Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- UNI’s market construction weakened additional.

- The 90-day Imply Coin Age rose as quarterly outperformed month-to-month holders.

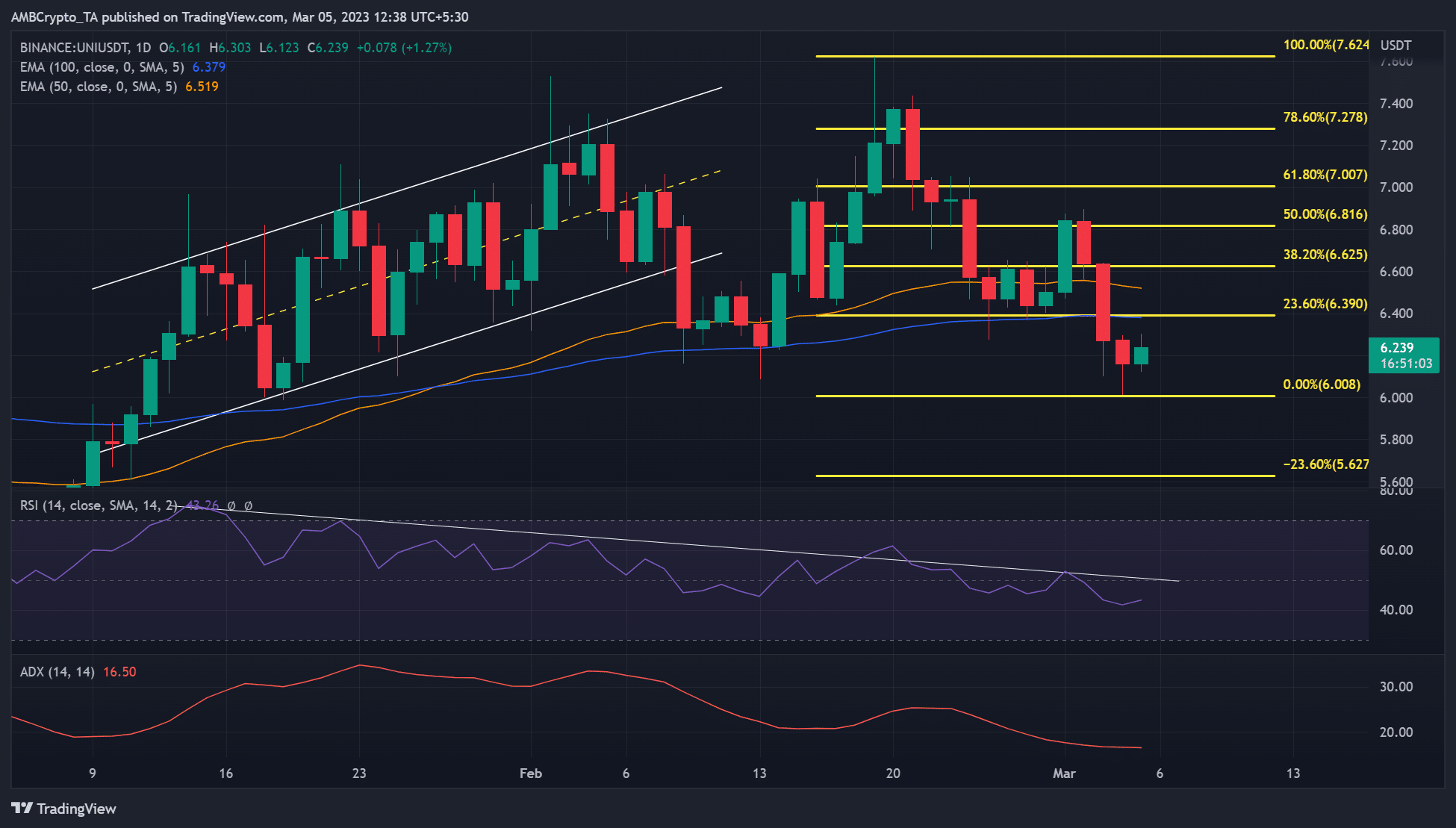

After the value rejection at $7.624 on 18 February, Uniswap [UNI] depreciated by 20%. At press time, the native DEX token traded at 6.239 and flashed inexperienced as bulls tried to entrance a restoration.

Nevertheless, key fundamentals and metrics provided conflicting outcomes, calling for traders’ warning.

Learn Uniswap [UNI] Value Prediction 2023-24

The market construction weakened extra – Can bulls survive?

Supply: UNI/USDT on TradingView

On the peak of the January rally, UNI entered a worth consolidation and fashioned a rising channel (white). The worth motion breached beneath the channel in early February however was checked by the 100-day EMA (exponential transferring common).

However bulls bought boosted after a retest of the pullback on the 100-day EMA that provided a powerful restoration, setting UNI to achieve an overhead resistance at $7.624. The retracement after the value rejection at $7.624 has undermined a profitable restoration.

