- BNB worth fell, its buying and selling quantity hit month-to-month excessive, whales dumped BUSD after regulator’s 13 February determination.

- Merchants quick BNB as NFDFS shared purpose for earlier decision.

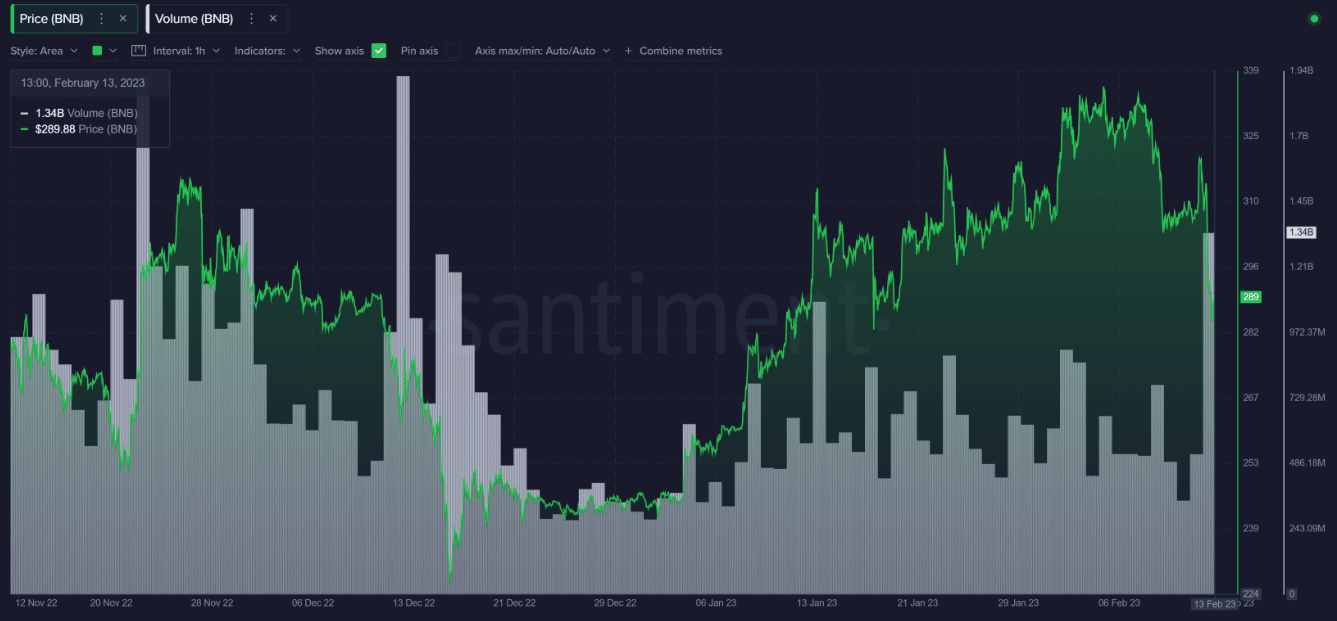

Binance Coin [BNB], the trade coin of the world’s largest cryptocurrency trade, felt the repercussions of the NYDFS’ determination to halt additional minting of Binance USD [BUSD]. In response to Santiment, it was virtually inevitable for BNB to be spared within the wake of the unfolding occasions. In its 13 February evaluation, the on-chain platform pointed out the BNB hit its highest buying and selling quantity since December 2022.

How a lot are 1,10,100 BNBs price immediately?

BNB: An affiliate to take the autumn

Ordinarily, the amount describes the quantity of transactions that move by a community inside an interval. The spike on this metric considers each transactions in losses and positive aspects. However the motion by traders would have principally resulted in taking accountability for dumping the asset.

Supply: Santiment

This was as a result of BNB, at press time, had misplaced 7.34% of its worth within the final 24 hours. A 108% improve throughout the identical interval, coupled with a ten.97% seven-day shred, would have absolutely left holders’ portfolios within the pink.

This situation signifies that BNB couldn’t curtail impending decline prefer it did when there was a huge FUD round Binance in December 2022.

As rightly confirmed by Binance’s CEO, CZ, on 13 February, BUSD’s market cap would proceed to lower due to the regulatory determination. Apparently, the autumn from its present seventh place may come quicker than anticipated.

