BlackRock’s submitting for a Bitcoin spot ETF (iShares Bitcoin Belief) has breathed new life into the market and sparked a powerful rally. The hope is that BlackRock will set off a “Nice Accumulation Race” round Bitcoin, fuelled by the truth that 69% of all traders have been unwilling to promote their Bitcoins for over a yr, Bitcoinist reported.

Market consultants give the BlackRock ETF a excessive probability of approval. Remarkably, BlackRock has an approval ratio of 575:1, however the US Securities and Trade Fee’s (SEC) ratio in terms of rejecting Bitcoin spot ETFs is simply as clear: 33:0.

However as a result of BlackRock has shut ties to US regulators and Democratic politicians, there may be room for an optimistic outlook on the probability of approval. As K33 Analysis writes of their newest market evaluation, BlackRock is unlikely to spend time and sources if they don’t see the prospect of approval as very excessive.

Race For The First Bitcoin Spot ETF

Rumors have already emerged in current days that BlackRock’s ETF submitting might be determined inside “days to weeks”, NewsBTC reported. However what are the precise deadlines? The SEC’s rules present a clue.

The necessary factor to know right here is that the deadlines for the SEC and its resolution on the iShares Bitcoin Belief depend upon when the appliance is revealed within the Federal Register for feedback. Since this has not formally occurred but, there are solely approximate estimates thus far.