Bears may re-enter the market if UNI fails to shut above the 23.6% Fib stage ($6.390). They might profit from shorting the asset at $6. Cease loss might be set above $6.390.

Quite the opposite, a every day shut above the 23.6% Fib stage may tip bulls to focus on the Fib ranges of 38.6% ($6.625), 50% ($6.816), or 61.8%($7.007). If Bitcoin [BTC] retests the $25K, UNI may swing to the overhead resistance stage of $7.624.

Nevertheless, the RSI on the every day chart confirmed an rising divergence. As well as, the Common Directional Motion Index (ADX) retreated, exhibiting the UNI’s market weakened and will enter consolidation or additional retracement.

However the 100-day EMA moved horizontally, exhibiting a consolidation might be doubtless within the mid-term.

Quarterly holders outperformed month-to-month friends

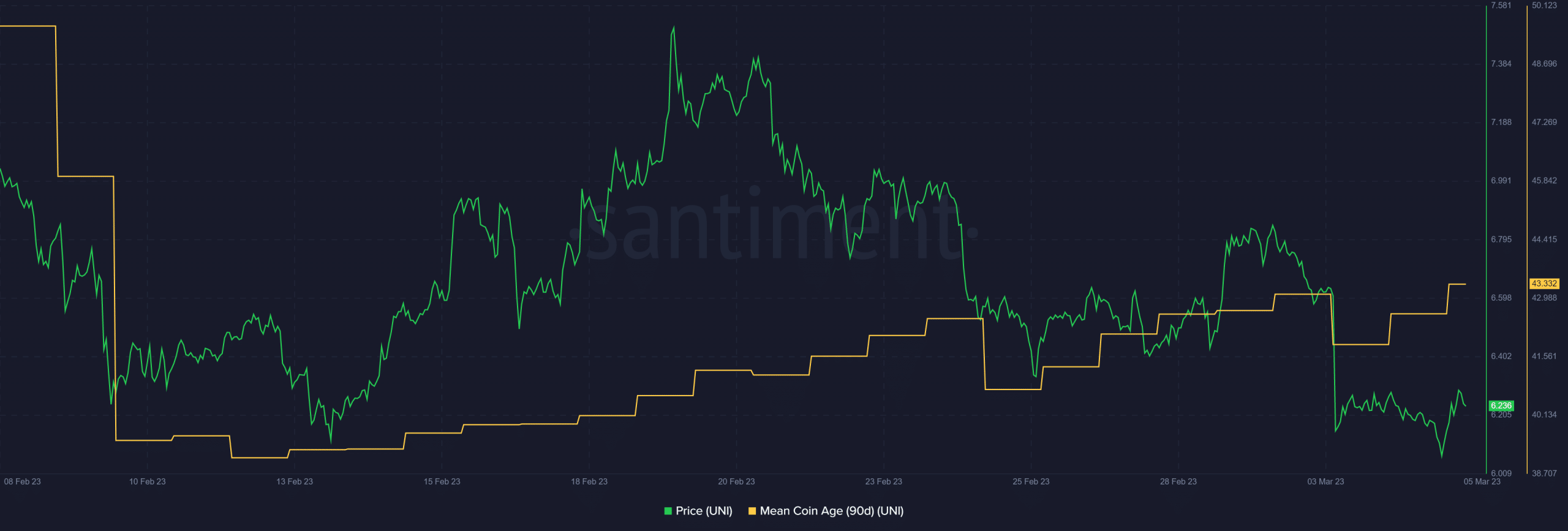

Supply: Santiment