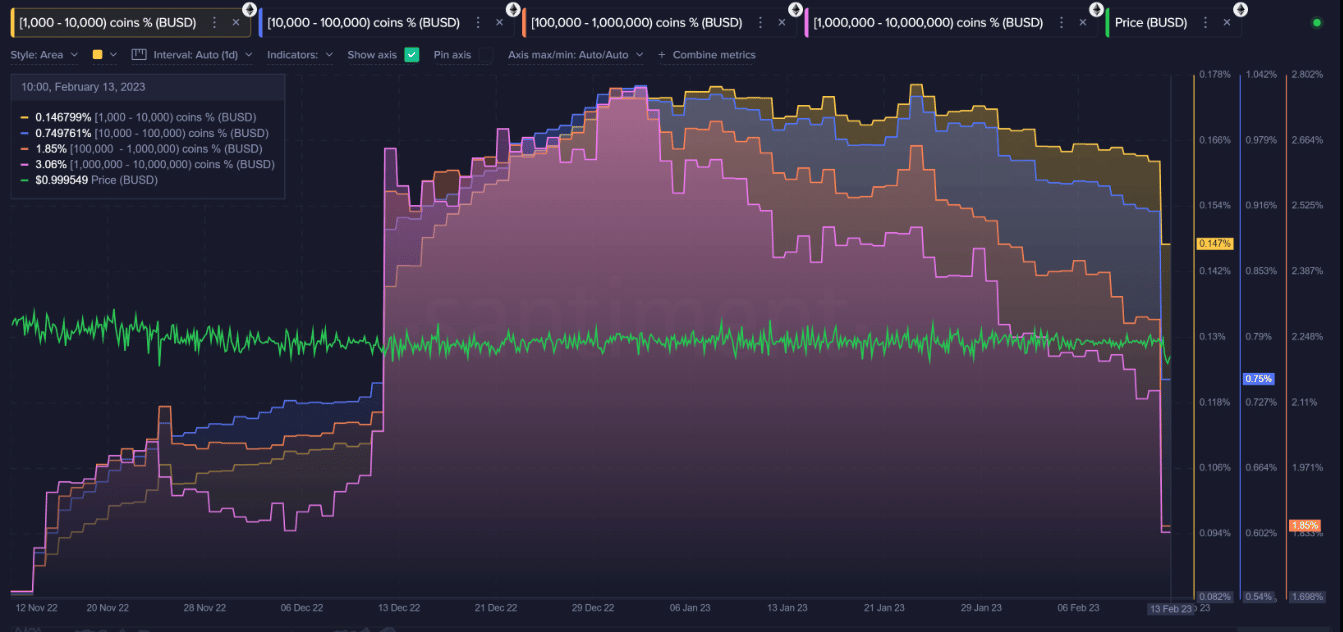

The rationale for this projection was due to the actions of whales and sharks. Primarily based on Santiment’s knowledge, addresses holding 1000 to 10000000 BUSD have collectively dumped over $200 million price of the stablecoin within the final 24 hours. BUSD’s projection to cease hovering across the $1 mark might have been important to the choice.

As anticipated, this has occurred with the likes of Tether [USDT], Circle [USDC], and DAI, all benefiting from immense accumulation.

Supply: Santiment

NYDFS presents readability as merchants go quick

Contemplating the backwards and forwards about NYDFS’ selections, the regulatory physique released its reasons for readability. In response to the memo, NYDFS admitted that Paxos had unresolved points. The regulator associated these points to the un-authorization of BUSD on every other blockchain besides Ethereum [ETH].

In the meantime, the physique additionally famous that it will monitor Paxos’ redemption because the agency ended its relationship with Binance. The discover learn:

“Paxos is required to redeem their Paxos-issued BUSD tokens for U.S. {dollars} by Paxos at a 1:1 trade fee pursuant to compliance protocols for patrons in good standing.”

Is your portfolio inexperienced? Take a look at the Binance Coin Revenue Calculator

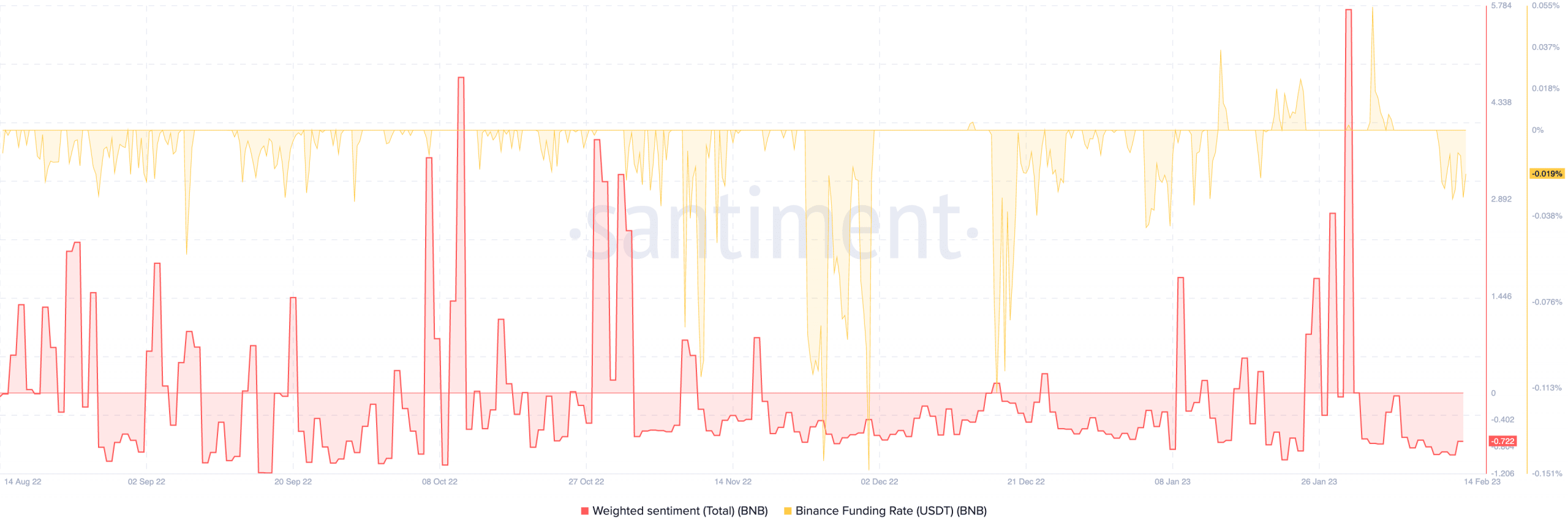

Following the event, the BNB funding fee had decreased. This implied that merchants have been less optimistic about positive aspects on the coin. Moreso, the weighted sentiment positioned at -0.0722 meant that the notion in direction of BNB was unfavourable and merchants have been principally shorting the coin.

Supply: Santiment

In conclusion, there was an opportunity that BNB might falter within the subsequent few days. Nevertheless, an finish to the FUD may prolong to stopping an extra lower.

![What BUSD’s fallout means for Binance Coin’s [BNB] future](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-14T081310.345-1000x600.png)