In March 2023, the SEC charged eight celebrities with violating sure provisions of the Securities Act of 1933 of their promotion of cryptocurrency belongings. The costs stem from Part 17(b) of the act, an anti-fraud and anti-touting provision that addresses the failure to reveal funds associated to promotional exercise.

The group of celebrities — which included Lindsay Lohan, Jake Paul, and Ne-Yo —particularly confronted accusations of illegally selling Tron (TRX) and/or BitTorrent (BTT) tokens supplied by firms underneath the course of Tron founder Justin Solar.

Whereas the SEC gained the case, the questions on the coronary heart of the matter stay unanswered: The place does praising a cryptocurrency finish and selling one start? Can there be such a factor as reputable cryptocurrency promotion? And what determines the standing of the asset as a safety?

Different ongoing authorized battles associated to the unlawful promotion of crypto — together with these involving celebrities endorsing FTX like Tom Brady, Larry David, Stephen Curry, and others — revolve across the similar essential questions. With more than 20 percent of U.S. customers proudly owning and utilizing crypto, it’s evident that clear traces should be drawn when promoting and selling digital belongings.

So, the place is that line? And is there a authorized distinction between merely supporting a particular digital asset and unlawfully selling it?

“Affordable client/investor” vs. public determine/superstar

On the most foundational degree, the primary query that needs to be requested is how we outline what it means to “patronize” and assist a specific digital asset — the place a person is merely sharing their funding holding with household, mates, and colleagues —versus what it means to “promote” that specific digital asset to a community-at-large with the precise intent of persuading one other to take a position their cash into that particular person asset.

Patronizing a digital asset isn’t too totally different from an individual merely sharing what shares they personal with a member of the family, good friend, or colleague. On this case, we now have to imagine that the typical client doesn’t absolutely perceive the mechanics of cryptocurrency, the way it works, and the legal guidelines surrounding it — particularly for the reason that legal guidelines and laws surrounding it are virtually non-existent with regards to the sale and promotion of digital belongings.

So, what’s “tipping” the size of a person harmlessly sharing pleasure a few specific digital asset to taking a considerable step in eager to create an “financial reliance” of such a magnitude that crosses into SEC territory?

It might appear that the precise info and circumstances of the promotion that’s predicated upon the next:

(1) who you might be as an individual/firm,

(2) the assets at your disposal to deliberately talk and promote the asset,

(3) the chance that your message/promotion will attain a big neighborhood of individuals, and

(4) the chance that the message/promotion will closely affect a 3rd celebration’s choice in order to create an financial reliance and monetary choice primarily based upon your social standing.

Addressing the primary ingredient of “who the promoter is,” it could make sense to use a “Affordable Particular person” commonplace, which might draw the road of whether or not we’re speaking about an on a regular basis client (skilled or novice) or a public determine/superstar, which carries extra weight and duties.

Generally, it could seem {that a} cheap, common client who’s supporting and sharing their funding into a specific digital asset is (most often) not going doing it for the expectation of serving to enhance the ground value or market value of that specific asset.

#TRX 🚀 @justinsuntron https://t.co/xh6xB6fNmo

— Jake Paul (@jakepaul) February 13, 2021

A public determine or superstar, however, has by and thru their “public” standing a uniquely highly effective capability to speak at massive a message or concept that has a really robust chance of persuading large quantities of individuals to behave or behave in a sure approach – no matter how skilled or well-versed they’re in having the ability to convey such a message precisely.

Because of this, figuring out who is definitely selling the digital asset is essential in assessing the “why” behind their promotion and whether or not it constitutes an “unlawful promotion” underneath present securities legislation.

The “feel and look” of the promotion

One other vital facet of figuring out the distinction between patronizing and selling is the “feel and look” of what’s being shared. We’ve seen the SEC come down exhausting on superstar endorsements of digital belongings that in the end communicate to the feel and appear of the superstar’s promotion of a cryptocurrency, together with the verbiage and nature of the disclosures particularly expressed within the publish.

