Blockchain

Proof-of-work (PoW) is a blockchain consensus mechanism that incentivizes community validation by rewarding miners for including computational energy and problem to the community. It’s a lottery system the place miners enhance their chance of receiving the reward the extra energy they add.

The consensus mechanism represents about 60% of the full crypto market capitalization.

The historical past of proof-of-work

The origin of proof-of-work could be traced again to 1993 when Cynthia Dwork and Moni Naor had been on the lookout for an answer to discourage e mail spam and DoS assaults. Their paper on pricing through processing outlined the fundamentals of proof-of-work.

In 1997, Adam Black built-in their thought into Hashcash. His algorithm made it tough for spammers to ship massive volumes of emails by requiring senders to incorporate a computationally costly string of characters within the e mail.

The answer to spam was basically growing the price to ship particular person emails. This experiment proved that you might use computational problem to signify the worth of one thing on-line. This impressed others to see if they may use the identical thought to make a digital illustration of money.

The thought made an look once more in Nick Szabo’s so-called ‘Principle of Collectibles’ and the paper “Shelling Out: The Origins of Cash.” In 2004, these concepts impressed Hal Finney to create a model of it known as reusable proof-of-work. And in 2009, Satoshi Nakamoto famously created the proof-of-work consensus mechanism for Bitcoin. It was the primary decentralized implementation that solved the double spending drawback and made bitcoin the primary profitable type of digital money.

What made proof-of-work completely different?

Earlier iterations earlier than Bitcoin failed as a result of they required centralized entities to stop the double spending of digital tokens.

Satoshi’s enhancements to proof-of-work used recreation idea to resolve this drawback. It made a solution to incentivize nameless volunteers known as miners to confirm the validity of all Bitcoin transactions – making certain that nobody is double-spending. This invention was the primary time a decentralized community of members might safe belief and not using a centralized middleman.

This gamification incentivizes community participation so nicely that nation-states corresponding to El Salvador use bitcoin as a reserve foreign money. However because the cryptocurrency presently employs roughly 99 terawatt hours of electrical energy per 12 months, many consider this development is unsustainable.

The “work” within the proof-of-work consensus mechanism is the supply of those unsustainability issues. To clarify, let’s first define the basics.

Learn Extra: The Newbie’s Information to Consensus Mechanisms

Proof-of-work (PoW) fundamentals

Sustaining the integrity and safety of all transactions within the community is the final word goal behind the proof-of-work consensus mechanism. Here’s a breakdown:

The work(ers)

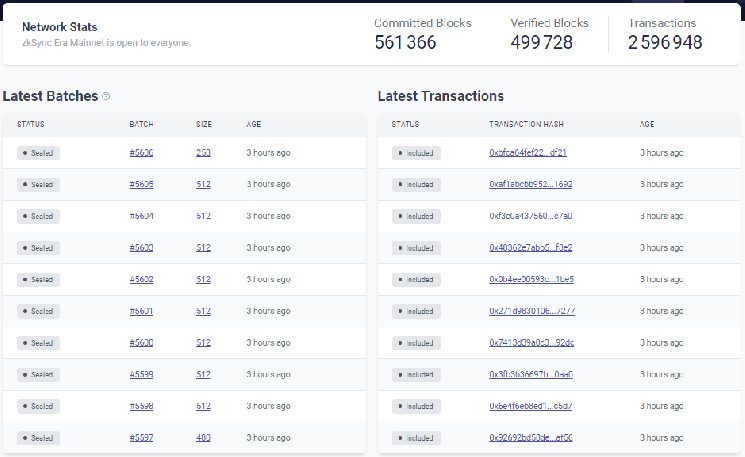

Proof-of-work blockchains are supported by a community of decentralized computer systems known as nodes. They’re tasked with two issues: accepting batches of transactions from different nodes and validating (or proposing) new blocks of transactions to the community.

These nodes are additionally known as miners as a result of they spend computing energy and sources in return for the community’s underlying cryptocurrency.

The “work” in proof-of-work is the computational energy nodes need to contribute in validating a brand new block of transactions. This energy is represented by the SHA-256 cryptographic hash perform, and it units this consensus mechanisms other than its counterparts.

