- Uniswap experiences a sudden drop in community quantity because the bulls take a breather.

- Assessing UNI’s newest demand, the place it’s headed, and what to anticipate.

Now that the crypto market has delivered an general bullish efficiency up to now this yr, you will need to assess the demand sources. Spot and derivatives demand has been fairly energetic however extra importantly, the DeFi phase has additionally carried out fairly properly.

Uniswap, one of many largest DeFi platforms internationally, skilled wholesome exercise amid the market restoration. Nonetheless, some observations could point out {that a} sizable change is about to happen.

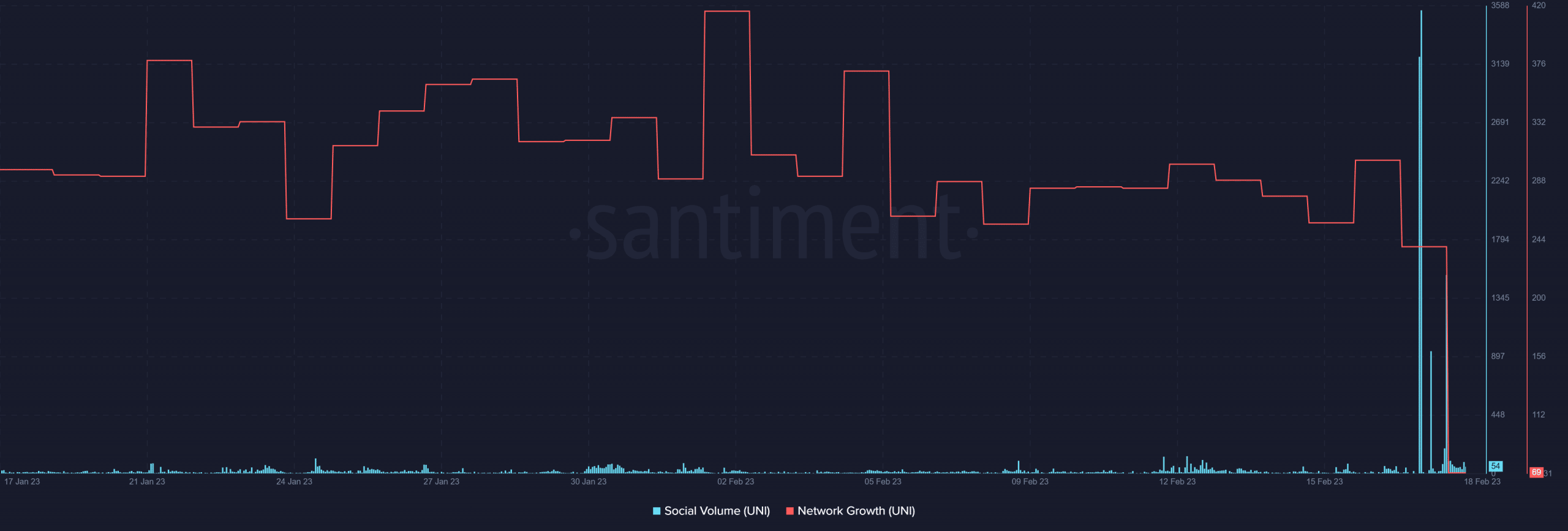

For instance, Uniswap’s community progress simply dropped out of its common 4-week vary and is now at its lowest stage seen in the identical interval.

The above commentary would possibly provide some insights into the present market situations, and therefore the demand for Uniswap.

Most high cryptocurrencies traded on the DeFi platform skilled a surge in demand in the previous few days. Nonetheless, the demand is now slowing down, because the market anticipates the following transfer.