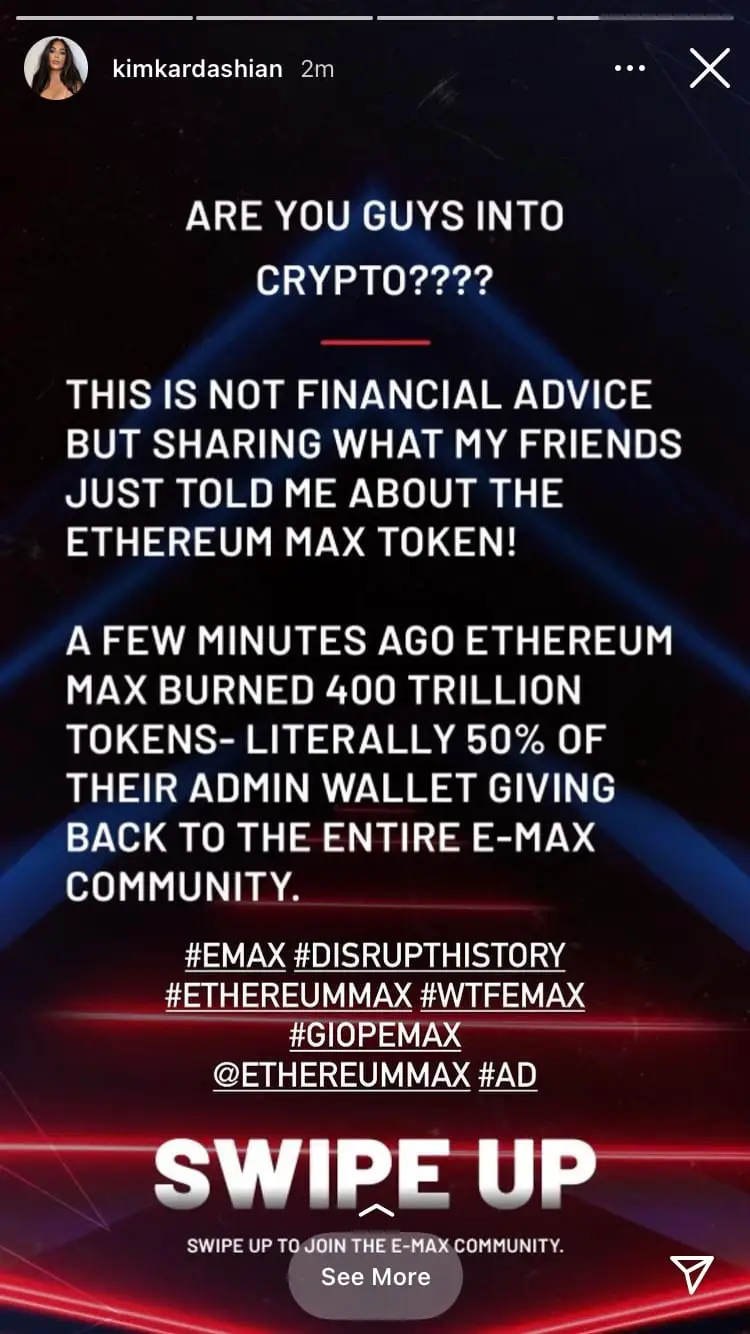

This started in October 2022 with Kim Kardashian and her unlawful promotion of EthereumMax (EMAX).

Whereas Kardashian agreed to settle the costs, paying $1.26 million in penalties, disgorgement, and curiosity, the SEC discovered that Kardashian had didn’t disclose that she was paid $250,000 to publish a publish in 2021 on her Instagram account (which now has 359M followers) about EMAX tokens.

Her publish contained a hyperlink to the EthereumMax web site, which supplied directions for potential traders to buy EMAX tokens, however nothing else. Whereas Kardashian had said in her publish that it was “not monetary recommendation” along with including totally different hashtags together with “#advert,” the SEC mentioned that wasn’t sufficient for compliance.