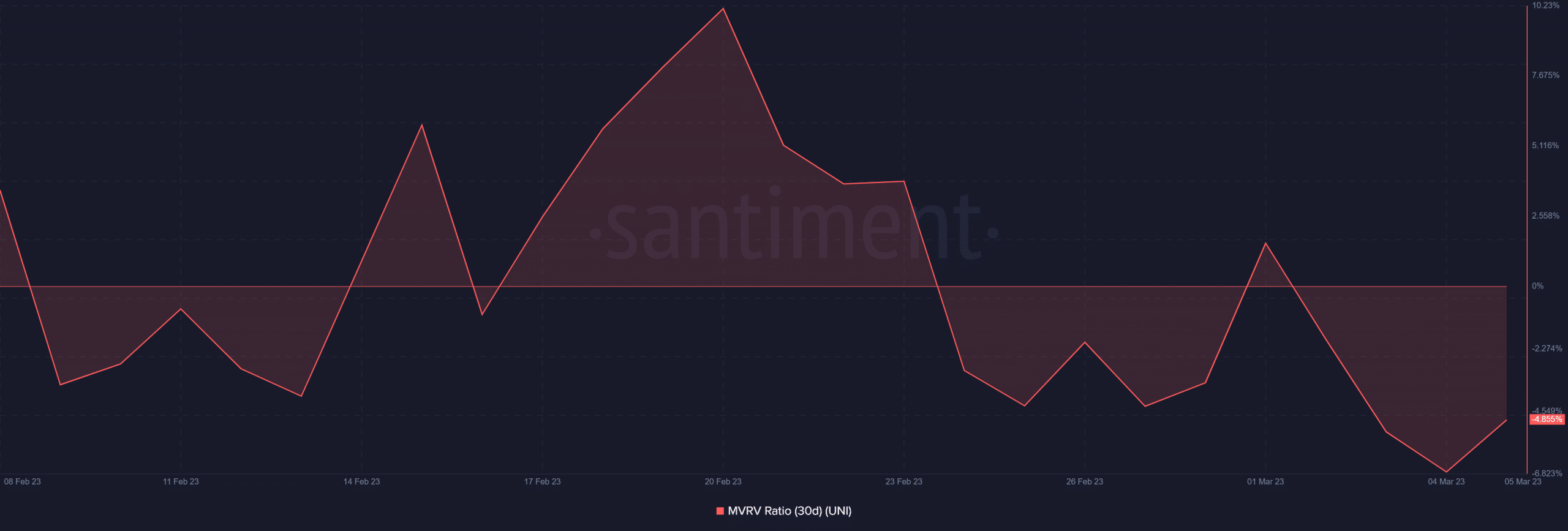

There was a wide-network accumulation of UNI tokens, as proven by the rising 90-day Imply Coin Age. It reveals there might be a possible bullish rally within the works. Nonetheless, month-to-month holders incurred losses of 5% at press time, as proven by the 30-day MVRV.

Is your portfolio inexperienced? Verify the UNI Revenue Calculator

Supply: Santiment

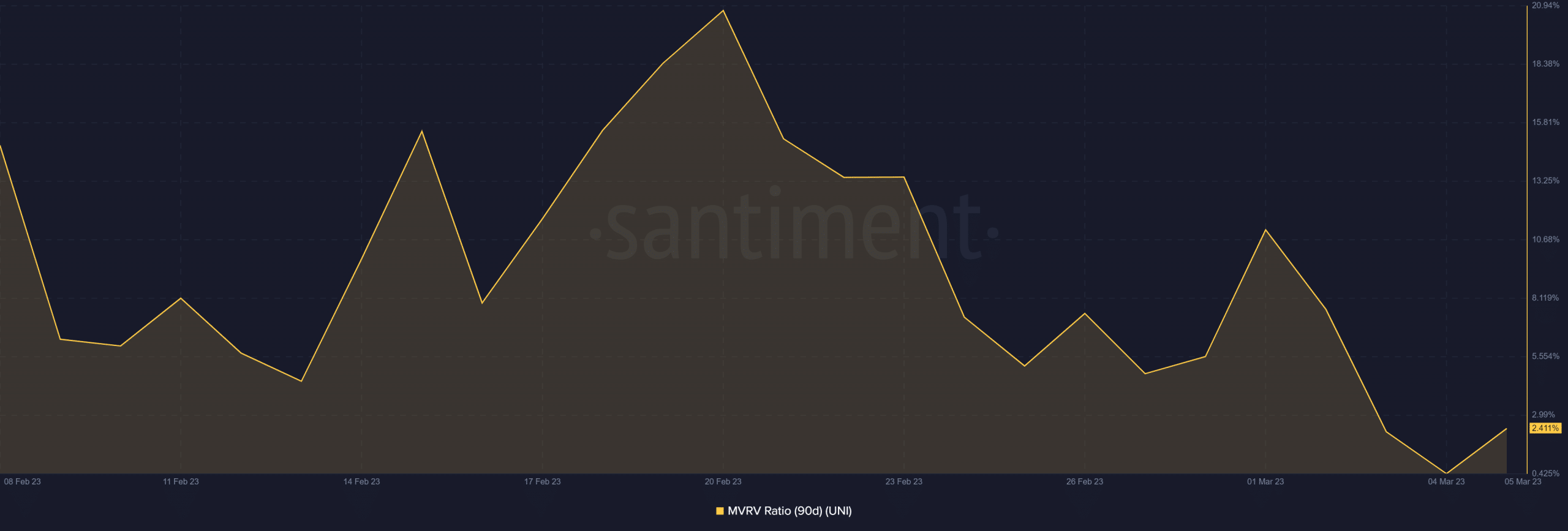

Quite the opposite, quarterly holders loved a modest revenue of two% after a lot of the positive factors in January bought cleared throughout the correction interval. Quarterly holders may reclaim among the misplaced positive factors if UNI clears the 23.6% hurdle.

Supply: Santiment

![Which way for Uniswap [UNI]- A recovery, consolidation or retracement?](https://ambcrypto.com/wp-content/uploads/2023/03/pexels-schach-1660753-1000x600.jpg)