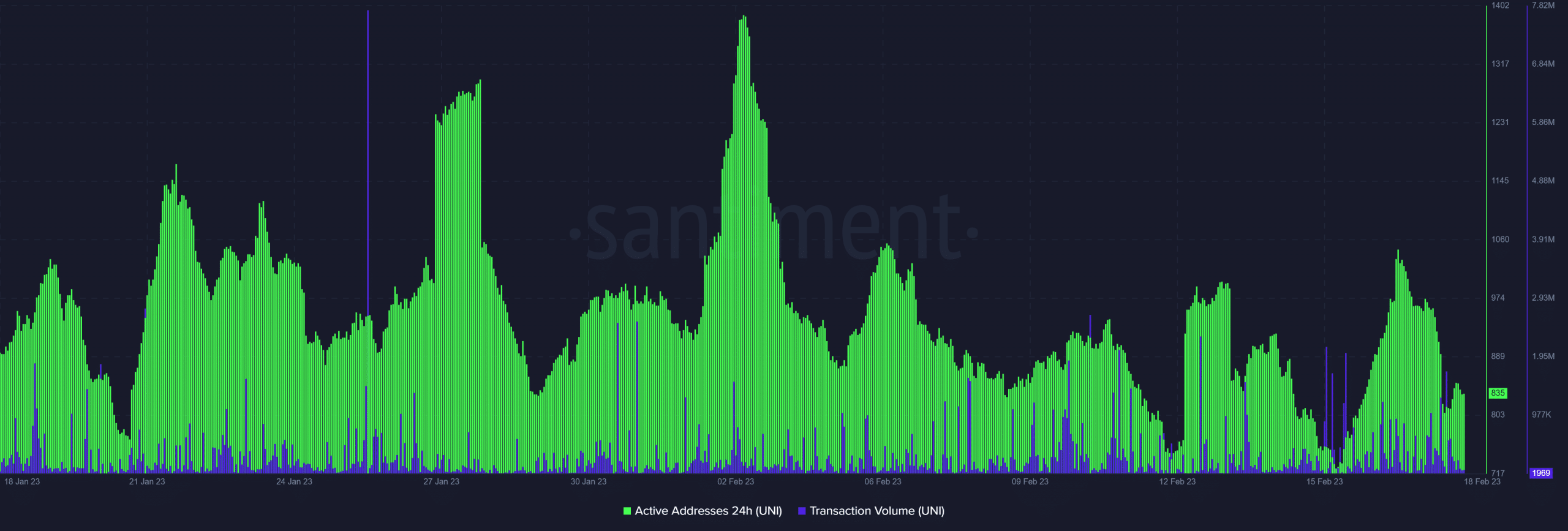

The result displays the drop in transaction quantity noticed within the final 24 hours. That is extra clearly mirrored within the each day energetic addresses which additionally dropped considerably throughout the identical interval.