Different celebrities focused by the SEC included Floyd Mayweather, Jr., DJ Khaled, Lindsay Lohan, Jake Paul, Soulja Boy, Akon, Ne-Yo, and Lil Yachty for a similar causes.

thanks guys, purchased some BNB, DGB, TRX, KLV, ZPAE and FDO 💪🏾 what’s subsequent? let’s go ✔️

— Soulja Boy (Draco) (@souljaboy) January 22, 2021

Then, in November 2022, FTX declared chapter, resulting in the collapse of the alternate and one of many largest monetary scandals since Enron and Bernie Madoff.

From Tom Brady, Madonna, and Gwyneth Paltrow to David Ortiz, Larry David, Jimmy Fallon, and extra, the SEC introduced its expenses as FTX’s collapse continued to unwind whereas additionally showcasing the necessity for public figures to make the correct disclosures on their social media posts and TV commercials that they’re getting paid to advertise these digital belongings.

This was a reminder and warning to celebrities and different public figures that they can not escape the necessities of the anti-touting provision of Part 17(b) of the Securities Act of 1933, which requires them to confide in the general public when they’re getting paid to advertise one thing, how a lot they’re getting paid to advertise investing in securities.

Beneath Part 17(b), a “promoter” is prohibited from publishing or circulating an article or communication for ‘a consideration obtained’ with out absolutely disclosing that consideration. Beneath the legislation, a “consideration” is a mutual alternate of worth that helps solidify the enforcement of a authorized contract or settlement.

Navigating the unknown

Sadly, there’s nonetheless a grey space in regards to the anti-touting provisions of Part 17(b), as a result of it solely applies if the instrument being promoted is a “safety.” And we nonetheless don’t have clear steering on what constitutes a “safety.”

This brings us to the latest sudden crackdown by the SEC in opposition to two of the world’s largest crypto exchanges and the continued debate and controversy surrounding the SEC’s “enforcement by regulation” strategy that’s significantly harming the expansion and growth of the {industry}.

Senator Cynthia Lummis (R-WY), who, along with Senator Kirsten Gillibrand (D-NY), has been a robust advocate for the institution of a whole regulatory framework, took to Twitter to share her adamant belief that the SEC has “failed to offer enough authorized steering on what differentiates a safety from a commodity.”

My assertion on the SEC suing Coinbase, inc. https://t.co/5KNEM0IPSV pic.twitter.com/EgRIxrIcjj

— Senator Cynthia Lummis (@SenLummis) June 6, 2023

Each she and Senator Kirsten Gillibrand (D-NY) have been the driving pressure behind their proposed, landmark bipartisan laws – the Responsible Financial Innovation Act, that may create a whole regulatory framework for digital belongings that encourages accountable monetary innovation, flexibility, transparency, and sturdy client protections whereas integrating digital belongings into present legislation – equivalent to Howey.

The landmark 1946 U.S. Supreme Court docket case of Howey is the guts of any conventional securities evaluation, presenting parts that have to be thought-about in serving to decide whether or not an instrument is taken into account a “safety” or “funding contract.”

An industry-wide gray space

Because it stands, this {industry} is working within the grey when it comes to how they introduce a digital asset to its buyer base and the mechanisms underlying its buy and sale of them, together with the strategies they use to advertise and/or in any other case promote the asset providing.

The pending litigation that we’re watching unfold will unquestionably carry these circumstances entrance and middle, starting with what standards makes a digital asset or providing a “safety” (versus a commodity) and the way an organization or model is ready to legitimately promote that asset or providing to traders and most of the people with out violating securities legislation.

The data supplied on this article doesn’t, and isn’t supposed to, represent authorized recommendation; as an alternative, all info, content material, and supplies out there on this web site are for common informational functions solely. Info on this web site might not represent essentially the most up-to-date authorized or different info. This web site comprises hyperlinks to different third-party web sites. Readers of this text ought to contact their legal professional to acquire recommendation with respect to any specific authorized matter. No reader, person, or browser of this web site ought to act or chorus from performing on the idea of data on this web site with out first looking for authorized recommendation from counsel within the related jurisdiction.