- Bitcoin risked an additional worth lower as a result of indications of the Delta cap and relations to the 2015 and 2018 pattern

- Worth motion confirmed {that a} breakout was not close by, at the same time as investor confidence dropped

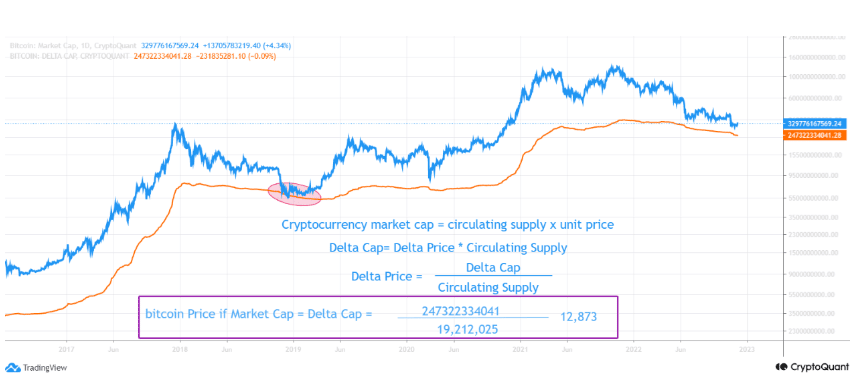

The Delta worth of Bitcoin [BTC] would possibly recommend that the worst was removed from over, believed Ghoddusifar, a CryptoQuant analyst. According to him, Bitcoin’s present Delta worth was $12,800.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

The Delta worth capabilities because the potential worth ensuing from the distinction between the realized cap and the typical market cap. This conclusion fashioned Ghoddusifar’s evaluation as properly, thus implying BTC might drop additional, as proven within the picture beneath.

Supply: CryptoQuant

Look again earlier than the turning level

The analyst targeted not solely on the current BTC pattern but in addition supplied proof of previous occurrences. He introduced up the truth that the earlier cycles of 2015 and 2018 have been much like the current circumstances.

This led to a BTC worth fall earlier than there was a “turning level.” For Ghoddusifar, the present situation had bearishness pasted throughout, making the value drop inevitable.

He stated,

“Based mostly on the quantity of bitcoin falling from the highest in earlier cycles in addition to the Onchain oscillators, though they present that bitcoin is near the turning level, the potential for extra falls can be confirmed.”

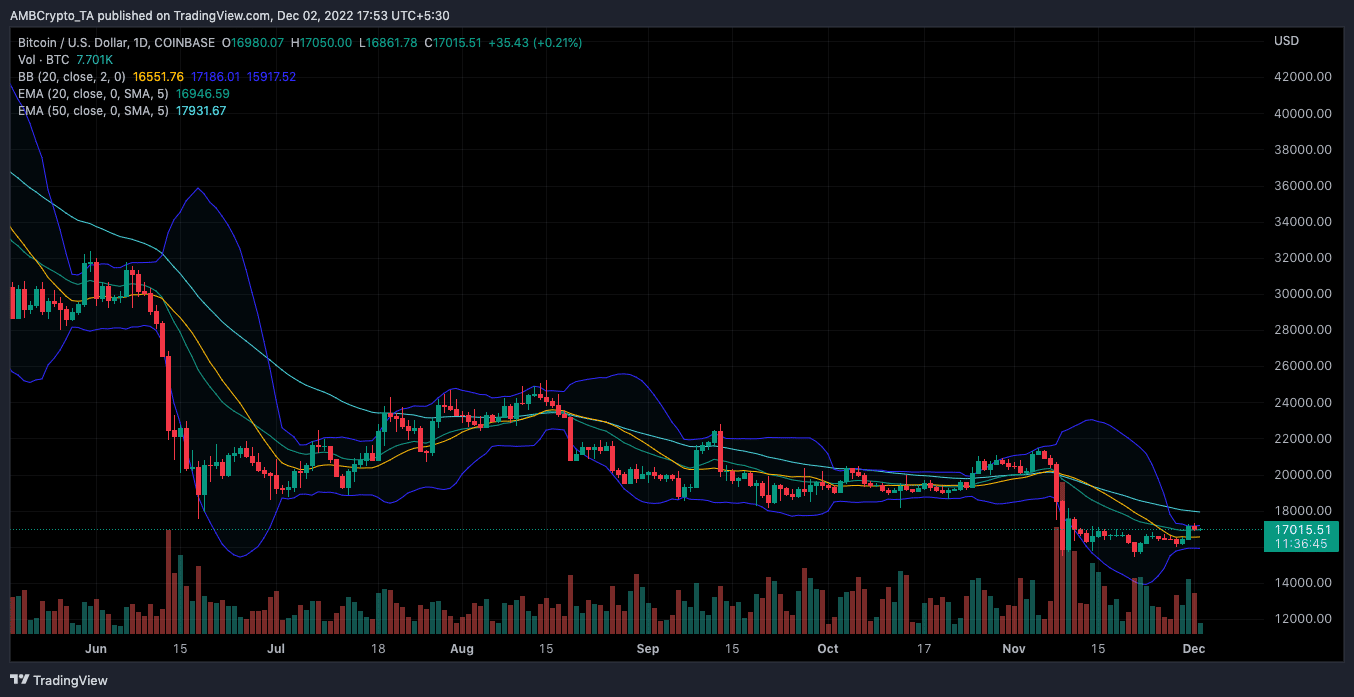

Technically, there appeared to be some legitimate calls from the analyst. The Bollinger Bands on BTC’s every day chart revealed that the coin’s volatility was extraordinarily low.

