- On-chain analyst predicted a $32,000 BTC halving value and a brand new ATH in 2025.

- The coin’s uptrend could possibly be halted resulting from its correlation with the normal markets and the UTXO situation.

The optimism behind Bitcoin [BTC] has been unusually excessive for the reason that coin started 2023 on a bullish word. Having hit $18,000 on 11 January, the primary cryptocurrency in market worth adopted by with an sudden landmark.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Within the late hours of 12 January, BTC hit $19,000, driving conversations round a doable bull market return. Nonetheless, the transfer solely lasted just a few hours because the coin retraced to $18,807 at press time.

Bitcoin halving is a cheat code

Amid the discussions, Plan B tweeted his opinion of the potential BTC value. In line with him, the $15,500 area of November 2022 was the underside of this cycle. The creator of the stock-to-flow mannequin additionally opined that the five-month Quick Time period Holder (STH) depend had already crossed into the having billed for 2024.

For context, the STH refers back to the cohort of traders who’ve been holding BTC for lower than 155 days. As a result of situation, Plan B famous that BTC would solely have minimal pullbacks and would most probably be value over $32,000 after the 2024 halving. He projected that the bull market might return to happen within the following yr, predicting the coin value hits $100,000.

My 2 sats on #bitcoin value:

– November 2022 low of $15,5K was the underside

– BTC has crossed Quick Time period Holder (STH) and can rise into 2024-halving and subsequent 2025 bull market. A number of on-chain alerts affirm STH sign.

– 2024 halving will probably be >$32K

– 2025 bull market >$100K pic.twitter.com/0QtbeOXwsG— PlanB (@100trillionUSD) January 12, 2023

In a follow-up dialog, the on-chain analyst responded that he was solely being modest about his prediction. Referring to his 2025 projection, he mentioned,

“Actually I believe the bull market vary will probably be $100K – $1M however many individuals don’t perceive the vast margins (or the volatility that creates them) so I pinned it on the certainly snug $100K.”

Untimely jubilation might finish in…

Regardless of the over 15% enhance in worth for the reason that yr started, some analysts agreed that it was not but time to have fun simply but. CryptoQuant analyst Elcryptotavo suggested {that a} retracement might occur within the quick time period.

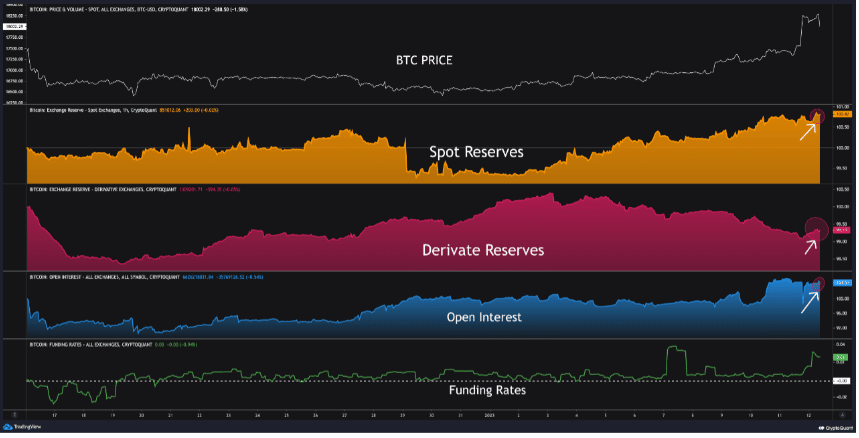

He concurred that though there have been some metrics that indicated long-term respite, just like the spike in spot and derivatives reserves, traders ought to decrease their expectations with respect to a continuing uptick.

Supply: CryptoQuant

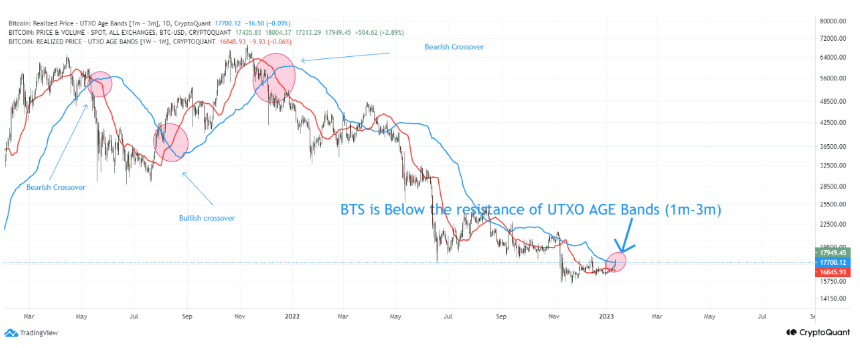

One other analyst on the great crypto information platform, Ghoddusifar aligned with Elcryptotavo’s viewpoint. Citing that the present pattern could possibly be a bull entice, Ghoddisufar famous if BTC hits $19,300, it might retrace. This was because of the resistance round that area.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Furthermore, the Bitcoin correlation with the U.S. inventory market might additionally influence the downturn. Whereas Bitcoin has recovered in double digits, the typical S&P 500 index (SPX) efficiency was a 4.5% enhance inside the similar interval. Therefore, the analyst famous the SPX respecting a projected resistance might ship the BTC value downwards.

In addition to the inventory market affect, the Bitcoin Unspent Transaction Output (UTXO) was nonetheless under the a million to 3 million resistance. The UTXO measures the variety of cash left after a crypto transaction has taken place. Because it was within the aforementioned area, it implied a doable bearish crossover.

Supply: CryptoQuant

![Why Bitcoin [BTC] holders should ‘keep calm’ despite crossing the STH](https://ambcrypto.com/wp-content/uploads/2023/01/po-2023-01-13T081259.745-1000x600.png)