Supply: Santiment

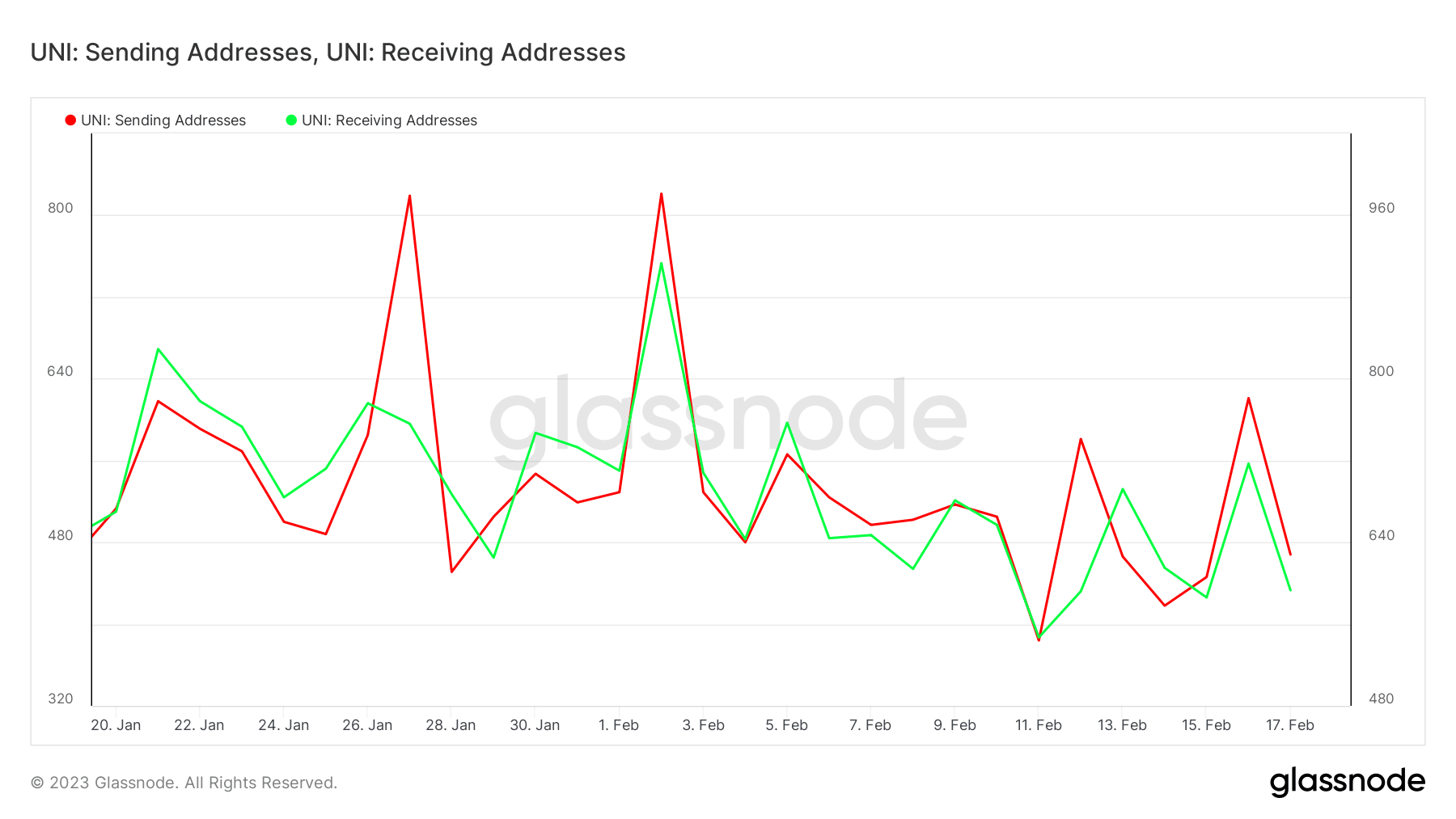

The aforementioned drop in community exercise is mirrored in handle exercise on the community. Each the sending and receiving addresses declined since 16 February, confirming the decrease buying and selling exercise.

Regardless of this, the variety of receiving addresses remained barely greater than sending addresses.

Supply: Glassnode

Oscillations within the handle flows are fairly frequent and don’t essentially counsel a pivot. Nonetheless, they might be aligned with such a market end result, particularly at resistance zones.

What concerning the demand for the UNI token?

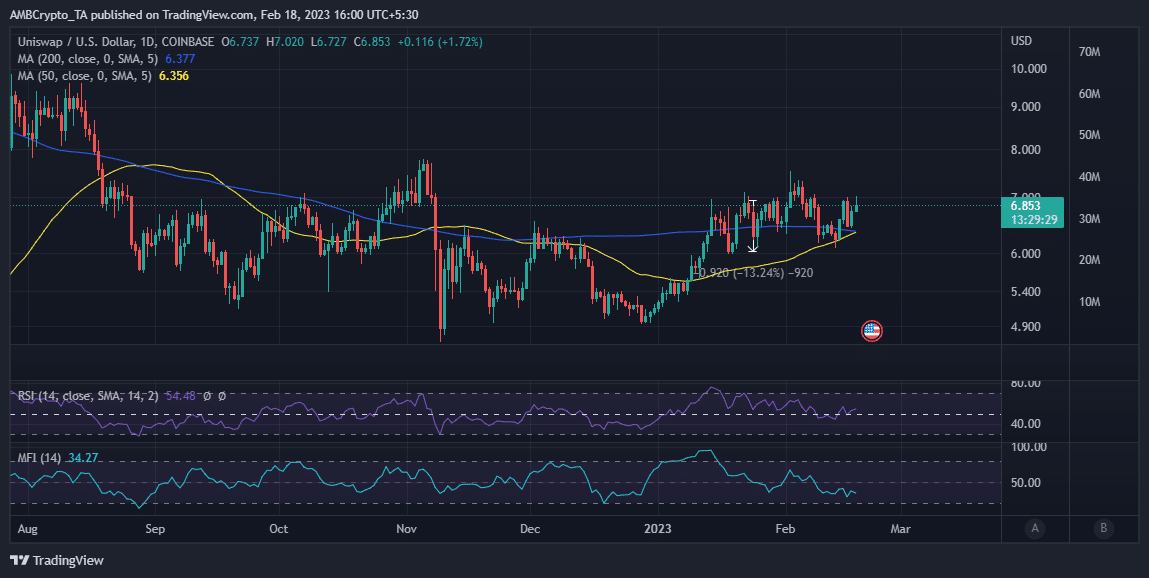

UNI has been caught in a zigzag worth sample since mid-January and has delivered an general bullish efficiency within the final seven days. This displays an try to beat the RSI mid-range.