Since BTC had not damaged the decrease BB stage, it was unlikely to anticipate a pointy bounce towards the upturn. As well as, the value, at $17,015, had failed in its bid to maneuver out of the bands. Consequently, the instructed upward pattern had been nullified.

Supply: TradingView

Furthermore, the Exponential Transferring Common (EMA) additionally indicated a potential drop in worth. This was as a result of 20 EMA (inexperienced) being unable to overlap the 50 EMA (cyan). On this occasion, a bearish motion was the possible possibility.

No danger, no reward for Bitcoin

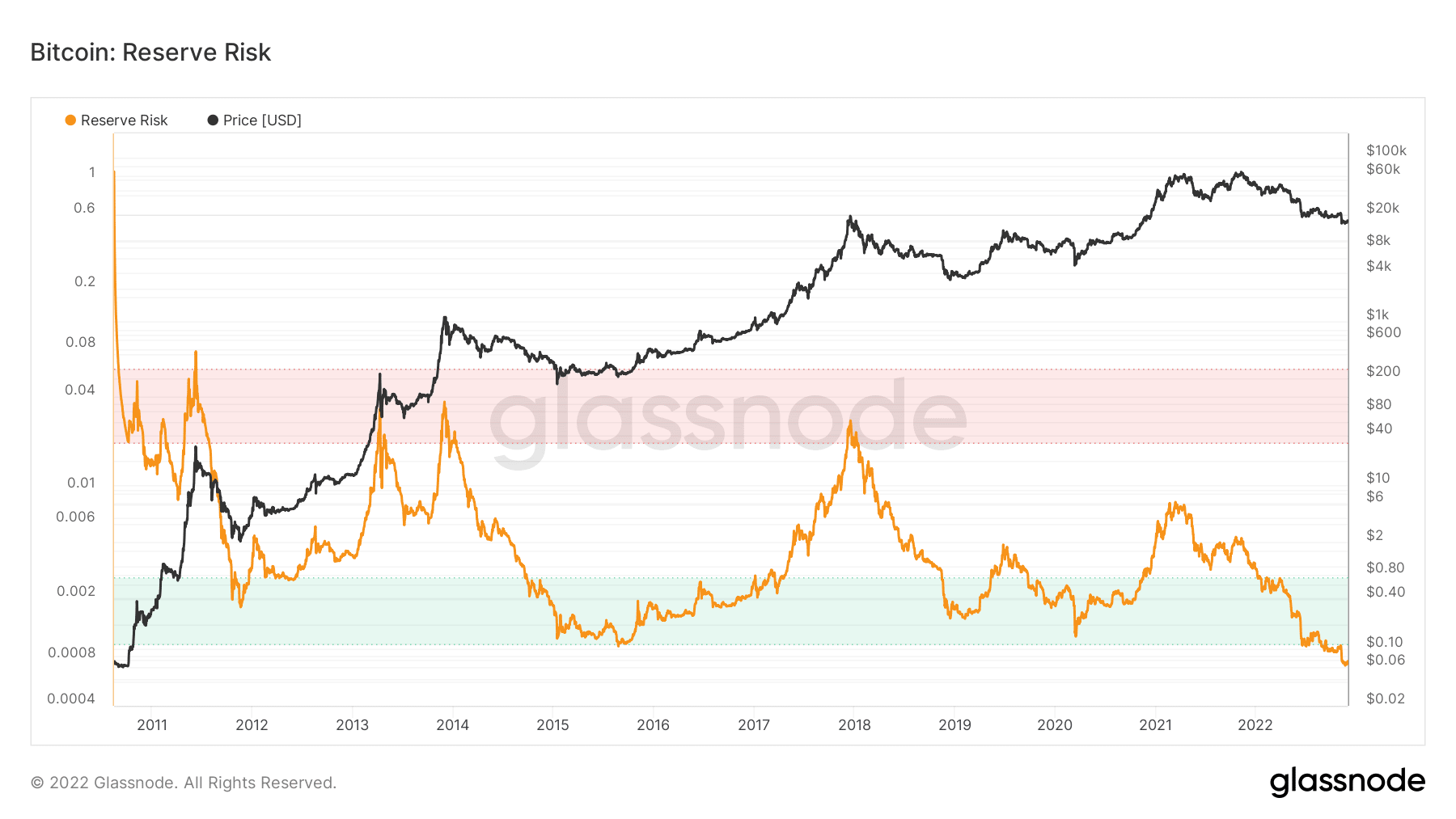

The above pattern, which instructed a BTC sink, appeared to have expanded in traders’ instructions. In line with Glassnode, the Bitcoin Reserve Threat was at 0.00076.

This level was thought of low and mirrored that long-term holders’ confidence was not at its peak. In a case the place the Reserve Threat was excessive and the value was low, it might sign a degree to accumulate,

Nonetheless, that was not the case, because it additional hinted at the truth that the sooner drop beneath $16,000 was not the bottom that BTC might hit.

Supply: Glassnode

![Why Bitcoin [BTC] may have one last dance to $12,800 before critical moment](https://ambcrypto.com/wp-content/uploads/2022/12/po-2022-12-02T134636.715-1000x600.png)