brand new video, Vays tells his 123,000 YouTube subscribers that even when Bitcoin falls to round $11,000, the most important crypto asset by market cap might nonetheless attain a brand new all-time excessive of $100,000 subsequent 12 months.

The veteran crypto dealer believes that his predicted Bitcoin collapse will probably appeal to consumers who plan to carry BTC for the lengthy haul.

“We will have a capitulation all the way down to $11,000 and nonetheless hit $100,000 subsequent 12 months. As a result of numerous Bitcoin is about to enter chilly storage as a result of folks can purchase it on a budget.”

Bitcoin is buying and selling at $16,886 at time of writing, up by about 8% from the two-year low of round $15,600 hit on Tuesday.

Vays says that if Bitcoin closes this week above the $18,500 assist stage, it might be a sign that the flagship crypto asset has bottomed out.

“If we shut the week above this assist stage [$18,500], I’m going to be considerably assured that the low may be in. Proper now, it seems very, very promising.”

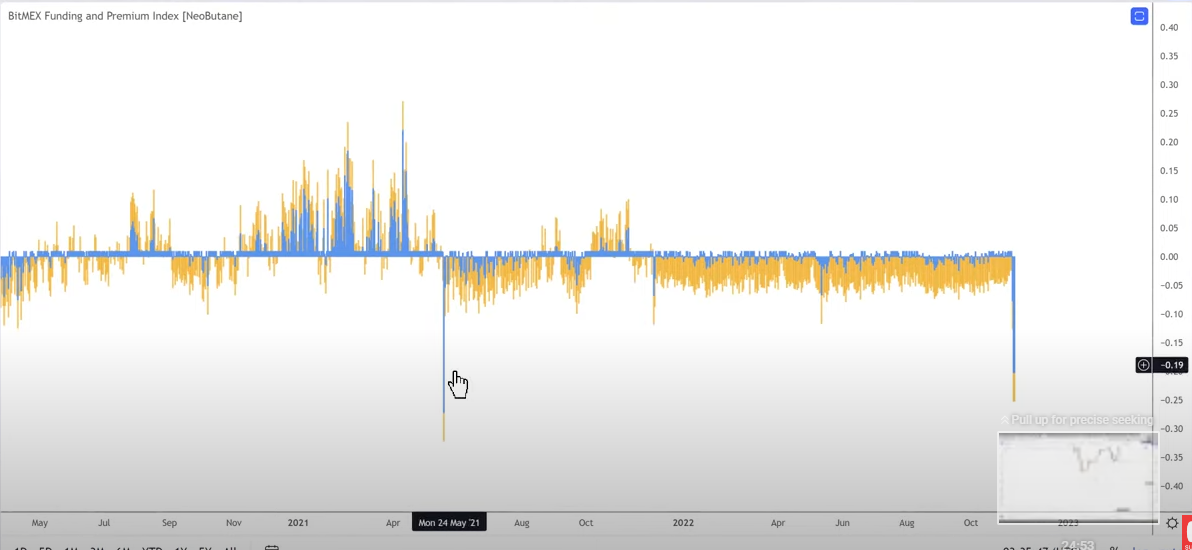

In keeping with the veteran dealer, the funding charges on crypto buying and selling platform BitMEX additionally point out {that a} backside might be in for Bitcoin primarily based on historic habits.

“That’s how markets are inclined to backside. Let’s have a look at the final time that BitMEX funding fee was this low. The final time the funding fee was this low was again in Could 2021. Let’s see what occurred in Could 2021. That was proper right here [$30,000]. Finally, off of that, we went to a brand new all-time excessive [of $69,000].

So I’ll take these odds. I’ll take the percentages that the low is in.”

Wanting on the dealer’s chart, it seems that funding charges are extraordinarily unfavourable, indicating that merchants are closely accumulating quick positions. The situation might probably arrange the crypto marketplace for a brief squeeze, the place merchants who borrow items of an asset at a sure worth in hopes of promoting them for a lower cost to pocket the distinction are pressured to purchase property again because the commerce strikes in opposition to their bias.

I

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Generated Picture: DALLE-2