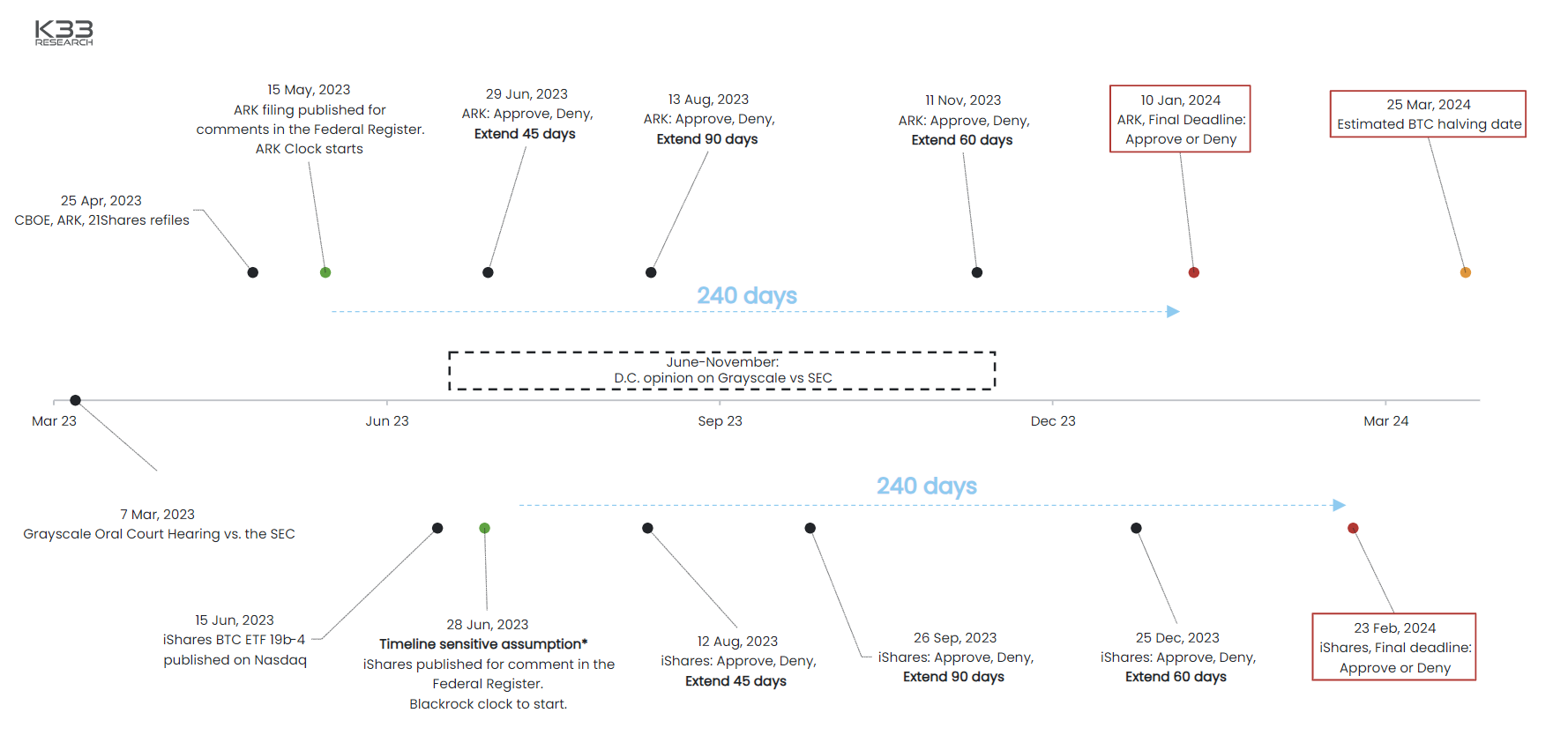

However, K33 Analysis has drawn up a tough timeline primarily based on the SEC’s deadlines. Theoretically, a call may be reached inside 4 time intervals, with the choice course of following a scheme of anchored resolution dates.

After publication of the appliance within the Federal Register, the SEC has 45 days within the first time interval to approve, reject or lengthen evaluation of the ETF. Assuming the appliance is revealed within the Register on June 29, the SEC’s first deadline could be August 12, 2023. Comparable inflection factors happen 45 days later, 90 days later and 60 days later.

When BlackRock #Bitcoin spot ETF?

Timeline is dependent upon the publication within the Federal Register. Assuming July 29:

August 12: Lengthen 45 days

September 26: Lengthen 90 days

December 25: Lengthen 60 days

Closing deadline: February 23, 2024.h/t @K33Research

Extra particulars 👇

— Jake Simmons (@realJakeSimmons) June 22, 2023

K33 Analysis states that the SEC should announce a call after 240 days on the newest. Because of this the market could have a call by February 23, 2024 on the newest (could also be shifted by a number of days relying on the publication within the Federal Register).

Will Grayscale Or CBOE Preempt BlackRock?

Despite the fact that everyone seems to be at present speaking about BlackRock’s ETF submitting, there’s a chance that two different establishments will get approval, or at the least a call on their issues, earlier than the world’s largest asset supervisor.

As K33 Analysis exhibits in its ETF schedule, the CBOE filed its “ARK 21Shares” earlier than BlackRock and will doubtlessly profit from BlackRock’s momentum. Already on Might 9, Cboe International Markets filed to record and commerce shares of a spot Bitcoin ETF from Cathie Woods Ark Make investments and crypto funding product agency 21 on the Cboe BZX trade.

As well as, Grayscale might additionally obtain a ruling forward of BlackRock in its authorized battle with the SEC. A ultimate ruling on Grayscale’s lawsuit might be imminent. The ultimate judgment is predicted three to 6 months after the listening to. The listening to was held on March 7, 2023. The core of Grayscale’s lawsuit is that the SEC acted arbitrarily in approving futures-based ETFs and rejecting spot ETFs.

As K33 Analysis discusses, all market members are at present in a race for first mover benefit. The launch of ProShares BITO clearly demonstrated this benefit. BITO noticed $1bn in inflows two days after launch. So far, BITO has a 93% market share amongst futures-based lengthy BTC ETFs.

Nonetheless, whoever wins the race, it appears clear in the meanwhile that Bitcoin traders would be the winners. Head of resaerch at CryptoQuant, Julio Moreno, not too long ago shared the chart beneath and commented: “Right here’s what occurs when an enormous fund [Grayscale’s GBTC] will increase Bitcoin demand.

At press time, the BTC worth has taken a breather above $30,000 after yesterday’s rally and was buying and selling at $30,150.

Featured picture from ETF Database, chart from TradingView.com