An algorithm known as the problem adjustment ensures that it’s going to take all the community a set set of time to validate new blocks of transactions. The problem adjustment happens roughly each 2,016 blocks (about as soon as each two weeks) to take care of the goal block time of 10 minutes. Miners coming and going from the community on a person foundation do nothing to have an effect on problem stage minute to minute, or everyday.

Miners win the reward once they guess a hash that falls under the edge offered by the community. As soon as a miner finds the legitimate block hash, it broadcasts this info to different miners who can rapidly validate and add the brand new block to their blockchain copies. This validation course of eliminates the potential of miners together with malicious transactions, corresponding to an try by a person to double-spend cash.

The reward

There’s an encoded rule relating to the quantity paid to the miner who completes the proof-of-work. On the time of writing, miners earn a set 6.25 BTC per block, plus any person transaction charges. This reward potential incentivizes miners to compete within the proof-of-work and stay sincere, as any try to cheat the system would waste sources.

The reward quantity is about to half each 210,000 blocks (roughly 4 years). This deflation charge is known as the halving cycle. Many worry that if bitcoin’s value fails to maintain tempo, miners will lose the motivation to take part. However as miners disconnect from the community, the problem stage drops accordingly. This balancing act makes the price to mine bitcoin drop as nicely.

The economics of bitcoin mining although should not straight ahead. There are numerous financing elements that drive miners to remain on-line even when they’re unprofitable.

Learn extra: Is Bitcoin Mining Nonetheless Worthwhile? The Economics Defined

The distinction between proof-of-work and proof-of-stake

The primary distinction between proof-of-work and proof-of-stake is the problem requirement. In proof-of-stake, validating nodes compete for blocks by locking or delegating extra of the community’s token to the community. This requires much less vitality however could make the entry barrier dearer.

A proof-of-work consensus mannequin is used extra for cryptocurrency networks centered on fee and financial use circumstances. Different blockchains, corresponding to Ethereum, Cardano and Solana, deal with powering decentralized purposes and make the most of the proof-of-stake (PoS) mannequin.

Learn Extra: Proof-of-work vs. Proof-of-Stake

Proof-of-work examples

Greater than 60% of the cryptocurrency market capitalization makes use of proof-of-work algorithms. Nonetheless, probably the most priceless networks implementing the consensus mannequin are as follows:

- Bitcoin: The community is the world’s most safe and decentralized PoW system. Bitcoin’s success has primarily been attributed to Satoshi’s ingenious PoW engineering, which past safety, gives sustainable economics for community members.

- Litecoin: Litecoin launched in 2011 as a Bitcoin fork, copying elements of the legacy community, corresponding to its PoW consensus mannequin. Litecoin is commonly known as the silver to Bitcoin’s gold and stays among the many high crypto property by market worth.

- Dogecoin: Meme-inspired cryptocurrency Dogecoin launched in 2013, implementing a PoW know-how with roots traceable to Litecoin. Dogecoin and Litecoin allow sooner transactions however are typically much less safe than Bitcoin.

- Monero: Monero is a privacy-focused cryptocurrency that implements a proof-of-work algorithm. Its distinctive options, together with ring signatures and stealth addresses, make it tough to hint transactions on the blockchain. Monero’s proof-of-work algorithm is designed to be ASIC-resistant, that means it’s extra accessible to particular person miners somewhat than massive mining operations.

- Bitcoin Money: Bitcoin Money is a cryptocurrency that was created in 2017 because of a tough fork from the Bitcoin blockchain. It makes use of a proof-of-work consensus algorithm, much like Bitcoin. Bitcoin Money goals to enhance on the scalability and transaction pace of Bitcoin by growing the block measurement restrict to 32 MB. Nonetheless, it has confronted criticism for centralization as a result of dominance of some mining swimming pools in its community.

How proof-of-work works

Bitcoin mining by proof-of-work works equally to purchasing lottery tickets with a prize draw each 10 minutes. Anybody can take part by buying a Bitcoin mining machine and plugging it into the community. Though everybody has the identical odds of being drawn, shopping for extra tickets will increase the statistical chance of profitable the lottery.