Supply: TradingView

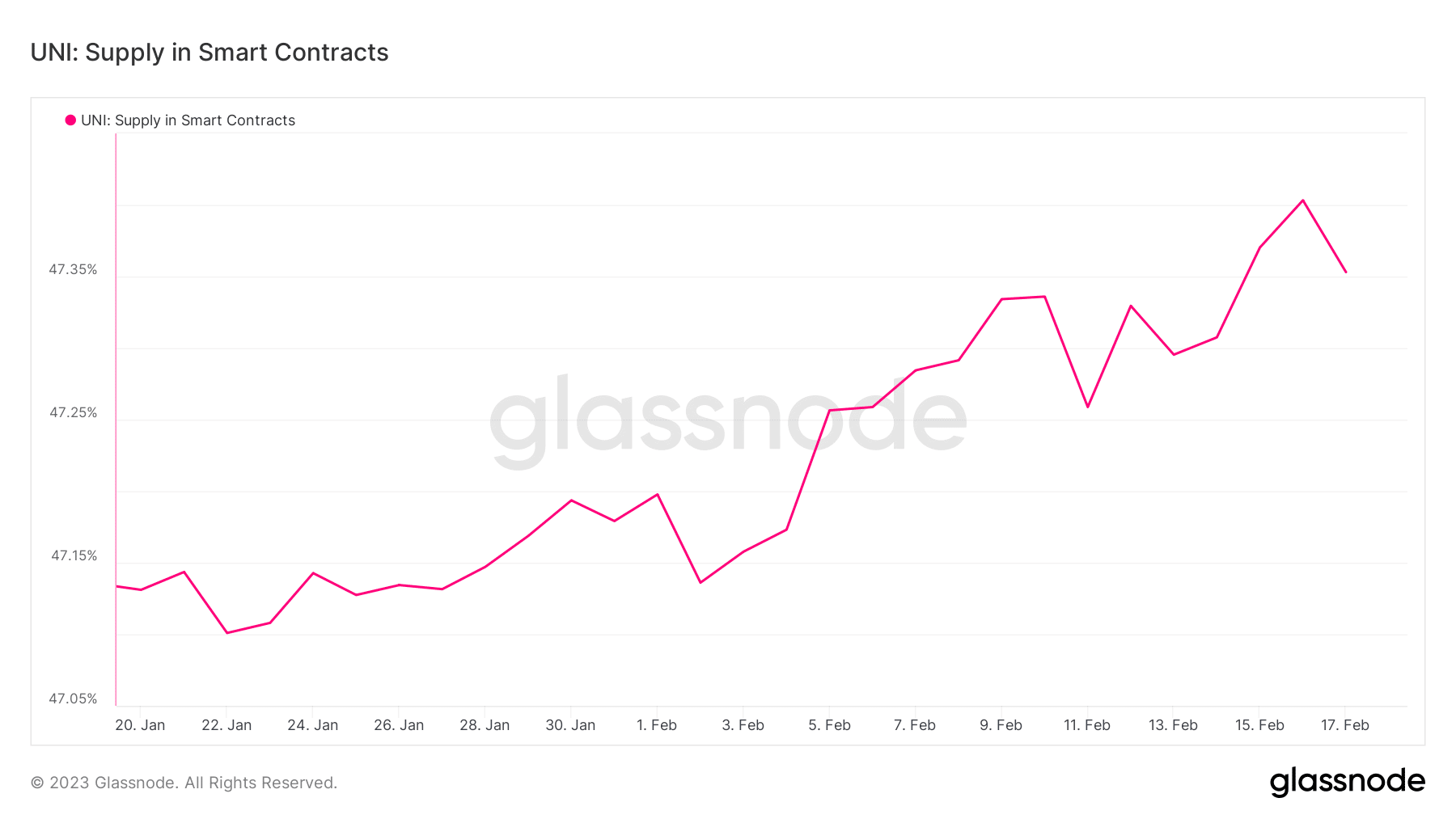

Apparently, the prevailing demand for UNI we have now seen up to now has been headed into DeFi. That is evident by the rise within the provide of UNI held in good contracts which have elevated considerably within the final 4 weeks.

Supply: Glassnode

Regardless, UNI continues to be closely influenced by the general crypto market situations.

This implies it can possible proceed to expertise sturdy demand if the market stays bullish. Then again, a return of bearish strain could set off some extra draw back.