Within the above instance, the lottery tickets signify the hash charge deployed, whereas the prize is the BTC reward paid for efficiently making a Bitcoin block. Hash charge is the variety of hashes per second mining tools can perform to search out the above-noted cryptographic hash perform. The extra environment friendly a mining gadget is, the upper possibilities a miner has of profitable the block rewards. For example, An S19j Professional machine can carry out 104 terahashes per second (TH/s), the equal of 104 trillion guesses or tickets per second.

In the meantime, customers can be a part of mining swimming pools; akin to workplace swimming pools or syndicates. Becoming a member of the pool voluntarily would enhance their probabilities of profitable the lottery, in contrast to solo mining, the place the chances of profitable a Bitcoin block right now are extraordinarily uncommon.

Nonetheless, each win on a public mining pool is cut up among the many members in proportion to their hashrate. Mining pool members should not obligated to stay within the pool. Many criticize swimming pools for being a centralizing drive within the community. However particular person members present a counterweight to that centralization. They’ll go away the pool or syndicate and achieve this very simply, a characteristic that turns out to be useful if the pool makes an attempt to turn into dishonest.

Just like the lottery, the foundations of participation and potential rewards are encoded within the Bitcoin software program. Anybody can confirm these guidelines and conform to play by them in the event that they select to arrange a Bitcoin mining operation.

Proof-of-work and mining

Proof-of-work is carefully intertwined with mining. PoW defines the precise course of by which miners present friends that they’ve carried out the required computation by producing a hash that matches the goal for the block. Then again, mining focuses on including a brand new block to the blockchain and receiving the related coin rewards.

Contemplating how Bitcoin transactions are processed gives a transparent perception into the connection between PoW and mining. All person transactions on the Bitcoin community find yourself in a reminiscence pool (mempool) from which miners choose transactions so as to add to the subsequent Bitcoin block. Each miner enters the race to create a brand new block for the Bitcoin blockchain, choosing a number of transactions from the mempool and bundling them right into a candidate block.

Nonetheless, earlier than a candidate block turns into accepted as legitimate, the miner should carry out computations that generate a hash under the goal set by the Bitcoin proof-of-work algorithm. The primary miner to provide an identical hash for his or her candidate block broadcasts it to different miners, who can simply confirm and validate its addition to the blockchain report.

The profitable miner receives the block rewards and related transaction charges, having added a brand new legitimate block to the blockchain. Thus, the Bitcoin blockchain top grows whereas the race for mining the subsequent block begins.

Why is proof-of-work vital?

The proof-of-work algorithm is significant for a number of causes. Essentially the most compelling is that it gives a safe and decentralized mechanism for community members to take care of the integrity of the blockchain ledger. PoW incentivizes miners worldwide to expend computing energy to validate blocks, thus filling the function often performed by a central entity corresponding to a financial institution.

One other main good thing about a PoW is that it regulates the creation of latest cash. In Bitcoin’s case, the algorithm features a mining problem adjustment that stabilizes the speed miners can produce new blocks. Bitcoin’s code specifies a goal of 10 minutes per block, with the algorithm designed to extend the problem of discovering a brand new block hash if the hash charge grows to some extent the place miners produce blocks sooner than the common.

With out the PoW-linked mining problem adjustment, miners can drain the BTC provide sooner than required for a sustainable economic system. Furthermore, because the community’s hashrate on a PoW chain grows, it turns into impractical for a foul actor to assault the system.

A Braiins examine places the conservative value of attacking the Bitcoin community by bodily hashrate at $5.5 billion. Nonetheless, such an operation is impractical to execute in the actual world as a result of the price assault outweighs any perceived advantages. Apart from that, a potential attacker can instantly obtain rewards for performing actually and contributing hash energy to Bitcoin.

Benefits and drawbacks

Being the earliest consensus mannequin for blockchains, the professionals and cons of proof-of-work methods have solely turn into evident because the trade matures. Regardless of newer improvements, PoW stays probably the most confirmed, time-tested methodology for reaching consensus on a public blockchain.

Issues with proof-of-work

Power utilization

Essentially the most prevalent criticism of proof-of-work is that it wastes vitality. A number of analysis estimates that Bitcoin makes use of extra vitality than a number of midsized international locations corresponding to Norway and Argentina. Nonetheless, different findings assume that the Bitcoin community considerably contributes to local weather change and can proceed to take action as adoption grows.

Nonetheless, proof factors on the contrary relating to the influence of Bitcoin and its novel proof-of-work system. The Bitcoin community consumes considerably much less vitality than present financial methods and different main industries, together with gold mining and monetary sectors.

Supply: Bitcoin Mining Council

One other very important level to contemplate is that vitality being the one variable in Bitcoin mining, incentivizes miners to hunt out the most cost effective strategies, corresponding to renewable sources. Over time, miners are adopting these cost-friendly vitality channels to maximise income. Trade estimates reveal that almost 59% of bitcoin mining makes use of environment-friendly vitality sources, a lot greater than different sectors and international locations.

Moreover, Bitcoin’s PoW know-how permits people and organizations to faucet into the vitality that will in any other case be wasted. That is very true for energy generated in places corresponding to oil drilling websites producing flare gasoline, agricultural areas harnessing biomass vitality or jurisdictions the place it’s impracticable to move such vitality. The portability of Bitcoin mining machines permits miners to monetize such energy and supply financial worth to the native communities.

Scalability

One other widespread criticism in opposition to PoW methods corresponding to Bitcoin is that they don’t scale as effectively as newer consensus fashions. Bitcoin advocates argue that Bitcoin’s distinctive positioning as a worldwide financial system means the delayed affirmation time contributes immensely to the community’s safety. PoW methods are optimized for safety and scale on secondary layers such because the Lightning Community implementations on Bitcoin and Litecoin.

Centralization

Lastly, critics additionally argue that proof-of-work consensus algorithms have turn into extra centralized over time. The growing value to entry and computing problem has consolidated community consensus choices round a handful of main mining swimming pools.

These swimming pools largely management the consensus choices of the community as a result of they collectively have extra hashing energy than particular person miners. However loads of this energy is contingent that the swimming pools act in good religion — as contributors can exit the pool at any time.

For instance, Bitmain, one of many largest producers of cryptocurrency mining {hardware}, managed a number of mining swimming pools that had greater than 43% of the hashing energy in 2018. With a couple of strategic strikes, Bitmain might have been in a position to execute a double spend assault. The harm that will have had on the community and their status in all probability prevented them from executing the assault.

What this implies for traders

Opposite to the mainstream notion that PoW methods are dangerous to the setting, the Bitcoin mining trade’s push towards renewable vitality sources reveals that the know-how might not have the influence they assume. Advocates even argue that Bitcoin has the potential to be a web optimistic to the planet.

Tying the Bitcoin community’s safety to a tangible real-world asset like vitality makes the community extra strong, particularly at optimum hash charge. It additionally lets traders get publicity to the underlying BTC asset by mining shares corresponding to Riot Blockchain, Hive, Marathon Digital, and Hut8. Moreover, whereas different sooner and extra revolutionary consensus fashions have emerged in recent times, the underlying networks are likely to turn into more and more centralized.

Being a time-tested mannequin for securing public blockchains implies that PoW will possible proceed to play a key function because the trade onboards extra mainstream audiences. Fairly than supersede the legacy consensus mannequin, newer methods spotlight the distinctive properties of PoW and make it extra engaging to traders that prioritize safety and censorship resistance.

The way forward for proof-of-work

Proof-of-work launched the world to blockchains. Miners compete in a endless race to provide new blocks and accumulate related rewards, thus making it more and more tough for unhealthy actors to compromise the community. The novel consensus mechanism gives unparalleled safety by incentivizing using computing energy to guard the integrity of the underlying ledger.

The PoW consensus algorithm goals to supply a secure economic system by regulating the coin’s issuance utilizing the problem adjustment implementation. The coin’s provide is distributed extra effectively as miners can not robotically increase their holdings or stake on the community by accumulating extra tokens.

The legacy consensus mannequin continues to energy the biggest market share of public blockchains and can possible all the time stay probably the most safe choice for establishing consensus amongst decentralized networks.